The award underscores VIB’s exceptional operational capabilities in international payments, trade finance, and foreign exchange, enabling businesses and individuals in Vietnam to streamline transactions, minimize errors, and optimize costs in cross-border payments.

VIB Honored with “Outstanding U.S. Dollar International Payment Quality 2025” by JP Morgan

Leading Transaction Bank for Global Financial Institutions

The U.S. Dollar Clearing Elite Quality Recognition Award, presented annually by JP Morgan, recognizes financial institutions worldwide based on payment volume and automated processing quality. This critical metric evaluates efficiency, accuracy, and standardization in international payment transactions, reducing risks and enhancing operational performance. The award not only acknowledges VIB’s commitment to delivering exceptional services but also highlights its adherence to international banking standards, advanced technology, and specialized expertise.

VIB Representative Receiving the “Outstanding International Payment Quality 2025” Award from JP Morgan

At the award ceremony, Shibu Thomas, APAC Director and Global Clearing Payment Solutions Lead at JP Morgan, stated: “JP Morgan commends VIB’s exceptional compliance rate achieved this year. VIB consistently ranks among the world’s top banks in international payment quality. This award not only celebrates current successes but also inspires continued collaboration between VIB and JP Morgan to innovate and enhance global trade payments and customer value.”

In addition to JP Morgan’s recognition, VIB received multiple 2025 awards from international organizations such as Euromoney, Global Brands Magazine, Global Business Outlook, and Boston Brand, honoring its innovative banking solutions and technology-driven services.

Elevating Transaction Banking Experiences

As the financial system enters a quality-driven growth phase, competition through customer value chain services intensifies. Transaction banking, a key focus for VIB, bridges daily business operations with banking capabilities, optimizing cash flow and financial management.

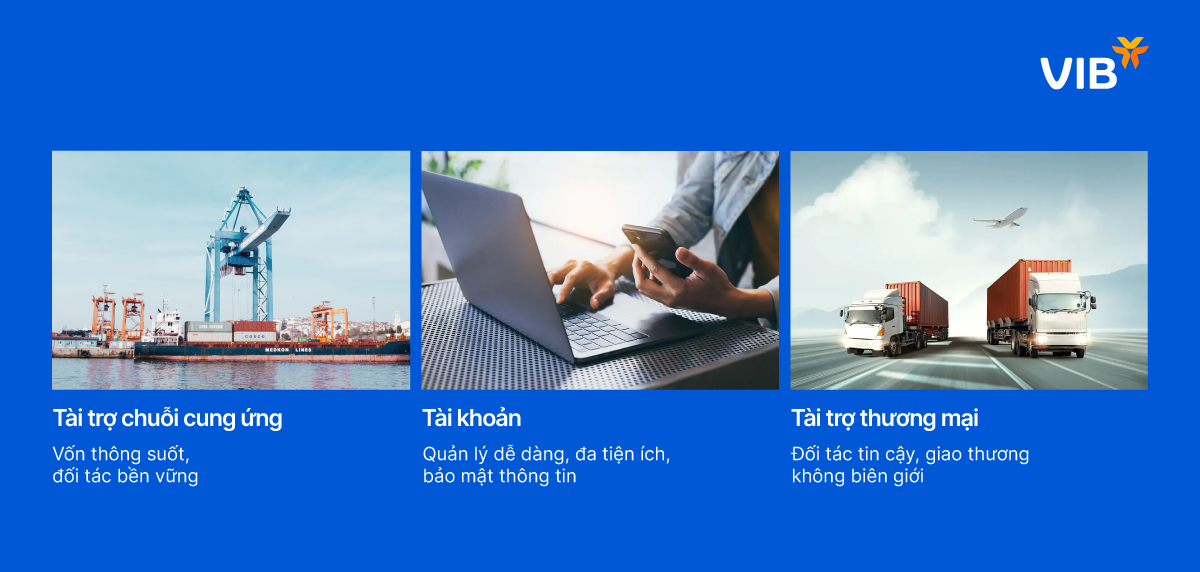

VIB has developed advanced solutions to enhance transaction banking, enabling efficient cash flow, working capital, and operational cost management. Key solutions include:

– Comprehensive Payment & Cash Flow Management: Empowering businesses to proactively manage liquidity, optimize capital, and enhance loan utilization while ensuring transparent financial control.

– Integrated System Solutions: Streamlining operations and reducing transaction costs through modern tools like API Banking, ERP integration, payment gateways, eKYC, digital onboarding, and real-time transaction management.

Through these solutions, VIB’s transaction banking evolves into a comprehensive financial ecosystem, helping businesses optimize cash flow, enhance governance, and align with international standards.

VIB Offers Diverse Transaction Banking Solutions

Aiming to be the “Leading Partner Bank for Businesses and Financial Institutions,” VIB consistently strengthens its reputation and strategically supports clients in financial management. This growth strategy reflects VIB’s vision to become Vietnam’s most innovative and customer-centric bank.

VPBank Triumphs at Vietstock IR Awards 2025: A Story of IR Excellence and Growth

Honored in the category of “Large-Cap Financial Enterprise with the Most Highly Rated IR Activities by Financial Institutions” at the IR Awards 2025, VPBank not only solidifies its leadership in transparency but also showcases a distinctive approach: IR is more than just a channel for announcing results—it’s a platform to narrate a strategic journey, build market trust through intrinsic capabilities, and foster long-term vision.

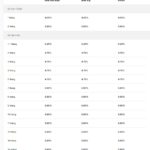

Three Major Banks Hike Savings Interest Rates

OCB, TPBank, and VIB have emerged as the latest commercial banks to raise deposit interest rates across various terms, marking a significant shift in the financial landscape.

2025 Bond Market Outlook: Sustained Stability and Positive Growth

On the afternoon of November 6th in Quang Ninh, the Hanoi Stock Exchange (HNX) collaborated with the Financial Institutions Department and the State Treasury to host a conference summarizing the 2025 bond market activities.