Vietnam’s stock market is experiencing a robust recovery, with Vingroup-affiliated stocks leading the charge in driving the VN-Index upward.

As of the December 1st session, Vinpearl’s VPL stock took center stage with a full-range breakout, even reaching a “zero sell” status. VPL’s price surged for the 7th consecutive session, hitting 101,600 VND per share—its highest level since listing over six months ago. Vinpearl’s market capitalization soared to 182 trillion VND.

Vinpearl, a newcomer to Vietnam’s stock market in 2025, listed on May 13th. It’s the fourth member of the Vingroup ecosystem to list on HoSE, joining Vingroup (VIC), Vinhomes (VHM), and Vincom Retail (VRE).

Recently, the Ho Chi Minh City Stock Exchange (HOSE) announced the removal of VPL – Vinpearl Joint Stock Company from the list of securities ineligible for margin trading.

After six months of listing, VPL shares are now eligible for margin trading, sparking positive reactions in the market.

In related news, Vinpearl issued a resolution to merge Cua Hoi Investment and Development JSC into VinWonders Nha Trang JSC.

Following the merger, Cua Hoi Investment and Development JSC will be dissolved, with Vinpearl remaining as the parent company of VinWonders Nha Trang. The company stated this move is part of its subsidiary restructuring plan to streamline operations and optimize performance.

Notably, the restructuring process has been swift. In late September 2025, Vinpearl approved the spin-off of Vinpearl Cua Hoi to establish Cua Hoi Investment and Development JSC with a charter capital of 1.137 trillion VND, 99.992% of which is held by Vinpearl.

Vinpearl Cua Hoi became a Vinpearl subsidiary on February 14, 2025, after Vinpearl acquired 99.99% of its shares from Vingroup for 1.855 trillion VND.

Currently, Vinpearl owns five subsidiaries: Phuc An Tourism Investment and Development, VinWonders Nha Trang, Landmark 81 Hotel Investment and Development, Thanh Hoa Hotel Investment and Development, and Vinpearl Cua Hoi.

In terms of business performance, Vinpearl’s Q3 2025 financial report shows core business revenue of 3.094 trillion VND, a 28% increase year-over-year. Gross profit from core operations surged 669% compared to Q3 2024, reaching 819 billion VND. Consequently, Vinpearl reported a Q3 2025 net profit of 169 billion VND.

For the first nine months of 2025, Vinpearl’s total operating revenue reached 12.7 trillion VND. Hotel service revenue across its system (including both owned and managed properties) totaled approximately 8.1 trillion VND, a 27% increase year-over-year. Net profit exceeded 428 billion VND.

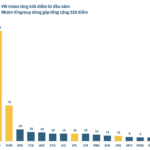

VN-Index Surges Past 1,700 Points in First Trading Session of the Month

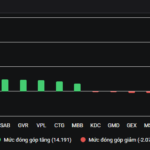

The VN-Index surged nearly 11 points in today’s session, reclaiming the critical 1,700 milestone after more than a month.

What Impact Does the Heat of Capital Withdrawal Have on Stocks?

The VN-Index extended its gains today (December 2nd). Amid a market lacking clear catalysts, several divestment stocks heated up, notably Giày Thượng Đình and VTC Telecom, both surging to their 10th consecutive upper limit session.