Reflecting on November, despite a somewhat rocky start, the VN-Index swiftly rebounded to close at 1,690.99 points—the highest monthly close ever recorded, breaking the two-month losing streak.

In a conversation with the author, Luu Chi Khang, Head of Proprietary Trading at Kien Viet Securities (CSI), noted that the market’s rally was met with skepticism. The lack of robust liquidity remains a hurdle for more substantial gains.

According to VietstockFinance, trading value on the HOSE in November averaged only VND 22.7 trillion per session, a sharp decline from the VND 38 trillion average over the previous four months.

Nguyen Hong Diep, Founder and CEO of ViCK Corporation, attributed the liquidity drop primarily to dwindling selling pressure after many stocks had already plunged. Another critical factor is the scarcity of fresh capital entering the market.

Specifically, high credit growth has left limited room for further lending. Recent interest rate hikes by banks also signal liquidity shortages, impacting cash flow into the stock market.

December: A Data Void with Exchange Rates in Focus

Luu Chi Khang believes December will be a month of anticipation for key macroeconomic data, including GDP, CPI, FDI, trade figures, and retail sales. However, these updates won’t be available until early 2026.

|

Instead, the spotlight falls on exchange rates, particularly influenced by the U.S. Federal Reserve’s meeting outcome on December 11th (Vietnam time). If the Fed cuts rates as widely expected, the recent tension in Vietnam’s exchange rates could ease, providing room for monetary policy relaxation.

Nguyen Hong Diep also highlighted the unusual persistence of a wide gap between official and black-market exchange rates, currently around 4-5%.

Experts stress that while such gaps aren’t uncommon, their prolonged duration is unusual. However, year-end remittance inflows could cool black-market rates, aligning them closer to the State Bank’s ceiling and bolstering VND liquidity.

Beyond exchange rates, Diep noted the market’s current lull in impactful news, leaving it directionless.

Globally, the Fed’s dovish stance will continue, and President Trump’s limited time in office reduces the likelihood of new tariffs. Domestically, there are no major red flags, particularly regarding bond defaults or rising bad debt. Natural disasters remain a concern but are unlikely to significantly impact markets.

Regarding foreign capital, experts widely anticipate a shift to net buying in 2026. In the short term, a December rate cut by the Fed could boost sentiment, though Diep views this as more psychological than fundamental.

Foreign Investors Slash Net Selling as VN-Index Hits All-Time Monthly High

What’s in Store for the VN-Index This December?

Nguyen Hong Diep outlines three scenarios for December. The most likely (60% probability) is sideways movement between 1,650 and 1,750 points, with moderate liquidity around VND 20 trillion per session.

In a more optimistic scenario (25% chance), positive news could propel the index above 1,800, setting the stage for 2026 peaks at 2,200 or even 2,500.

However, a correction to 1,600 isn’t ruled out if the index falters after breaching 1,700, particularly with weak liquidity (15% probability).

|

Diep advises investors to split portfolios: 50-60% for mid-to-long-term holdings in stable sectors like banking, real estate, and logistics, and the remainder for short-term trades, targeting 4-5% profits.

He cautions against rushing into sectors like securities, which face liquidity challenges that could dent Q4 earnings. Despite recent declines, high valuations and large issuances warrant patience.

Luu Chi Khang remains optimistic, expecting a “zigzag” rally toward 1,720-1,760 if liquidity returns. For 2026, he forecasts a bullish trend, potentially reaching 1,960 by mid-year, fueled by robust macroeconomic prospects.

Short-term traders should target deeply discounted stocks with strong fundamentals, while long-term investors should focus on sectors with attractive P/E ratios, such as steel, energy, chemicals, retail, insurance, and industrial real estate.

– 09:03 03/12/2025

Vietstock Daily 03/12/2025: Strengthening the Upward Momentum

The VN-Index extended its winning streak to a fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands. Trading volume surpassed the 20-day average, while both the Stochastic Oscillator and MACD maintained their upward trajectories following buy signals, reinforcing a positive short-term outlook.

Billionaire Pham Nhat Vuong’s Shares Targeted in Massive $100 Billion Buyout Blitz

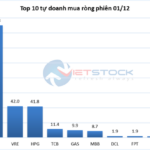

Proprietary trading desks at securities companies collectively net purchased VND 54 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.