Dragon Capital plans to list all 31.2 million outstanding shares (equivalent to 100% of the shares) of DCVFM on the UPCoM trading platform. The shareholder record date for registration with VSD and trading registration is December 4th.

In 2003, Dragon Capital co-founded Vietnam Fund Management Joint Stock Company (VietFund Management – VFM), the first local fund management firm in Vietnam specializing in securities investment funds and portfolio management.

In 2021, Dragon Capital and VFM formed a comprehensive partnership, establishing Dragon Capital Vietnam Fund Management Joint Stock Company (DCVFM).

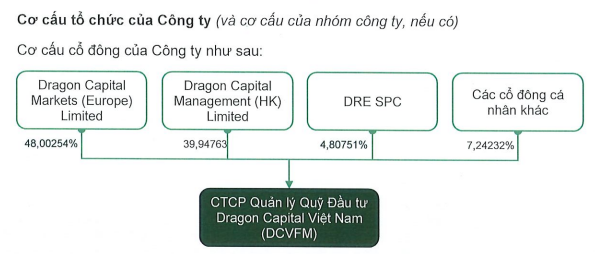

Dragon Capital’s shareholder structure comprises three organizations: Dragon Capital Markets (Europe) Limited (48%), Dragon Capital Management (HK) Limited (39.9%), and DRE SPC (4.81%), with individual shareholders holding the remaining 7.24%.

Source: DCVFM

|

Chairman Dominic Scriven, who has served as Director of Dragon Capital Group since 1994, also holds the position of DCVFM’s Chairman, overseeing the company’s operations for over 20 years. He owns 210,750 shares, representing 0.675% of the charter capital.

DCVFM’s core business activities include securities investment management, portfolio management, and investment advisory services. As of May 2025, the company manages and advises on approximately VND 128,000 billion in assets.

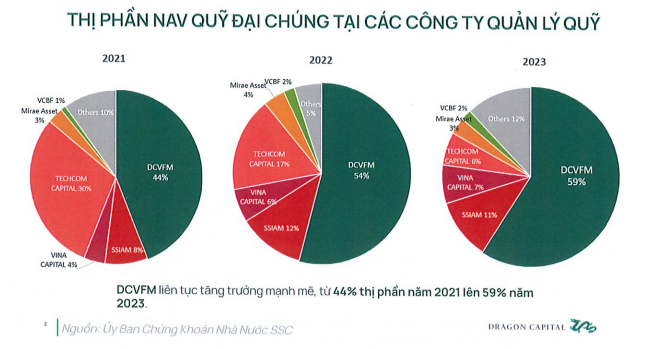

DCVFM is a leading public fund management company in Vietnam, both in terms of the number of funds and total net asset value (NAV), accounting for 59% of the total NAV of public funds in the Vietnamese market.

In the first nine months of 2025, DCVFM reported an after-tax profit of nearly VND 87 billion, a 48% decrease compared to the same period last year. As of September 30, 2025, total assets reached over VND 1,085 billion, with equity amounting to VND 800 billion.

Looking ahead, DCVFM aims to leverage machine learning, big data analytics, and international market research to optimize its existing public fund products, attract a broader customer base, and adapt to the evolving economic and social landscape. Future fund products will cater to diverse customer segments, considering factors such as age, wealth, and risk appetite.

DCVFM will also focus on developing innovative and mainstream fund products to enable Vietnamese investors to invest sustainably and avoid falling prey to non-traditional investment schemes.

In terms of distribution channels, DCVFM will enhance customer experience across multiple platforms, partnering with new distributors, including banks, securities companies, and licensed trading platforms, to offer tailored services. The company’s goal is to provide investment and asset management solutions to millions of Vietnamese citizens.

– 4:00 PM, December 3, 2025

VIDEO: Dragon Capital Chairman Discusses Benefits of 5 Million Household Businesses Upgrading to Enterprises

The transformation of sole proprietorships into formal businesses has the potential to contribute a 1% annual increase to GDP over the next three years.

Prominent Investment Fund Movements in the Last Week of November

Last week (November 24-28, 2025), investment funds predominantly disclosed prior transactions, with selling activities taking the lead. Building on the upward momentum from the previous week, the VN-Index continued its ascent in the final week of November 2025, edging closer to the 1,700-point mark.

Breaking News: Vietnam’s Top Billion-Dollar Gold Mining Giant Issues Urgent Alert on Potential Public Status Revocation Amid 5x Stock Surge

With an overwhelmingly concentrated shareholder structure, where state ownership dominates nearly entirely, Vietnam National Coal and Mineral Industries Group (Vinacomin) has announced its intention to file for the revocation of its public company status.