|

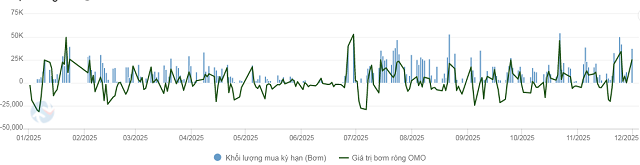

OMO Operations Net Injection Trends Since 2025. Unit: Billion VND

Source: VietstockFinance

|

This week, the State Bank of Vietnam (SBV) lent a total of 158.313 trillion VND through collateralized loans with terms ranging from 7 to 91 days at an annual interest rate of 4%. Meanwhile, the maturing amount was only 59.333 trillion VND. As a result, the net capital injection into the system reached nearly 99 trillion VND, second only to the record high of 140.382 trillion VND recorded in the week of January 20 – February 3.

After seven consecutive weeks of net injections, the total circulation on OMO increased to over 379.036 trillion VND.

|

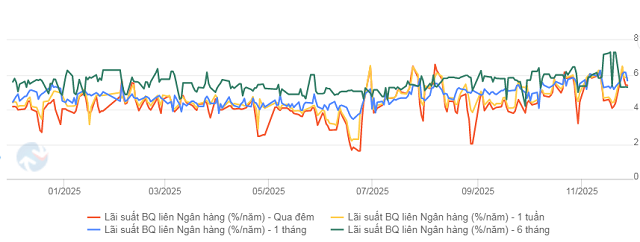

Interbank Interest Rate Trends Over the Past Year

Source: VietstockFinance

|

System liquidity fluctuations led to a sharp rise in interbank interest rates last week. The overnight rate jumped from 4.38% at the end of the previous week (November 21) to 6.4% on Tuesday (November 25), then dropped to 5.4% on November 28—a 102 basis point increase over the week. Notably, the average daily overnight trading volume reached a record high of over 1,000 trillion VND, up more than 40% from the previous week.

The one-week and one-month rates rose to 5.82%/year and 5.67%/year, respectively, increasing by 111 and 35 basis points compared to the previous week. Conversely, the six-month rate dropped significantly by 201 basis points to 5.29%/year.

|

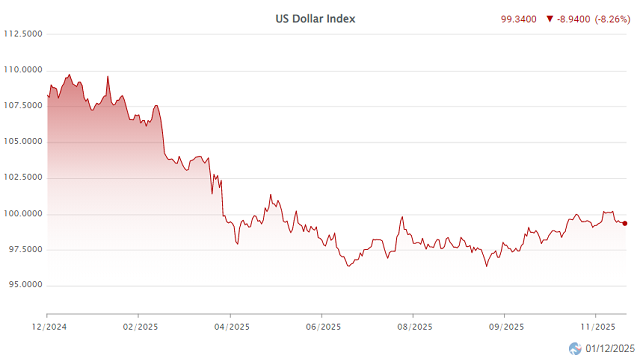

DXY Trends from the Beginning of 2025 to December 1

Source: VietstockFinance

|

In the international market, the USD Index (DXY) closed at 99.41 points on November 28, down 0.7 points from the previous week. The greenback faced its steepest decline in four months following reports that White House Economic Advisor Kevin Hassett is a leading candidate to succeed Federal Reserve Chairman Jerome Powell. Hassett is known for his dovish monetary policy stance and support for President Trump’s approach to interest rate cuts.

– 11:28 02/12/2025

Finance Ministry Proposes Approval of Credit Limit Exemption for EVN

In the draft Decree on the operational mechanism and special financial management mechanism for Vietnam Electricity (EVN), the Ministry of Finance proposes specific regulations regarding EVN’s capital mobilization and lending mechanisms.

Why Banks Are Universally Raising Savings Interest Rates

Rising interest rates on deposits stem from various factors, notably the allure of competing investment avenues.