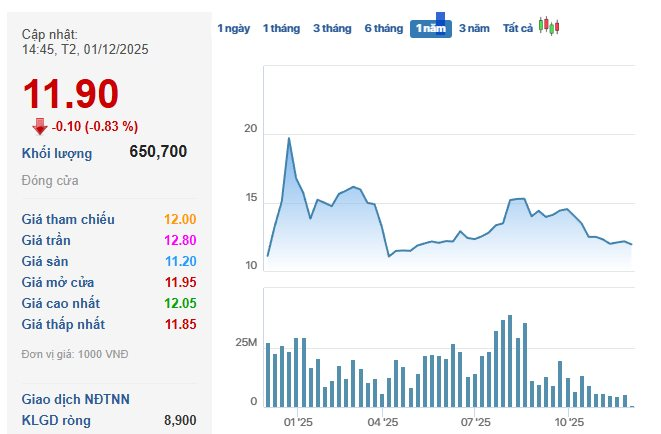

In its latest announcement, the Finnish investment fund Pyn Elite Fund successfully acquired 792,600 shares of YEG, issued by Yeah1 Group Corporation. Following this transaction, the fund’s holdings increased from over 17.1 million shares to nearly 18 million shares, raising its ownership stake from 8.94% to 9.36% of Yeah1’s capital.

The transaction was executed on November 24, 2025. Based on the closing price of VND 12,350 per share on the same day, Pyn Elite Fund is estimated to have spent approximately VND 10 billion on this purchase.

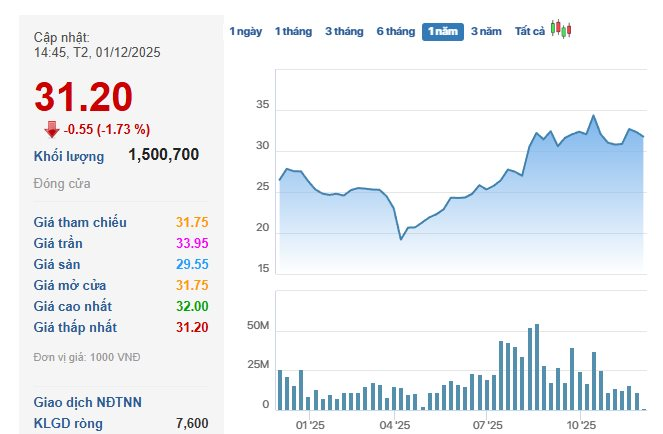

On the same day, Pyn Elite Fund also purchased 955,600 shares of HDG, issued by Ha Do Group Corporation. After the transaction, the fund held 37,039,580 shares of the company, equivalent to a 10.017% ownership stake. Based on market prices, Pyn Elite Fund is estimated to have invested around VND 31 billion.

Pyn Elite Fund is one of the largest foreign investment funds in the market, with a managed portfolio valued at EUR 940 million (approximately VND 28,600 billion or USD 1.1 billion) as of the end of October. Since the beginning of the year, the fund has achieved a 21% return. Currently, HDG ranks as the 9th largest holding in Pyn Elite Fund’s portfolio, with a weight of 4.1%.

In the latest update, Mr. Petri Deryng, the head of Pyn Elite Fund, has raised the target for the VN-Index to 3,200 points by 2028. According to Mr. Deryng, when he initially allocated investments by country a decade ago, he set a long-term target for the VN-Index at 2,500 points, but this target has since been revised upward.

Mr. Petri Deryng further explained that the Vietnamese government is aggressively steering the economy toward greater prosperity, with large-scale public investment projects poised to usher in a new era of robust growth and stimulate private sector investment.

Simultaneously, the rapid modernization of the financial market and strong bank credit growth are providing significant support. In summary, according to Pyn Elite, these policies are creating an even more favorable environment for Vietnam’s economic growth and the increasing profitability of listed companies.

Over the past 15 years, the VN-Index’s P/B ratio has surpassed 3 times on three occasions. Over the long term, the average P/E ratio has hovered around 16 times, and during three periods, the P/E ratio exceeded 20 times. According to Pyn Elite, the 6-month and 12-month profit outlook remains highly positive. The market could resume its upward trend at any moment.

Market Pulse 03/12: Foreign Investors Maintain Net Buying, Capital Flows Back to Financial Sector

At the close of trading, the VN-Index surged by 14.71 points (+0.86%), reaching 1,731.77 points, while the HNX-Index climbed 0.8 points (+0.31%) to 267.61 points. Market breadth favored the bulls, with 461 stocks advancing and 236 declining. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 9 fell, and 2 remained unchanged.

Vietstock Daily 03/12/2025: Strengthening the Upward Momentum

The VN-Index extended its winning streak to a fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands. Trading volume surpassed the 20-day average, while both the Stochastic Oscillator and MACD maintained their upward trajectories following buy signals, reinforcing a positive short-term outlook.