Vietnam Value Investment Fund (VVIF2020), a member of Vietnam Intelligence Fund Management Joint Stock Company, has recently registered to purchase 3.3 million shares of EVS Securities JSC (EVS).

The transaction is scheduled to take place between December 4 and December 31, 2025, with the purpose of investment. If successful, VVIF2020 will increase its holdings from 5.2 million EVS shares (3.17%) to 8.5 million shares (5.17%), becoming a major shareholder of EVS Securities.

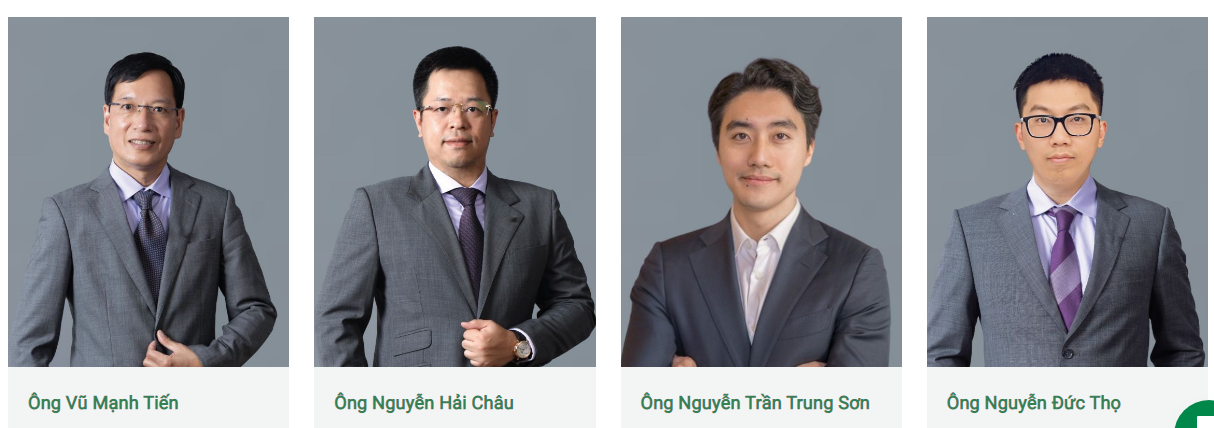

Notably, Mr. Nguyen Hai Chau, Chairman of EVS Securities’ Board of Directors, also serves as Vice Chairman of Vietnam Intelligence Fund Management’s Board of Directors.

Mr. Vu Manh Tien, a member of EVS’ Board of Directors, is concurrently the Chairman of Vietnam Intelligence Fund Management’s Board of Directors.

Leadership team of IVAM. Source: Ivam.vn

Another member of Vietnam Intelligence Fund Management, Vietnam Value Discovery Fund (VVDIF), currently holds 7.8 million EVS shares, representing a 4.75% stake.

Vietnam Intelligence Fund Management (IVAM) was originally established in 2008 as Bao Tin Fund Management Company. In 2011, it was renamed Global Partnership Fund Management JSC. By 2015, the company adopted its current name and increased its capital from VND 50 billion to VND 70 billion. During this period, IVAM also entered a strategic partnership with Everest Securities, the predecessor of EVS Securities.

In 2022, IVAM began managing two funds, VVIF2020 and VVDIF. In 2023, IVAM increased its capital to VND 116 billion.

On November 27, 2025, the State Securities Commission issued Certificate No. 452/GCN-UBCK, approving the establishment of VVIF2020 with a charter capital of VND 102 billion.

Regarding EVS Securities’ business performance, the company reported VND 209 billion in revenue for the first nine months of 2025, a 41% increase year-over-year. Pre-tax profit reached VND 11 billion, 2.3 times higher than the same period last year.

As of September 30, 2025, EVS’ total assets stood at VND 2,323 billion, a 5.8% decrease year-over-year.

Its financial assets at fair value through profit or loss (FVTPL) totaled VND 723 billion, including VND 433 billion in listed stocks and VND 251 billion in unlisted stocks. Outstanding loans amounted to VND 140 billion.

Notably, receivables accounted for half of the total assets at VND 1,255 billion. These receivables likely include unrecovered bond debts, such as VND 328.5 billion from Viet Media, VND 737.5 billion from Tien Thanh Consulting Services LLC, and VND 189 billion from Toan Xuan Thinh Investment and Trading JSC.