Phuoc An Port Investment and Exploitation Joint Stock Company (stock code: PAP, listed on UPCoM) has approved the issuance of 125 million private placement shares to 11 individual investors.

The offering price is set at VND 13,610 per share, nearly 50% lower than PAP’s current market price. Newly issued shares will be subject to a one-year transfer restriction.

The offering is scheduled for 2025-2026, pending approval from the State Securities Commission (SSC). Upon completion, Phuoc An Port’s chartered capital will increase to VND 3,570 billion.

Among the 11 investors, Tran Phi Hung is expected to purchase the largest stake of 18 million shares, becoming a major shareholder with 27 million shares, representing 7.56% ownership.

Ten out of the 11 investors have no affiliation with PAP’s insiders. Tran Manh Cuong, father of Tran Thi Lam Giang (a member of PAP’s Supervisory Board), is the exception. Cuong plans to acquire 6 million shares, increasing his ownership to 4.92% (over 17.5 million shares post-issuance).

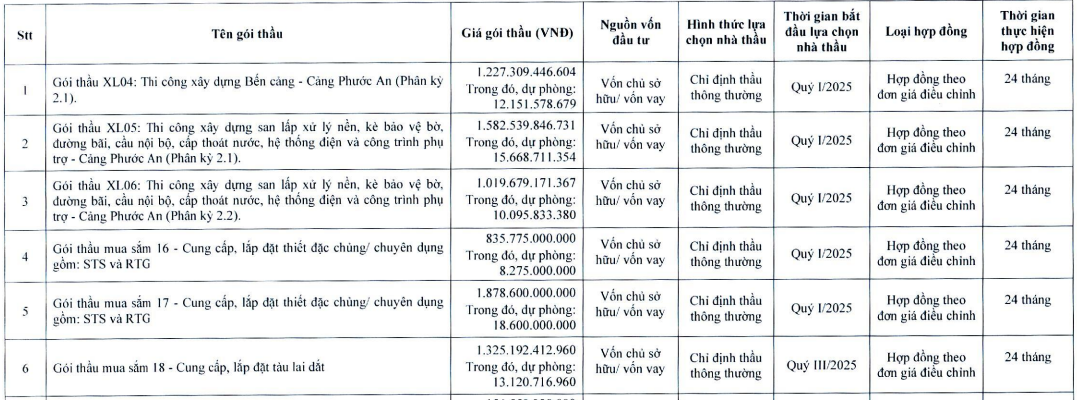

Phuoc An Port anticipates raising up to VND 1,701 billion from this offering. Funds will be allocated as follows: VND 500 billion for Package XL04 (Phase 2.1 port construction); VND 550 billion for Package XL05 (land reclamation, foundation treatment, shoreline protection, internal roads, and auxiliary systems in Phase 2.2); and over VND 651 billion for a tugboat purchase under Package 18. Disbursement is planned for 2025-2026.

According to Resolution No. 99/NQ-PAP dated October 1, 2025, Phase 2 of the Phuoc An Port construction project comprises 21 packages totaling VND 8,223.5 billion.

Key packages include XL04 (VND 1,227.3 billion), XL05 (VND 1,582.5 billion), and Package 18 (VND 1,325.1 billion).

Source: PAP

In other developments, PAP’s Board of Directors has approved the investment in the Phuoc An Industrial Park infrastructure project in Phuoc An Commune, Dong Nam Province.

Spanning 3.3 million square meters with a 50-year operation period, the project’s total investment is nearly VND 4,962 billion. Implementation is scheduled for 2025-2028, funded through equity and mobilized capital.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.

MST Successfully Sells 30 Million Shares to Nine Domestic Investors

MST successfully offered 30 million shares to nine domestic investors at a price of 10,000 VND per share, raising a total of 300 billion VND from this issuance.

Penalties for Private Stock Offering and Sale Violations Can Reach Up to 1.5 Billion VND

The Vietnamese government has issued Decree No. 306/2025/NĐ-CP, effective November 25, 2025, amending and supplementing several provisions of Decree No. 156/2020/NĐ-CP on administrative penalties in the securities and stock market sector. Notably, the decree introduces a significant fine ranging from VND 1 billion to VND 1.5 billion for offenses such as forging documents or providing false certifications to meet the conditions for offering or issuing shares.