I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 3, 2025

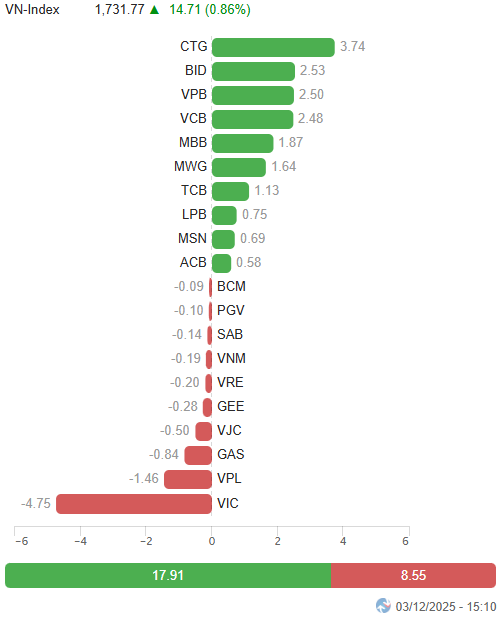

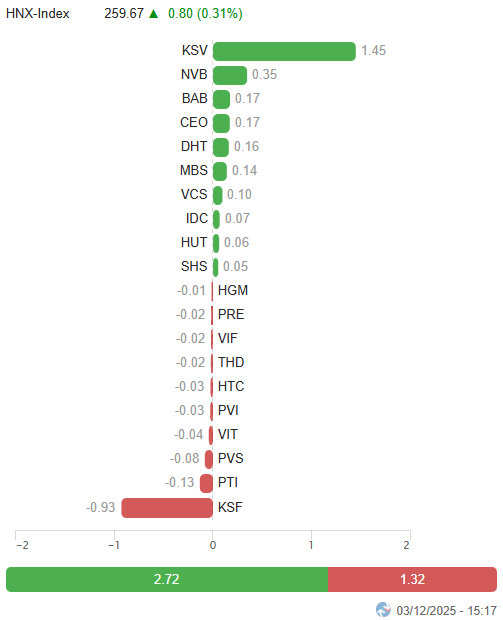

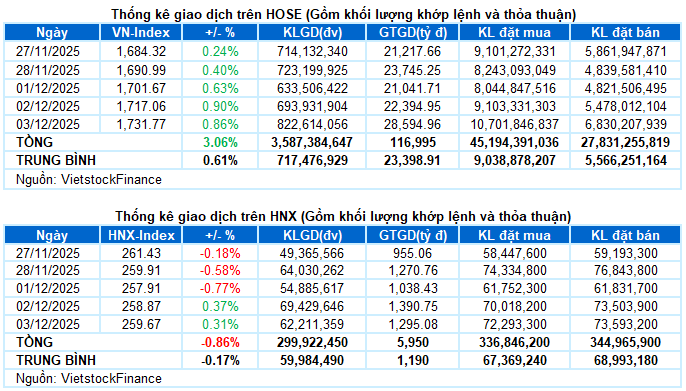

– Key indices continued to surge in the December 3 trading session. Specifically, the VN-Index rose by 0.86%, reaching 1,731.77 points, while the HNX-Index saw a slight increase of 0.31%, closing at 259.67 points.

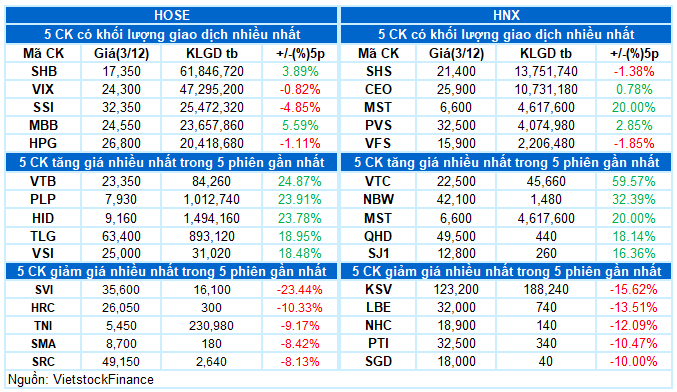

– Trading volume on the HOSE floor increased by 9%, exceeding 720 million units. In contrast, the HNX floor recorded nearly 60 million matched units, a slight decrease of 0.7% compared to the previous session.

