Numerous banks are implementing average balance-based fee policies to curb dormant accounts.

Illustrative image (MB). |

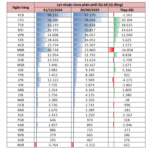

According to current bank fee schedules, account management fees are structured as follows:

Sacombank charges 6,000 VND/month for accounts with an average monthly balance below 500,000 VND. Other service packages, such as payment accounts with payment cards, automatic transaction alerts via Sacombank Pay, and Alert SMS, range from 10,000 to 20,000 VND/month, depending on the balance conditions.

At Vietcombank, the standard account management fee is 2,000 VND/month, while the general account management fee is 10,000 VND.

BIDV charges 5,000 VND/month for accounts with an average balance below 2 million VND; 3,000 VND/month for accounts with balances between 2 and 10 million VND; and waives fees for accounts maintaining an average balance of 10 million VND or more.

For VietinBank customers, the maintenance fee for payment accounts without eBanking registration is 3,000 VND/month, while inactive accounts incur a fee of up to 10,000 VND/month.

At VPBank, payment accounts with an average balance of 2 million VND or more are exempt from fees. Accounts below this threshold are charged 10,000 VND/month.

TPBank sets its fee at 8,000 VND/month, while LPBank and Agribank charge 5,000 VND/month.

Overall, banks’ account management fee policies aim to encourage customers to maintain substantial balances in their payment accounts, leveraging non-term deposits. Additionally, banks seek to streamline accounts by reducing dormant ones.

In essence, account management fees are charges customers pay to banks to maintain their payment accounts. However, most banks offer fee waivers for priority members, with conditions that are relatively easy to meet.

According to the latest data from the State Bank of Vietnam (SBV), as of November 14, 2025, the banking sector has over 136.1 million individual customer profiles (CIF) and more than 1.4 million organizational customer profiles verified through chip-embedded CCCD or the VneID app.

To enhance security and combat high-tech crimes in banking, the SBV has piloted the SIMO system, which supports risk management, monitoring, and prevention for customers.

As of October 31, 2025, over 1.7 million customers have received warnings, with more than 567,000 halting or canceling transactions post-alert, totaling over 2.2 trillion VND.

Tuân Nguyễn

– 08:36 02/12/2025

Enhancing Market Stability Mechanisms for Gold

To date, eight commercial banks have met the required capital criteria to be licensed for gold production, import, and export activities.

Governor of the State Bank of Vietnam Nguyễn Thị Hồng and Deputy Governor Phạm Thanh Hà Awarded First-Class Labor Orders

On November 24, 2025, the State Bank of Vietnam (SBV) will host the 9th National Emulation Congress of the Banking Sector and the Conference to Review the 5-Year Implementation of the National Strategy on Gender Equality, Women’s Advancement, and the “Proficient in Banking, Exemplary at Home” Movement (2021–2025) in Hanoi. This prestigious event underscores the sector’s commitment to fostering excellence, equality, and progress within the banking industry and beyond.

After the Prolonged Boom, Real Estate Prices Face Sharp Correction Due to This Key Factor

The real estate market is teetering on the brink of a significant cooldown, and the culprit can be summed up in two words: interest rates.