Success Attributed to 5 Key Factors

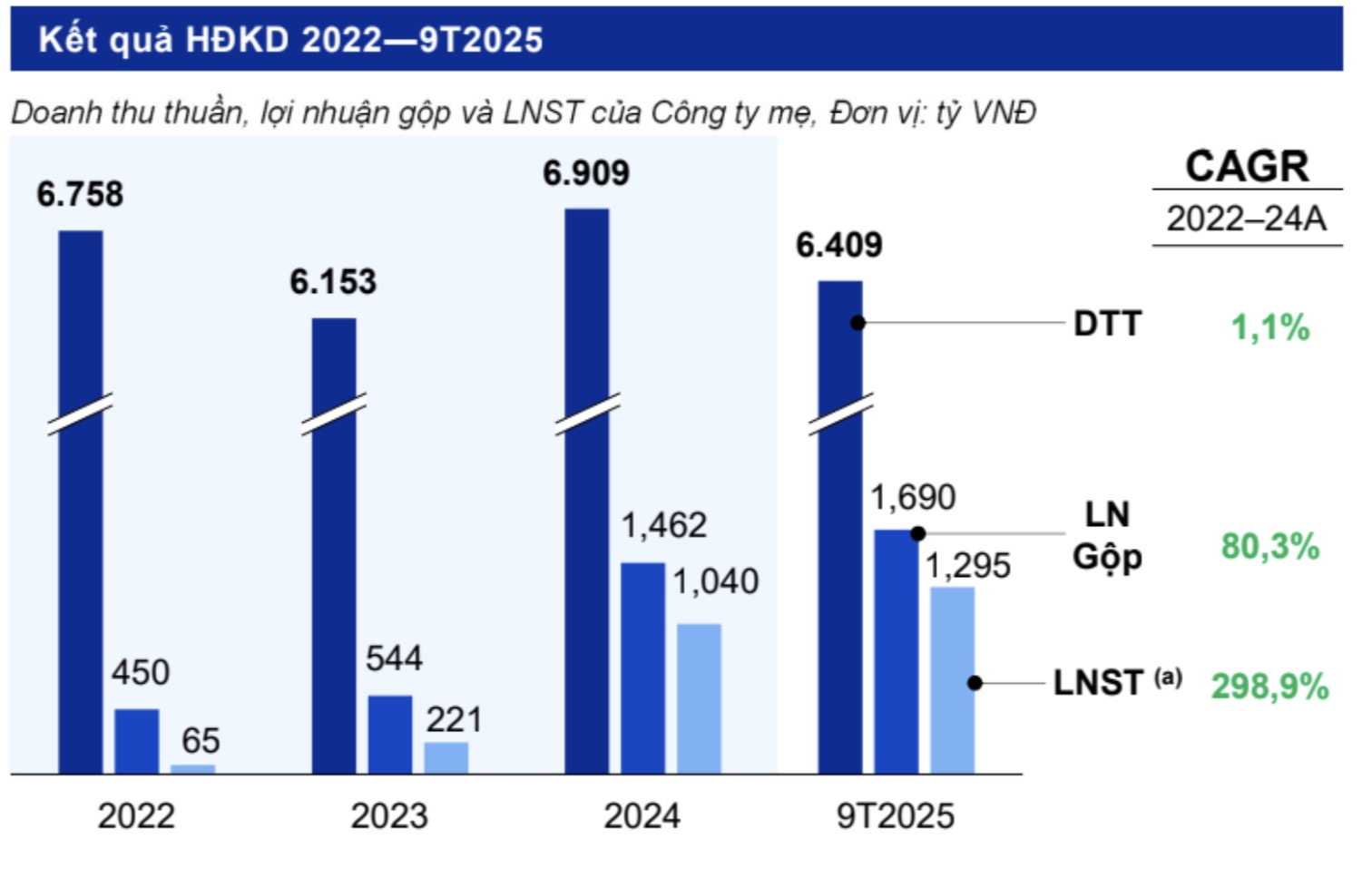

According to Ms. Van, HPA has achieved remarkable milestones in recent years. In 2024, the company’s net revenue surpassed 6.9 trillion VND, with the pig farming segment contributing the most, followed by animal feed, cattle farming, and poultry. Gross profit reached 1.46 trillion VND, 2.7 times higher than the previous year. Post-tax profit exceeded 1 trillion VND, a 4.7-fold increase year-on-year. Post-tax profit margin, ROE, and ROA stood at 15.1%, 30.6%, and 21.4%, respectively.