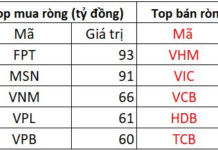

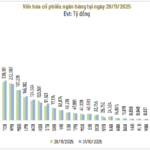

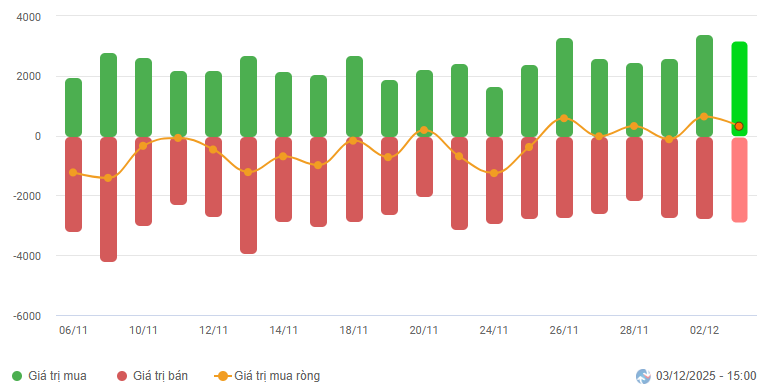

– Foreign investors continued to net buy with a value of over 367 billion VND on the HOSE floor but still net sold over 16 billion VND on the HNX floor.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

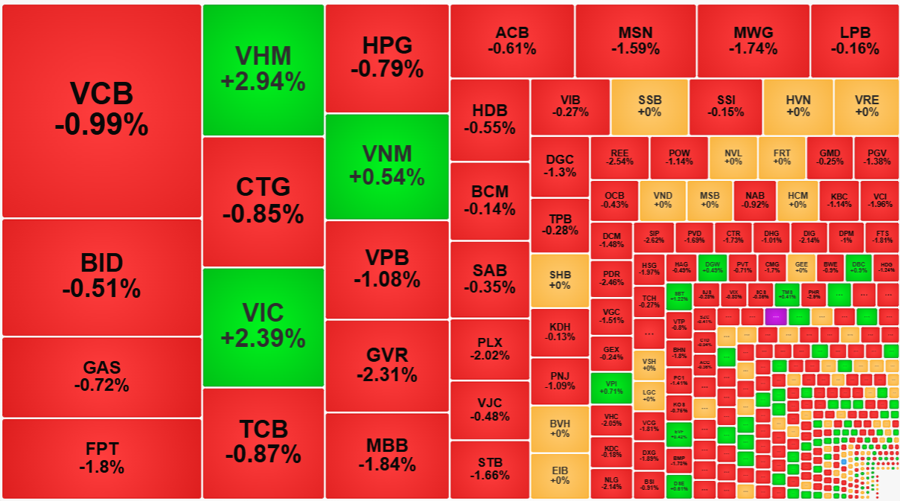

– The market continued its breakout on December 3, dominated by green across the board from the opening. Despite Vingroup’s major stocks experiencing adjustments, causing the VN-Index to fluctuate in the morning session, market breadth significantly improved compared to previous sessions. Most sectors maintained a positive stance, boosting investor sentiment in the afternoon session and driving stronger buying interest. At the close, the VN-Index settled at 1,731.77 points, up 0.86% from the previous session.

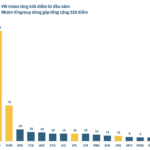

– In terms of influence, the banking sector led the market today, occupying 8 out of the top 10 positions among stocks contributing positively, adding a total of over 15 points to the VN-Index. Conversely, VIC‘s adjustment exerted the most significant pressure, deducting 4.75 points from the index.

