At the end of the day, while Mi Hong reduced the price of gold bars to 153 – 154.5 million VND per tael, other gold retailers maintained their previous rates. Today, gold bar prices dropped by approximately 700,000 VND per tael compared to yesterday’s closing session. Currently, SJC, DOJI, and PNJ are uniformly listed at 152.5 – 154.5 million VND per tael, while Bao Tin Manh Hai and Bao Tin Minh Chau are trading at 153.1 – 154.5 million VND per tael and 153 – 154.5 million VND per tael, respectively.

For gold rings, Bao Tin Minh Chau further reduced prices by 200,000 VND per tael compared to the latest update, now buying and selling at 151 – 154 million VND per tael. PNJ, DOJI, and Phu Quy are trading at 150.6 – 153.6 million VND per tael, a 600,000 VND decrease per tael from yesterday. The price of Kim Gia Bao gold ingot rings at Bao Tin Manh Hai is listed at 153.1 – 154.3 million VND per tael. SJC reduced prices by 700,000 VND per tael today, down to 150.3 – 152.8 million VND per tael.

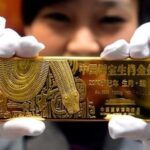

Gold prices at Bao Tin Manh Hai

———————

As of 1:30 PM, gold bar prices at SJC, DOJI, and Bao Tin Minh Chau continued to drop by 100,000 VND per tael compared to the latest update, trading at 152.5 – 154.5 million VND per tael, 152.5 – 154.5 million VND per tael, and 153 – 154.5 million VND per tael, respectively. This brings the total decrease to 700,000 VND per tael compared to yesterday’s closing session. Other gold retailers have not yet adjusted their prices.

Gold ring prices at Bao Tin Minh Chau dropped by an additional 200,000 VND per tael compared to the latest update, totaling a 700,000 VND decrease today, and are listed at 151.3 – 154.3 million VND per tael. Prices at other gold retailers remain unchanged.

———————

As of 9:00 AM, SJC gold bar prices across brands fell by approximately 600,000 VND per tael compared to the previous session’s close, for both buying and selling. SJC, DOJI, and PNJ are listed at 152.6 – 154.6 million VND per tael, while Bao Tin Manh Hai and Bao Tin Minh Chau are trading at 153.2 – 154.6 million VND per tael and 153.1 – 154.6 million VND per tael, respectively. Mi Hong’s buying and selling rates are at 153.3 – 154.6 million VND per tael.

Gold ring prices across brands also decreased by 500,000 – 700,000 VND per tael compared to yesterday’s close. Currently, Kim Gia Bao gold ingot rings at Bao Tin Manh Hai and plain gold rings at Bao Tin Minh Chau are listed at 151.5 – 154.5 million VND per tael. SJC is trading gold rings at 150.3 – 152.8 million VND per tael, while PNJ and DOJI are at 150.6 – 153.6 million VND per tael.

———————

Early morning update, domestic gold prices remained unchanged from the previous session’s close.

For gold bars, SJC, DOJI, and PNJ are uniformly listed at 153.2 – 155.2 million VND per tael for buying and selling. Bao Tin Minh Chau and Bao Tin Manh Hai are trading at 153.7 – 155.2 million VND per tael. Phu Quy and Mi Hong are listed at 152.2 – 155.2 million VND per tael and 153.5 – 155.2 million VND per tael, respectively.

For gold rings, Kim Gia Bao gold ingot rings at Bao Tin Manh Hai are listed at 152 – 155 million VND per tael. SJC is trading at 151 – 153.5 million VND per tael, while DOJI and PNJ are at 151.2 – 154.2 million VND per tael.

According to Reuters, global gold prices rose to a six-week high on Monday, driven by expectations of imminent U.S. rate cuts and a weaker USD, while silver hit a new record ahead of key U.S. economic data.

Overnight (Vietnam time), spot gold prices peaked at $4,241.27 per ounce, the highest since October 21. At the time of reporting, prices were hovering around $4,227 per ounce, approximately $20 million VND per tael lower than domestic prices (based on Vietcombank’s exchange rate).

The USD fell to a two-week low, making gold more affordable for buyers using other currencies. “The overall context with continued rate cut expectations and inflation remaining above the Fed’s target… remains supportive for gold and silver,” said David Meger, Director of Metals Trading at High Ridge Futures.

Traders increased the probability of a Fed rate cut in December to 87%, following weaker economic data and dovish remarks from Fed officials, including Governor Christopher Waller and New York Fed President John Williams. Lower rates typically benefit non-yielding assets like gold.

Investors are now awaiting key U.S. economic data this week, including the November ADP employment report on Wednesday and the September Personal Consumption Expenditures (PCE) index—the Fed’s preferred inflation gauge—on Friday. Fed Chair Jerome Powell’s speech later on Monday is also expected to provide further monetary policy insights.

Additionally, expectations that the next Fed Chair will adopt a more dovish stance than their predecessor are supporting gold and silver prices, Meger noted. White House economic advisor Kevin Hassett said on Sunday he would be willing to serve as Fed Chair if chosen. Treasury Secretary Scott Bessent indicated the successor could be announced before Christmas.

“We still believe gold and silver are maintaining a strong sideways trend, leaning toward an upward trajectory,” Meger added.

Linh San

Afternoon of November 27: Gold Ring Purchase Prices Continue to Decline

In today’s trading session, a leading gold retailer further reduced the buy-in price of gold rings to 149.5 million VND per tael.