According to the Ho Chi Minh City Stock Exchange, Pyn Elite Fund, a Finnish investment fund, has submitted a report to the State Securities Commission, the Stock Exchange, and Ha Do Group Joint Stock Company (Stock Code: HDG, HoSE) regarding changes in ownership by a major shareholder holding 5% or more of the shares.

On November 24, 2025, Pyn Elite Fund successfully purchased 955,600 HDG shares on the trading floor. Following this transaction, the fund’s holdings increased from nearly 36.1 million shares to over 37 million shares, raising its ownership stake from 9.75% to 10.01% of Ha Do Group’s capital.

Illustrative image

Based on the closing price of HDG shares at 32,800 VND per share on November 24, 2025, the Finnish fund is estimated to have spent over 31.3 billion VND on this acquisition.

In terms of business performance, Ha Do Group recorded revenue of nearly 1,901 billion VND in the first nine months of 2025, a 3.2% decrease compared to the same period in 2024. After-tax profit reached nearly 571 billion VND, up 4.8% year-on-year.

For 2025, Ha Do Group aims to achieve consolidated revenue of 2,936 billion VND and after-tax profit of 1,057 billion VND.

By the end of the first three quarters, the company has fulfilled 64.7% of its revenue target and 54% of its after-tax profit goal.

As of September 30, 2025, Ha Do Group’s total assets rose by 4.6% from the beginning of the year to nearly 14,481 billion VND. Fixed assets accounted for 56.5% of total assets, totaling over 8,180 billion VND, with inventory at 781 billion VND and long-term work in progress at nearly 1,772 billion VND.

On the liabilities side, total payables stood at nearly 6,413 billion VND, slightly lower than at the start of the year. Loans and financial lease liabilities amounted to nearly 4,879 billion VND, representing 76.1% of total liabilities.

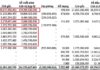

HOSE Announces 65 Stocks Removed from Margin Trading List

As per regulations, investors are prohibited from using credit limits (financial leverage or margin) provided by securities companies to purchase any of the 65 stocks listed as ineligible for margin trading.