The Vietnamese government has issued Decree No. 304/2025/NĐ-CP, effective from December 1, 2025. This decree, comprising 8 articles, outlines the conditions for seizing collateral assets related to non-performing loans under Clause 2, Article 198a of the Law on Credit Institutions, amended by the National Assembly in June 2025.

Key provisions include: If a bank seizes a borrower’s sole residence, as verified under the decree, the secured party must allocate 12 months’ worth of the minimum wage (from collateral liquidation proceeds) to the guarantor. For the seizure of primary or sole work tools not financed by the loan, the bank must provide 6 months’ worth of the minimum wage to the guarantor.

Banks must provide 12 months’ wage support when seizing a borrower’s sole residence. (Illustrative image)

Guarantors must verify and prove asset status within 10 working days of the secured party’s request. Verification can be included in the collateral agreement or a separate document. Failure to comply results in the asset being classified as non-sole residence or work tool.

Guarantors are responsible for the legality of submitted documents, including: ownership certificates for collateral and related assets; bank statements showing monthly income; proof of personal income tax compliance; utility bills confirming residence; and other relevant documents.

According to the State Bank of Vietnam, the decree aims to balance the rights and interests of borrowers and lenders. It adopts a comprehensive approach to collateral seizure for non-performing loans, minimizing disruption to borrowers’ daily lives, production, and labor, thereby contributing to social stability.

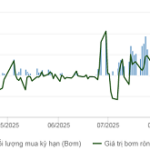

Central Bank’s Record Net Injection in 10 Months

During the week of November 24 to December 1, the State Bank of Vietnam (SBV) significantly expanded its liquidity support to the system, injecting a net of VND 98,980 billion into the open market operations (OMO). This marks the seventh consecutive week of net injections and represents the highest level since late January this year.

Businesses Deposit Over 8.35 Quadrillion into Banks

As of the end of September 2025, corporate deposits in the banking system surpassed 8.35 quadrillion VND, marking an 8.91% increase compared to the end of 2024. This figure also exceeded individual deposits by a significant margin of 518 trillion VND.