Riding the wave of recovery, the VN-Index traded positively on December 1st, closing above the 1,700-point mark. However, the upward momentum was not widespread, primarily concentrated in a few large-cap stocks. The order-matching value on HoSE reached nearly VND 16.2 trillion.

Foreign trading activity was a downside, with net selling of approximately VND 317 billion across the market. Specifically:

On HoSE, foreign investors net sold roughly VND 298 billion

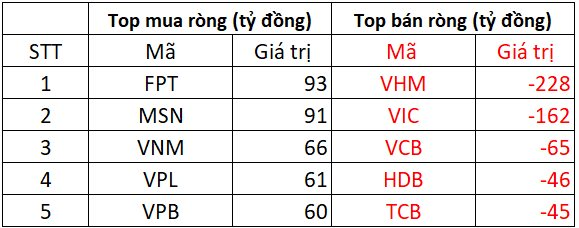

On the buying side, FPT was the most heavily accumulated stock by foreign investors, with a value of around VND 93 billion. MSN followed with a net buy of VND 91 billion, while VNM attracted foreign capital with a value of approximately VND 66 billion. VPL and VPB were also net bought, with values of VND 61 billion and VND 60 billion, respectively.

Conversely, selling pressure was concentrated in blue-chip stocks. VHM led with a net sell value of approximately VND 228 billion. VIC was next, with a net sell of VND 162 billion, and VCB recorded a net sell of around VND 65 billion. Two other banking stocks, HDB and TCB, were also sold off by foreign investors, with values of VND 46 billion and VND 45 billion, respectively.

On HNX, foreign investors net sold approximately VND 9 billion

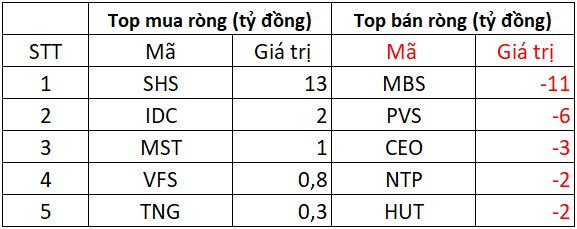

On the buying side, foreign investors most actively purchased SHS, with a value of around VND 13 billion. Additionally, foreign capital flowed into IDC (VND 2 billion), MST (VND 1 billion), VFS (VND 0.8 billion), and TNG (VND 0.3 billion).

On the selling side, pressure was concentrated in financial and oil & gas stocks. MBS led with a net sell value of approximately VND 11 billion, followed by PVS with a net sell of VND 6 billion. CEO, NTP, and HUT also recorded net sell values of VND 2–3 billion each.

On UPCOM, foreign investors net sold approximately VND 9 billion

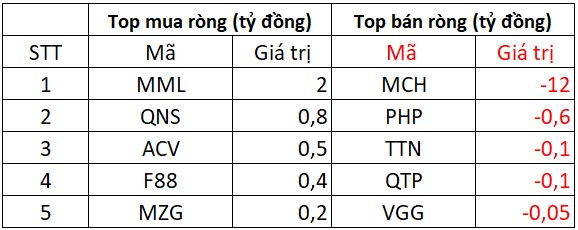

On the buying side, foreign trading was modest, with MML being the most heavily net bought at around VND 2 billion. Other stocks like QNS (VND 0.8 billion), ACV (VND 0.5 billion), F88 (VND 0.4 billion), and MZG (VND 0.2 billion) also saw light net buying.

Conversely, selling pressure was primarily on MCH, which was sold off for approximately VND 12 billion – the highest on UPCoM today. Additionally, PHP, TTN, QTP, and VGG recorded smaller net sell values, ranging from VND 50 million to VND 600 million each.

Vietstock Daily 04/12/2025: Will the Rally Continue?

The VN-Index extended its winning streak to six consecutive sessions, breaking above the 50-day SMA and now hugging the Upper Band of the Bollinger Bands. This bullish outlook is reinforced by the MACD indicator, which continues to widen its gap above the Signal line. However, caution is warranted as the Stochastic Oscillator has ventured deep into overbought territory, leaving investors vulnerable to a potential sell signal in the coming sessions.

Vietnam’s Stock Market Diverges: King Stocks and VN-Index No Longer in Sync

Amidst the ongoing correction in the market’s largest-cap stocks, the VN-Index managed to maintain its upward trajectory in November. This divergence highlights that the market’s momentum is increasingly driven by sectors beyond banking, signaling a broader-based rally.