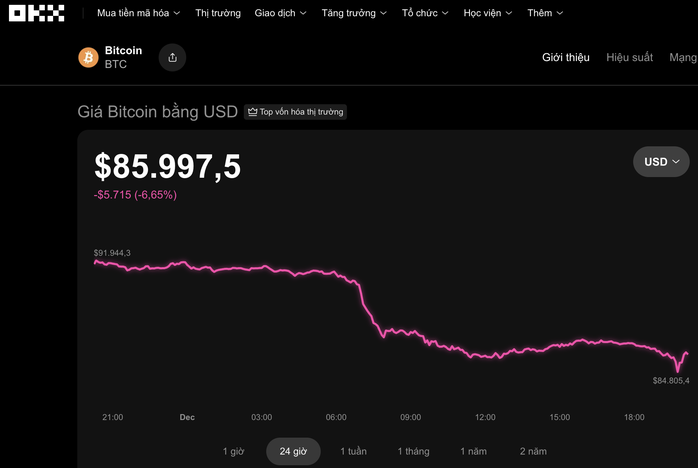

On the evening of December 1st, the cryptocurrency market experienced a sharp downturn. Data from the OKX exchange revealed that Bitcoin plummeted nearly 7% in the past 24 hours, settling at $85,997.

Other major cryptocurrencies also saw significant declines. Ethereum dropped over 6% to $2,820; BNB and Solana both fell more than 7%, reaching $822 and $127, respectively; while XRP suffered the steepest fall, losing nearly 8% to $2.

According to Cointelegraph, Bitcoin started December with a 5% drop, pulling its price down to the $85,000 – $86,000 range and raising concerns about further market weakness.

Over $600 million in trading positions were liquidated in a single day, as thin liquidity exacerbated price volatility.

Many traders warn that if Bitcoin fails to reclaim the $88,000 – $89,000 level soon, it could revisit November’s lows or even retreat to $50,000.

Bitcoin is currently trading at $85,997. Source: OKX

More pessimistic views suggest a potential drop below $40,000. Conversely, optimistic analysts predict Bitcoin could consolidate between $80,000 and $99,000, but it needs to surpass $99,800 to confirm an upward trend.

November marked Bitcoin’s worst monthly performance since 2018, with a nearly 18% decline. The total drop in Q4 now exceeds 24%, mirroring a similar sharp decline from seven years ago.

International pressures have also contributed to market instability. Japanese bond yields reached their highest since 2008, raising speculation that the country may raise interest rates, contrary to the global trend of central banks maintaining or lowering rates.

Despite these challenges, some positive signs have emerged. The Bitcoin price premium on U.S. exchanges has turned positive, indicating improved buying demand in this key market.

Additionally, the amount of capital “waiting to buy” on exchanges has hit record highs, potentially fueling a recovery once market sentiment stabilizes.

Vietstock Daily 03/12/2025: Strengthening the Upward Momentum

The VN-Index extended its winning streak to a fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands. Trading volume surpassed the 20-day average, while both the Stochastic Oscillator and MACD maintained their upward trajectories following buy signals, reinforcing a positive short-term outlook.

Digital Currencies Face Severe Volatility After Months of Unprecedented Growth

The cryptocurrency market experienced a significant upheaval as Bitcoin, the most renowned digital currency, plummeted from its record high of $126,000 to below $80,500 on November 28th.