In a recent report, Mirae Asset Securities analyzed Q3/2025 business results to identify stocks with stable performance, strong growth potential, and unique market narratives. The selection criteria combine Mark Minervini’s SEPA fundamental analysis method with William O’Neil’s CANSLIM investment strategy.

Based on this analysis, sectors like Insurance, Electricity, and Food remain safe bets due to their stability. Notably, the revised Power Plan 8 and amended Electricity Law aim to foster a more competitive power generation market. Electricity consumption is projected to grow between 2026–2030, supporting Vietnam’s 10% annual GDP growth target.

Additionally, sectors with compelling narratives and recovery potential are attractive at current price levels. Construction (HHV, VCG) and Building Materials (KSB, DHA) show promise as public investment gains momentum, with disbursement expected to accelerate by year-end (51% of the plan achieved by October 2025).

From 2026–2030, major projects like the Hanoi–Hai Phong–Lao Cai railway, North–South railway, expanded North–South expressway, and HCMC’s Ring Road 3–4 will significantly boost backlogs for construction and building material firms, driving mid-term growth.

Real estate (KDH, NLG) is poised for recovery as low interest rates persist and legal hurdles for projects are resolved. The amended Real Estate Business Law and Construction Law, effective since 2025, further support sector revival.

Construction plastics (BMP, NTP) benefit from low PVC resin prices (near 2016 lows). As real estate and public investment rebound, demand for plastic pipes and materials from infrastructure and housing projects will stabilize, improving profit margins amid lower raw material costs.

Rubber (PHR, DPR, TRC) remains robust due to global supply shortages and high prices. Average export prices reached $1,758/ton in the first 10 months of 2025, up 7.4% YoY.

Securities firms (VIX, CTS, SHS) are also promising. In October 2025, over 310,000 new trading accounts were opened—the highest in 14 months—bringing the total to 11.3 million (11% of the population). Market upgrade prospects, increased margin lending, and low interest rates shifting savings to stocks fuel sector growth.

Mirae Asset screened 18 “Super Stocks” based on Q3/2025 gross profit margins exceeding Q2/2025 and 2024 levels, with sufficient liquidity. Notable picks include insurers (BVH, MIG, PVI), real estate (KBC), securities (VIX), and bank (SHB).

Additionally, 10 “Good Stocks” were identified, meeting Q3/2025 margin criteria, including KDH, NLG, KSB, VEA, CTS, and SHS.

“A New Consumer Blue-Chip on HOSE: What Does MCH Bring to the Market?”

On December 4, 2025, Masan Consumer Corporation (Masan Consumer, UPCoM: MCH) will unveil detailed plans for its listing on the Ho Chi Minh City Stock Exchange (HOSE). This milestone not only marks a significant step for the company but also stands as a notable highlight in Vietnam’s stock market landscape, which is entering its final acceleration phase of the year—a period when investors actively seek clear signals to shape expectations for the year ahead.

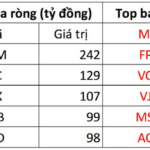

Foreign Investors Reverse Course, Net Buying VN30 Stocks with Hundreds of Billions in Session 28/11

Foreign investors’ net buying spree of 343 billion VND across the market has become a significant highlight in today’s trading session.

Corporate Governance in the Evolving Landscape of the Stock Market

The year 2025 is poised to be a pivotal moment for Vietnam’s stock market upgrade. Amid this backdrop, leading financial experts underscore the critical role of corporate governance—a non-financial factor hailed as the “global currency” that empowers businesses to enhance value, attract foreign investment, and lower capital costs.

Stock Market Week 24-28/11/2025: A Deceptive Rally

The VN-Index closed in the green for the final session of the week, marking its third consecutive week of recovery. However, the upward momentum remains unconvincing, as liquidity stayed low and buying demand failed to broaden. Without significant improvement, the market is likely to continue experiencing sideways movement and volatility, particularly as the index approaches the psychological threshold of 1,700 points.

$30 Billion Poised to Flood Vietnam’s Stock Market?

A representative from the State Securities Commission stated that with the upgrade of the stock market, Vietnam could attract $25–30 billion in investments by 2030. This advancement is expected to spark a competitive race among leading enterprises, particularly the top 100, as they vie for inclusion in the prestigious FTSE index.