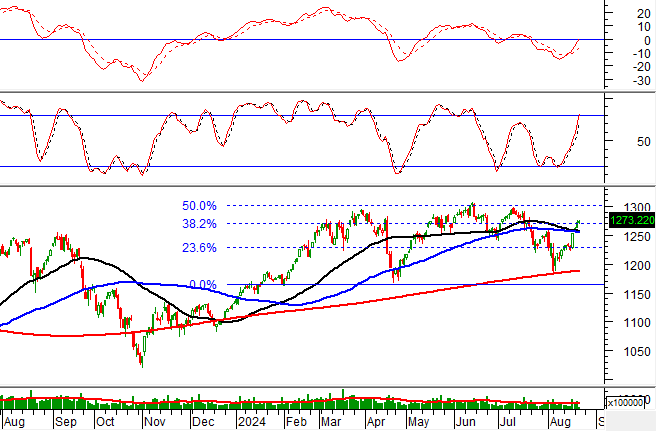

After a tumultuous start, Vietnam’s stock market staged a remarkable turnaround in the afternoon session, surging ahead with impressive gains.

Led by a rally in blue-chip stocks, the VN-Index closed the December 2nd session with a significant uptick of over 15 points, reaching 1,717 points. Trading volume on the Ho Chi Minh City Stock Exchange (HoSE) showed improvement, with order-matching value exceeding VND 20.1 trillion.

Foreign investors returned to the market, recording a net buy value of VND 652 billion across all exchanges. Here’s a breakdown:

On HoSE, foreign investors net bought approximately VND 652 billion

On the buying side, VJC saw the strongest foreign inflows, with a net buy value of around VND 224 billion. This was followed by VIC (+VND 149 billion), TCB (+VND 131 billion), MBB (+VND 124 billion), and VNM (+VND 113 billion), all recording net buys exceeding VND 100 billion.

Conversely, ACB witnessed the heaviest foreign outflows, with a net sell value of approximately VND 75 billion. VIX, VPI, VRE, and VCI also featured prominently in the net sell list, with respective outflows of VND 57 billion, VND 50 billion, VND 49 billion, and VND 48 billion.

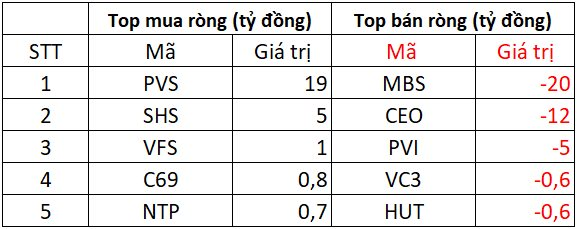

On HNX, foreign investors net sold approximately VND 13 billion

On the HNX, PVS led the buying activity with a net foreign inflow of around VND 19 billion, followed by SHS with a net buy of approximately VND 5 billion. VFS, C69, and NTP also saw modest net buying, ranging from a few hundred million to VND 1 billion each.

On the selling side, CEO and MBS experienced the heaviest outflows, with net sells of VND 12 billion and VND 20 billion, respectively. PVI saw a net sell of around VND 5 billion, while VC3 and HUT faced lighter selling pressure, with net sells below VND 1 billion.

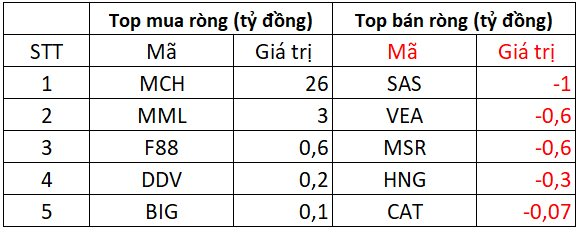

On UPCOM, foreign investors net bought approximately VND 28 billion

On UPCOM, MCH saw the strongest foreign buying, with a net inflow of VND 26 billion. MML also recorded a net buy of VND 3 billion, while F88, DDV, and BIG saw negligible net buying activity.

On the selling side, stocks like HNG, MSR, VEA, and SAS recorded net sell values ranging from a few hundred million to VND 1 billion.

VN-Index Surges Past 1,700 Points, Yet Investor Portfolios Continue to Shrink

Amidst the market’s deceptive “green exterior, red core” dynamics, the majority of investors find their accounts lingering in the red, underscoring the prevailing challenges in navigating such volatile conditions.

Blue-Chip Stock Code Unexpectedly Hit by Strong Net Selling from Securities Firm’s Proprietary Trading on December 2nd

Proprietary trading desks at securities firms reversed their position, shifting to net selling with a total value of 64 billion VND.