On December 2, the Ho Chi Minh City Stock Exchange (HOSE) announced the receipt of the listing application for 149 million shares of Ton Dong A Corporation, valued at VND 1.491 trillion based on par value. Ho Chi Minh City Securities (HSC) is acting as the advisor for this transaction.

This isn’t the first time the leading steel sheet manufacturer has aimed for HOSE. Since 2021, Ton Dong A has planned to IPO and list on HOSE but was forced to halt due to the steel industry’s downturn, which resulted in losses and failure to meet listing criteria. In September 2023, the company listed its GDA shares on UPCoM as a stepping stone, before its board approved the transfer to HOSE in early October 2025.

This move places Ton Dong A among prominent names listing on HOSE this year, including TCBS Securities, VPBank Securities, and most recently, Hoa Phat Agriculture (HPA).

This wave of listings comes amid a once-vibrant stock market with high liquidity, though it has cooled in recent months. Securities experts predict IPOs and HOSE listings will continue to thrive in the near future.

Vietnam’s Top 3 Steel Sheet Manufacturer

Founded in 1998, Ton Dong A specializes in producing galvanized steel sheets, aluminum-zinc alloy coated steel, color-coated steel, and black color-coated steel. With a factory capacity of approximately 800,000 tons/year, the company ranks among Vietnam’s top 3 largest steel sheet manufacturers.

Over the years, Vietnam’s steel sheet industry has faced prolonged challenges, only beginning to recover in 2024. In 2025, the sector faces new hurdles as many countries erect trade barriers, notably the U.S. imposing high tariffs on Vietnamese steel sheet products.

In the first nine months of 2025, Ton Dong A reported net revenue of over VND 11.9 trillion and net profit of over VND 235 billion, down 22% and 27% year-on-year, respectively. These results equate to 66% of the revenue target and 78% of the profit goal for the year.

| Ton Dong A’s Quarterly Business Results |

From 2025 to 2026, the company plans to finalize legal procedures and launch Phase 1 of Factory 4, with a capacity of 300,000 tons/year. The factory’s total design capacity is expected to reach 1.2 million tons/year upon completion.

Simultaneously, Ton Dong A aims to expand its product portfolio to include specialized steel sheets for home appliances, interiors, and automobiles, while focusing on developing high-end segments to increase added value.

– 13:58 03/12/2025

Foreign Investors Reverse Course, Selling Hundreds of Billions of Dongs in Session 1/12: Which Stocks Were Hit Hardest?

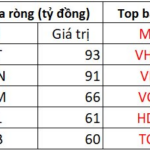

In the afternoon trading session, foreign investors aggressively accumulated FPT shares, with the total value reaching approximately 93 billion VND.

Why Did Masan Consumer Choose This Moment to Announce Its HOSE Listing Plan?

On December 4th, Masan Consumer (UPCoM: MCH) will unveil details regarding its planned transition from UPCoM to HOSE listing. This move is garnering market attention, as companies typically opt for such a shift only when they have solidified operational foundations, financial capabilities, and long-term growth strategies.

Hoà Phát Agriculture Declares 38.5% Cash Dividend; No White Chicken Farming or Southern Egg Sales Yet

On the afternoon of December 1st, Hoa Phat Agricultural Development Joint Stock Company (HPA) hosted an investment opportunity seminar, announcing the public offering of 30 million shares at a price of VND 41,900 per share. The company is expected to list on the Ho Chi Minh City Stock Exchange (HOSE) in early 2026.