The year 2025 marks a significant turning point for Phu My as the fertilizer market rebounds, input gas prices optimize, and product diversification enhances. The first nine months of the year reveal several notable highlights.

In terms of production, Phu My achieved 683,687 tons of urea (88% of the annual plan), 173,239 tons of NPK (105%), and 43,003 tons of commercial ammonia (84%). Total sales volume for the nine months reached 1,226,654 tons, equivalent to 94% of the full-year plan.

Financial performance showed a marked improvement compared to the same period in 2024. In Q3/2025, the company recorded revenue of VND 3,805 billion, a 21% increase year-over-year. Notably, the gross profit margin surged to 19.3%, nearly double the 11.7% recorded in the same period last year. As a result, the leading fertilizer brand, Phu My, reported a 275% surge in net profit to VND 236 billion.

Over the first nine months, DPM achieved VND 13,150 billion in net revenue and VND 844 billion in net profit, up 27% and 51% respectively year-over-year.

These positive results stem from improved selling prices, optimized costs, and the favorable impact of the VAT amendment effective from July 1, 2025. A more diversified product portfolio also contributed to expanding profit margins.

Phu My forecasts a 4-8% growth in the fertilizer market in 2025 compared to 2024, with NPK increasing by 5-8% and urea by 0-2%. Despite Q3 being a low season with unfavorable weather and a nearly 10% drop in domestic urea demand, average prices rose due to higher production costs and the gap with international prices.

To maximize output, Phu My rescheduled its major maintenance to December 22, 2025, lasting 38 days. As a result, 2025’s estimated urea production will reach 880,000 tons (113% of the plan), and NPK will hit 190,000 tons (115% of the plan). Total sales are projected at 1.43 million tons, achieving 109% of the plan.

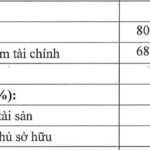

In 2025, Phu My plans to pay a dividend of VND 1,200 per share. The company recently completed a bonus share issuance of 288.6 million shares, increasing its charter capital to VND 6,800 billion. Notably, as of Q2/2025, the company holds VND 11,500 billion in cash and short-term investments (approximately USD 500 million), accounting for 65% of total assets, reflecting a robust financial position.

Expanding the Chemicals Segment

Phu My is Vietnam’s largest fertilizer producer, commanding a 40% market share in domestic urea. The “Phu My Fertilizer” and “Phu My Chemicals” brands are market leaders, supported by an extensive distribution network and a strong financial foundation.

In its mid to long-term strategy, the company aims to diversify its product portfolio, focusing on NPK, NH3, CO2, UFC85, DEF, and basic chemicals. It is also pursuing investments and M&A in the chemicals and fertilizers sector, aligned with its ESG commitments: cleaner technology, reduced emissions, and CO2 recycling.

In November 2025, Phu My signed an MoU with Nghi Son Refinery to develop a chemical investment project—a strategic move to expand its value chain. The company is also planning to develop green products like clean ammonia, hydrogen, and carbon black using sustainable technology.

Additionally, Phu My is preparing to establish a representative office in Singapore to optimize access to regional supply chains and customers.

From 2026 to 2030, Phu My aims to become an integrated clean energy and chemicals producer, leading the decarbonization trend in industry, agriculture, and logistics. Strategic goals include new products contributing 25% to revenue, international business accounting for 30% of revenue, and standardizing its ESG system to international benchmarks.

With its strong brand, scale, financial resources, and distribution network, Phu My is well-positioned to capitalize on the new growth cycle in the fertilizers and chemicals industry. The significant margin improvement in 2025 underscores the effectiveness of its operational optimization and product diversification strategy.

The company’s vision to achieve USD 1 billion in annual revenue during 2026-2030, coupled with a clear ESG roadmap by 2050, highlights its commitment to sustainable growth and international expansion.

– 10:48 02/12/2025

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.