Following a session of gains with subdued trading volume, the stock market faced downward pressure on December 2nd, dipping to 1,690 points. However, the market demonstrated improved diversification, with buying momentum strengthening in the afternoon session. By the close, the VN-Index had risen by 15.39 points (+0.90%), settling at 1,717.06 points.

In terms of foreign trading activity, foreign investors resumed net buying, totaling 652 billion VND across the market.

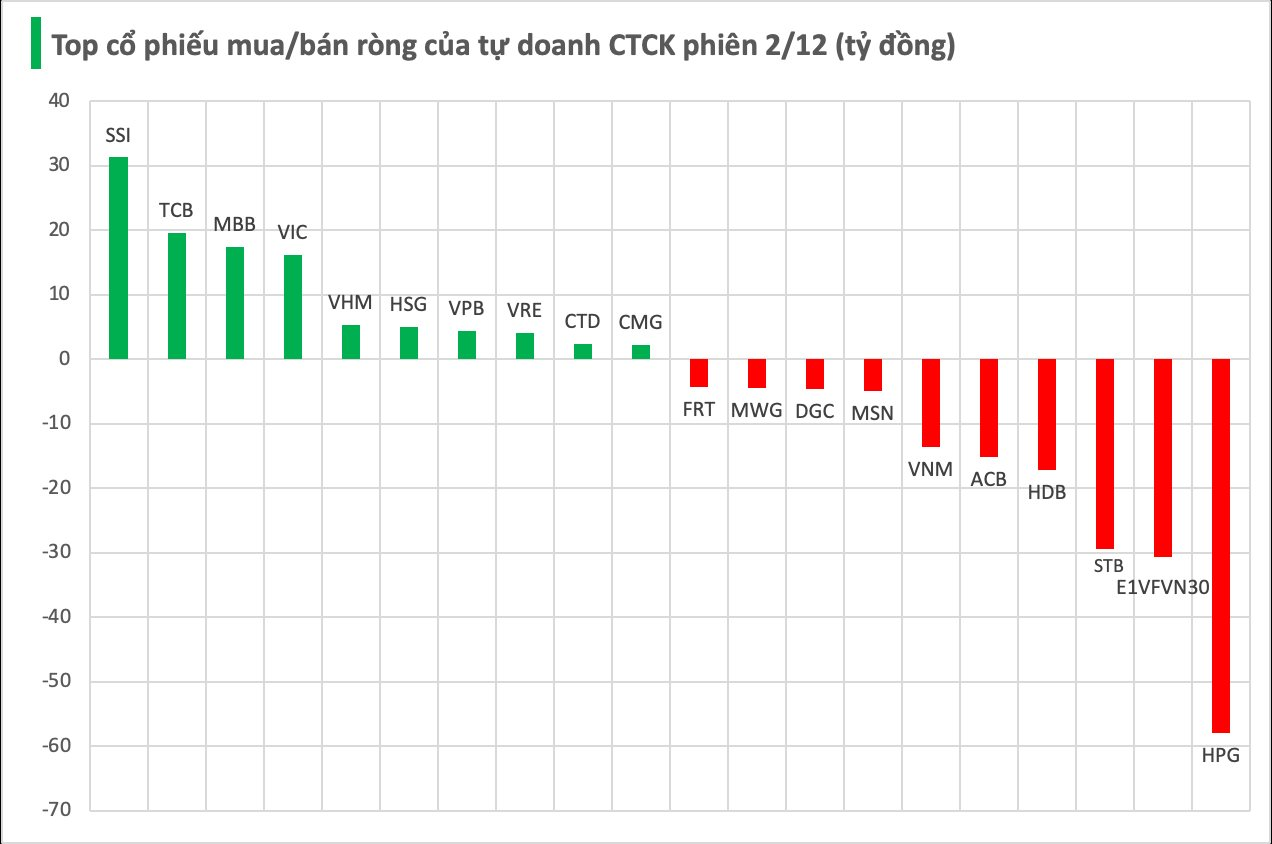

Securities firms’ proprietary trading desks reversed to net selling, totaling 64 billion VND.

Specifically, proprietary trading desks of securities firms recorded the highest net selling in HPG, with a value of -58 billion VND, followed by E1VFVN30 (-31 billion), STB (-29 billion), HDB (-17 billion), and ACB (-15 billion VND). Other stocks also saw notable net selling, including VNM (-14 billion), MSN (-5 billion), DGC (-5 billion), MWG (-5 billion), and FRT (-4 billion VND).

Conversely, SSI shares led in net buying with a value of 31 billion VND. This was followed by TCB (20 billion), MBB (17 billion), VIC (16 billion), VHM (5 billion), HSG (5 billion), VPB (4 billion), VRE (4 billion), CTD (2 billion), and CMG (2 billion VND).

Market Pulse 03/12: Foreign Investors Maintain Net Buying, Capital Flows Back to Financial Sector

At the close of trading, the VN-Index surged by 14.71 points (+0.86%), reaching 1,731.77 points, while the HNX-Index climbed 0.8 points (+0.31%) to 267.61 points. Market breadth favored the bulls, with 461 stocks advancing and 236 declining. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 9 fell, and 2 remained unchanged.

Vietstock Daily 03/12/2025: Strengthening the Upward Momentum

The VN-Index extended its winning streak to a fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands. Trading volume surpassed the 20-day average, while both the Stochastic Oscillator and MACD maintained their upward trajectories following buy signals, reinforcing a positive short-term outlook.