From December 1st to 12th, the Vietnam Export-Import Bank (Eximbank) officially introduced a monthly account management fee of 11,000 VND for accounts with an average balance below 500,000 VND and no transaction activity over an extended period. This new policy has sparked varied reactions. While some customers accuse the bank of “overcharging,” experts advise users to review and close unnecessary accounts.

Customer Frustration

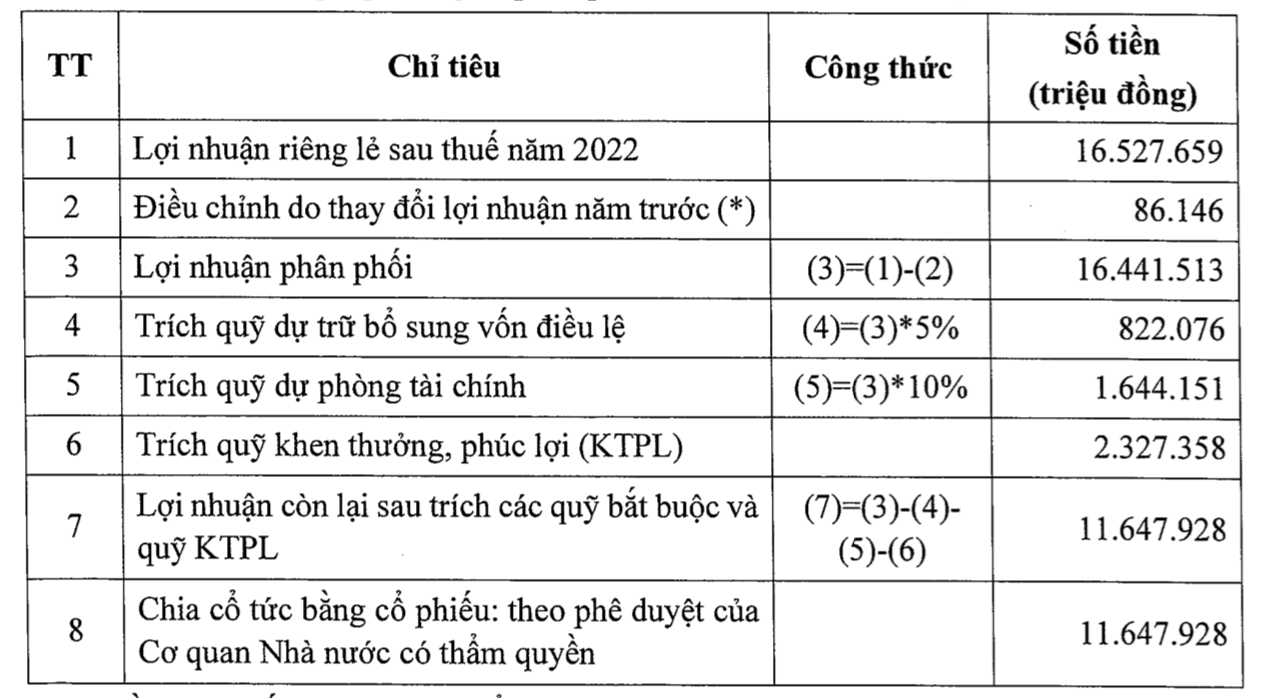

According to Eximbank, the bank previously charged fees for accounts with an average balance below 300,000 VND per month. The threshold has now been raised to 500,000 VND to reduce “junk” accounts—those opened but inactive, which incur maintenance and system management costs.

Eximbank is not alone; the International Bank (VIB) has also implemented a new fee structure, charging 10,000 VND per month (excluding VAT) for inactive payment accounts over 12 consecutive months. Fees also apply to dormant accounts with insufficient balances.

Although unannounced, several major banks quietly impose similar fees for low-balance accounts. Banks justify these charges as necessary to reduce forgotten accounts. Even inactive accounts require resources for security, infrastructure, and risk management. “If an account is unused, closing it is advisable to avoid fees and fraud risks,” a bank executive noted.

Eximbank charges a management fee for accounts with balances under 500,000 VND per month and prolonged inactivity.

When announcing the fee adjustment, VIB advised customers to close unused accounts at branches to avoid unexpected charges.

However, many customers disagree with fees for low-balance accounts. While the fee is modest, it feels like “overcharging.” Additionally, customers face numerous other fees, such as transfer, counting, and transaction cancellation fees.

Enhancing Competition and Cleaning Customer Data

This is not the first time banks have faced controversy over service fees. Earlier, increases in SMS Banking fees based on message volume drew customer backlash. In March 2024, Eximbank customers reported unexpected charges for SMS Banking and account management fees (for balances under 300,000 VND). Upon closing accounts, some were charged hundreds of thousands to millions of VND. Other banks also charged fees for zero-balance accounts over multiple years. After complaints, these policies were revoked.

In an interview with the Labor Newspaper, financial expert Dr. Châu Đình Linh noted that customers accustomed to free account services for years feel “overcharged” when banks reintroduce fees, especially for low-balance accounts. However, customers can proactively manage their accounts by maintaining 1-3 active accounts and closing unused ones to avoid unnecessary fees.

Dr. Linh emphasized that account balances are customer assets, while banks provide services. Maintaining a 24/7 payment system with robust security and technology requires significant investment. Thus, fees are reasonable for service quality and system development. “Banks previously waived fees to attract deposits. Now, with a competitive market, they adjust policies, such as charging for balances under 500,000 VND while waiving fees for higher balances,” he explained.

Other experts suggest that banks aim to clean customer data, retaining only active accounts as directed by the State Bank. As of mid-November 2025, the banking sector has over 136.1 million individual customer files (CIF) and 1.4 million organizational files verified through chip-embedded ID cards or the VNeID app.

Need for Transparent Fee Disclosure

Regarding service fee disputes, experts stress the State Bank’s role in ensuring transparency by requiring commercial banks to clearly disclose fees. Fee competition among banks will naturally drive customer choice. Banks with superior service quality, stable systems, robust security, and fair pricing will attract more customers.

Eximbank Credit Grows by 8.51%, Pre-Tax Profit for 9 Months Reaches VND 2,049 Billion

Eximbank is embarking on a transformative journey, poised to establish a robust foundation for sustainable growth and solidify its position within Vietnam’s financial and banking ecosystem.

Eximbank Honored with “Asia’s Outstanding Enterprise” and “Fast-Growing Enterprise” Awards at APEA 2025

On October 9, 2025, Eximbank was honored at the Asia Pacific Enterprise Awards (APEA) 2025 with two prestigious accolades: the Corporate Excellence Award and the Fast Enterprise Award. This achievement marks a significant milestone, solidifying Eximbank’s growing prominence in the regional financial market.

Eximbank Honored as “Outstanding Digital Transformation and Technology Product of 2025”

On September 25th, Vietnam Export-Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) was honored with the prestigious “Outstanding Digital Transformation and Technology Product of the Year 2025” award.