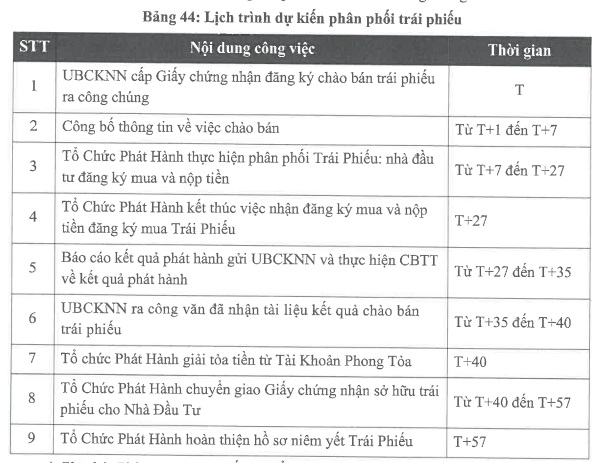

On November 25, the State Securities Commission (SSC) granted approval for BAF to issue a bond worth VND 1,000 billion. According to the issuance plan, these bonds offer a fixed interest rate of 10% per annum with a 36-month term, and interest is paid semi-annually. Additionally, the bonds are non-convertible, unsecured, and do not include warrants.

Based on the prospectus, the bond distribution will take place between T+7 and T+27 (where T is November 25), scheduled for December 2025 or early 2026.

Source: BAF

|

Notably, BAF previously adjusted its capital allocation plan for the bond proceeds. The overall structure remains unchanged, with VND 670 billion allocated for working capital to support hog farming and VND 330 billion for debt repayment.

However, the debt repayment beneficiaries have been revised. Initially, the funds were intended to repay principal debts of three subsidiaries: BAF Tay Ninh 1 High-Tech Farming (VND 150 billion), BAF Tay Ninh 2 (VND 150 billion), and BAF Tay Ninh 1 Feed Production (VND 30 billion). Under the new plan, the entire amount will be used to settle principal debts owed to financial institutions: MSB (VND 200 billion), BIDV – Bac Ha Branch (VND 35 billion), and E.SUN Bank – Dong Nai (VND 95 billion). Disbursement is expected in Q1/2026.

BAF explained that debts to financial institutions mature earlier than those to subsidiaries. Prioritizing bank repayments aims to reduce financial pressure, maintain creditworthiness, and ensure future access to capital for upcoming projects.

The VND 670 billion allocated for working capital will be used to pay for feed, livestock, and goods from suppliers such as Hai Dang Tay Ninh High-Tech Farming (VND 180 billion) and Green Farm Investment 1 & 2 (VND 150 billion in total).

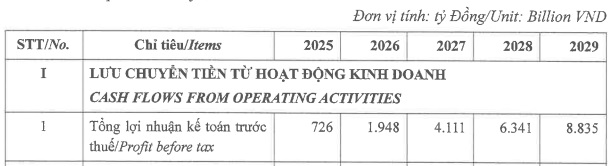

Alongside the debt repayment plan, BAF released a cash flow projection for 2025-2029. Pre-tax profit for 2025 is estimated at VND 726 billion, with significant growth expected in subsequent years: VND 1,948 billion (2026), VND 4,111 billion (2027), and peaking at VND 8,835 billion by 2029.

Source: BAF

|

– 15:15 02/12/2025

VIB Honored by JP Morgan with the “2025 Outstanding International Payment Quality Award”

On November 28, 2025, JP Morgan, a leading American bank, awarded Vietnam International Bank (VIB) the prestigious “Outstanding USD International Payment Quality Award 2025.” This accolade recognizes VIB’s exceptional achievement in automating international payment transactions, with an impressive 99.94% success rate in meeting global standards.

HDBank Raises VND 1,000 Billion Through Bond Issuance

HDBank has successfully issued 1,000 bonds under the code HDB12508, with a face value of 1 billion VND per bond, totaling an issuance value of 1 trillion VND.