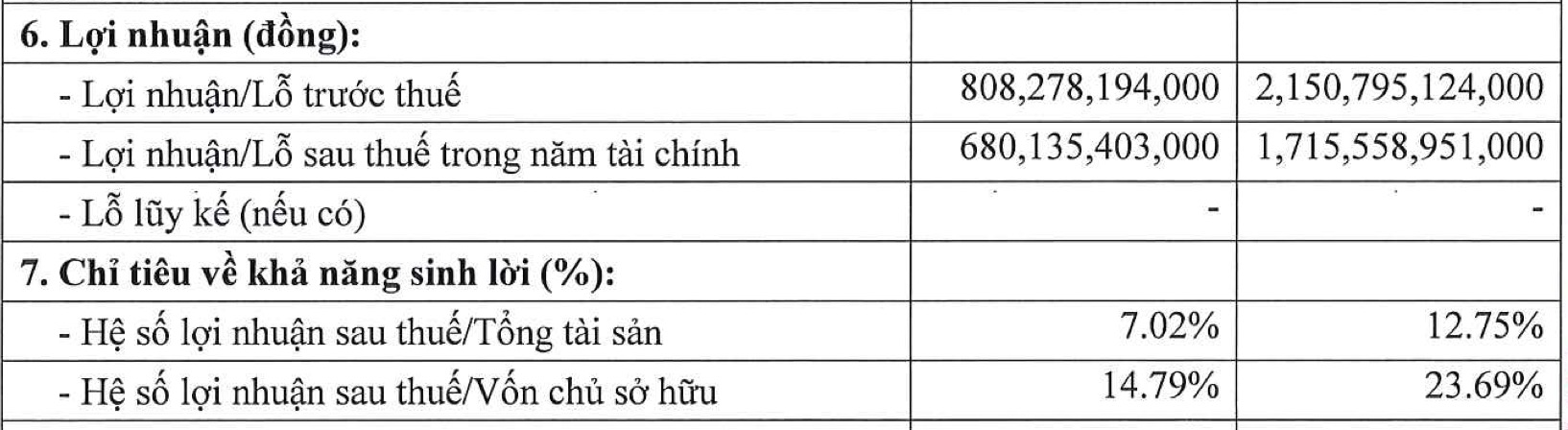

Specifically, in the first six months of 2025, GreenFeed reported an after-tax profit of over 1.7 trillion VND, a 2.5-fold increase compared to the same period last year (680 billion VND). The Return on Equity (ROE) improved from nearly 14.8% to approximately 23.7%.

The positive business results also contributed to the company’s equity capital reaching over 7.24 trillion VND by the end of June, a 57% increase from the 4.6 trillion VND recorded in the same period last year. Accumulated profit reached 6.1 trillion VND, a significant rise from the 3.6 trillion VND of the previous year.

Source: HNX

|

GreenFeed’s debt-to-equity ratio (D/E) decreased from 1.11 to 0.86. However, total liabilities recorded at over 6.2 trillion VND, an increase of nearly 1.2 trillion VND (equivalent to 22%) compared to the same period last year. Despite this, the company’s outstanding bond debt remained unchanged at 700 billion VND.

Due to the significant growth in equity capital, the bond debt-to-equity ratio decreased from 0.15 to 0.1. This debt stems from a privately placed bond issued in the domestic market, specifically the GFVCH2128001 bond series with a total issuance value of 1 trillion VND (currently 700 billion VND remaining), which is the only outstanding bond series of GreenFeed.

The bond has an 84-month term, issued on November 3, 2021, and matures on June 15, 2028. Vietcombank Securities (VCBS) acted as the advisor, registrar, issuer, and transfer agent for the bond. The applicable interest rate for the bond is 6.53% per annum, with interest paid semi-annually.

This non-convertible bond is unsecured, backed by collateral, and guaranteed for payment. The bondholder is the International Finance Corporation (IFC). The collateral includes 100% of the equity capital in GreenFarm LLC and LinkFarm LLC (both owned by GreenFeed), along with all related rights and income.

GreenFeed Vietnam was established in 2003, operating in the production of animal feed and later expanding into meat processing and food production. The company owns the G Kitchen pork brand in the market.

– 21:01 02/12/2025

VPS Securities Approved by HOSE to List Over 1.48 Billion Shares

On December 1st, the Ho Chi Minh City Stock Exchange (HOSE) approved the listing of over 1.48 billion shares of VPS Securities JSC. The brokerage firm had previously expressed its anticipation of being listed as early as December 2025.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.

Amid Novaland’s Stock Recovery, Chairman’s Wife Sells 2.3 Million Shares, Pocketing Over VND 23 Billion

Mrs. Cao Thi Ngoc Suong has successfully sold over 2.3 million NVL shares, significantly lower than the initially registered figure of more than 17 million units.

Spectacular Business Breakthrough: OCBS Surges Capital to 3.2 Trillion VND with a Series of Major Strategic Moves

On November 27, 2025, OCBS Securities Corporation (OCBS) held an Extraordinary General Meeting of Shareholders to approve a capital increase plan, raising its charter capital to VND 3,200 billion. This marks OCBS’s second capital hike in 2025, following the successful completion of its previous increase from VND 300 billion to VND 1,200 billion in July 2025.