In the latest update, for the first nine months of 2025, HPA recorded a post-tax profit of nearly 1.3 trillion VND, with ROE and ROA at 56.4% and 31.7%, respectively.

Ms. Van attributed these results, in part, to HPA’s closed-loop business model encompassing Feed and Farm segments—from animal feed production to farming operations. The company has achieved self-sufficiency in animal feed with two factories in Hung Yen and Dong Nai. In 2024, 51% of sales were directed to internal farms, while 49% were distributed through a network of 629 distributors with 150 product codes.

Ms. Pham Thi Hong Van – CEO of HPA

|

“The closed-loop model, successfully applied in steel, has been adapted to agriculture. Self-sufficiency in Feed-Farm gives us a stable internal system and cost advantages. It allows us to evaluate and optimize raw materials and additives before market deployment, ensuring highly efficient feed production,” said the CEO of HPA.

The second factor is breeding stock. Ms. Van highlighted HPA’s bold decision to introduce high-yield breeds: DanBred pigs from Denmark, Hy-line chickens from the U.S., and high-quality Australian beef cattle. Notably, DanBred pigs achieve 33-34 piglets per sow per year, 1.5 times the Vietnamese average.

“This was a risky move, as these breeds require stringent conditions. However, as late entrants, we chose the challenging path to surpass competitors,” she added.

Third, HPA’s large-scale investment in state-of-the-art farms ensures real-time climate control, automated feeding, and reduced tropical climate impact. Land allocation is generous, with 10 hectares dedicated to 1,200 sows, compared to the typical 2-3 hectares. This facilitates robust biosecurity zoning.

Biosecurity is a top priority for HPA. “Designing biosecurity is easy, but ensuring strict adherence is the challenge,” Ms. Van noted. The company uses specialized tankers for feed transport, minimizing disease risks and maintaining herd health and economic efficiency.

Lastly, Ms. Van emphasized Hoa Phat’s corporate culture—a team with strong management experience, a learning mindset, and a commitment to excellence. This human factor is pivotal in maximizing the effectiveness of the other four elements.

Expanding with 3 New Farms, Food Segment on Hold

Regarding IPO proceeds, Ms. Van stated that funds will enhance working capital, repay debts, and finance three new pig farms, a feed mill, and poultry equipment upgrades.

Cattle farming, once HPA’s most profitable segment (2017-2021), now yields lower profits due to restructuring. However, Ms. Van sees potential in this sector, given existing resources and stricter border controls on smuggling.

For poultry, despite its volatility, egg production recently matched feed segment profits. Ms. Van remains optimistic about its future, citing regional tensions as a potential growth driver.

While HPA has integrated Feed and Farm, some shareholders questioned the absence of a Food segment to complete the 3F chain.

Mr. Nguyen Viet Thang, CEO of Hoa Phat Group (HOSE: HPG) and HPA’s Chairman, explained, “While 3F is a common model, Hoa Phat’s B2B steel background influenced our agricultural approach. Entering Food requires not just processing but also a distribution network. We aim to connect directly with consumers. Food is under study, and we’ll pursue it only when success is assured,” he concluded.

– 10:00 02/12/2025

Hoà Phát Agriculture Declares 38.5% Cash Dividend; No White Chicken Farming or Southern Egg Sales Yet

On the afternoon of December 1st, Hoa Phat Agricultural Development Joint Stock Company (HPA) hosted an investment opportunity seminar, announcing the public offering of 30 million shares at a price of VND 41,900 per share. The company is expected to list on the Ho Chi Minh City Stock Exchange (HOSE) in early 2026.

“Bách Việt Group Vice Chairman Shares Reverse Investment Story: ‘Nurturing the Highlands to Sustain the Lowlands’ and the Philosophy of ‘The Mila Bird on the Highway’”

As we approach the 15th anniversary of Bach Viet Group, we had the privilege of sitting down with Vice Chairman Nguyen Tan Thanh. He shared insights into the Group’s remarkable 15-year journey, highlighting their unique strategy of “nurturing the upstream to sustain the downstream.” This approach has been instrumental in elevating the value and sustainability of real estate in Vietnam’s provincial areas.

F88 Secures Double Victory as “Best Place to Work in Vietnam 2025”

At the Best Places to Work in Vietnam 2025 Conference held on November 19th in Ho Chi Minh City, F88 was honored by Anphabe in two categories: Best Places to Work in Vietnam and Companies with the Happiest Workforce. This recognition celebrates F88’s decade-long commitment to fostering a work environment that prioritizes its people.