Top Influencing Stocks on the Index. Unit: Points

– The VN30-Index gained 21.87 points (+1.12%), reaching 1,971.99 points. Buyers dominated with 19 advancing stocks, 9 declining stocks, and 2 unchanged stocks. CTG led the pack with a remarkable 6% increase, followed by MWG, VPB, BID, and MBB, each surging over 4%. Conversely, GAS, VIC, and VJC lagged, each declining by approximately 2%.

Green returned to most sectors. The communication services sector index recorded the strongest gain, driven by notable contributions from VGI (+3.32%), FOX (+4.23%), CTR (+0.69%), SGT (+1.53%), ICT (+1.66%), TTN (+1.7%), ABC (+1.4%), and VTK (+1%).

Financial and non-essential consumer sectors also made strong impressions, with several stocks surging over 2%, including SHB, MBB, CTG, VPB, ACB, VCB, TCB, MSB, BID, ABB; MWG, PET, DGW, TNG, and even FRT hitting its upper limit.

Meanwhile, the real estate sector index fell by 0.9%, pressured by adjustments in VIC (-2.04%), VRE (-1.15%), KSF (-2.51%), and SNZ (-2.56%), although most others attracted decent buying interest, such as KDH (+1.94%), KBC (+1.01%), NVL (+1.01%), NTL (+2.75%), CEO (+1.97%), NLG (+2.56%), and LDG, VCR, NRC hitting their upper limits.

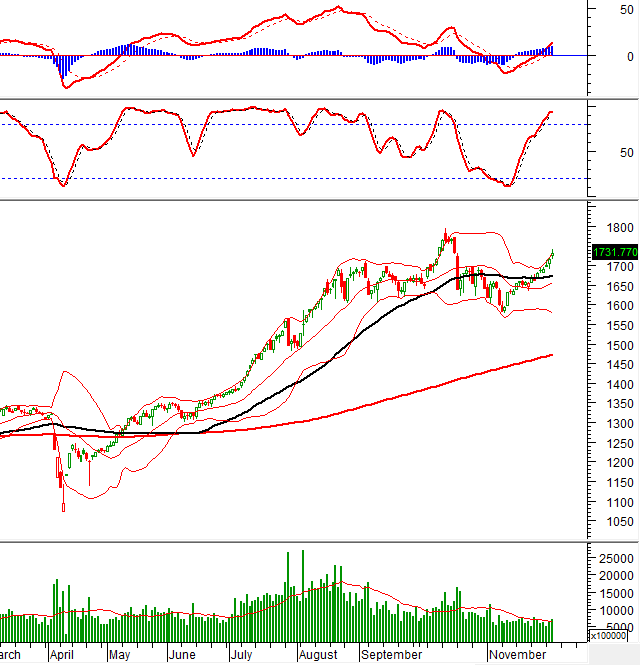

The VN-Index marked its 6th consecutive gaining session after surpassing the 50-day SMA and is currently hugging the Upper Band of the Bollinger Bands. The positive outlook is reinforced as the MACD indicator continues to widen its gap with the Signal line. However, the Stochastic Oscillator is venturing deep into overbought territory, so investors should exercise caution if this indicator signals a sell-off in upcoming sessions.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Hugging the Upper Band of the Bollinger Bands

The VN-Index recorded its 6th consecutive gaining session after surpassing the 50-day SMA and is currently hugging the Upper Band of the Bollinger Bands.

The positive outlook is reinforced as the MACD indicator continues to widen its gap with the Signal line. However, the Stochastic Oscillator is venturing deep into overbought territory, so investors should exercise caution if this indicator signals a sell-off in upcoming sessions.

HNX-Index – Spinning Top Candlestick Pattern Emerges

The HNX-Index saw a slight increase while forming a Spinning Top candlestick pattern, accompanied by trading volume remaining below the 20-day average, indicating investor hesitation.

Currently, the MACD indicator is narrowing its gap with the Signal line. If buying signals re-emerge in upcoming sessions, the short-term outlook will improve.

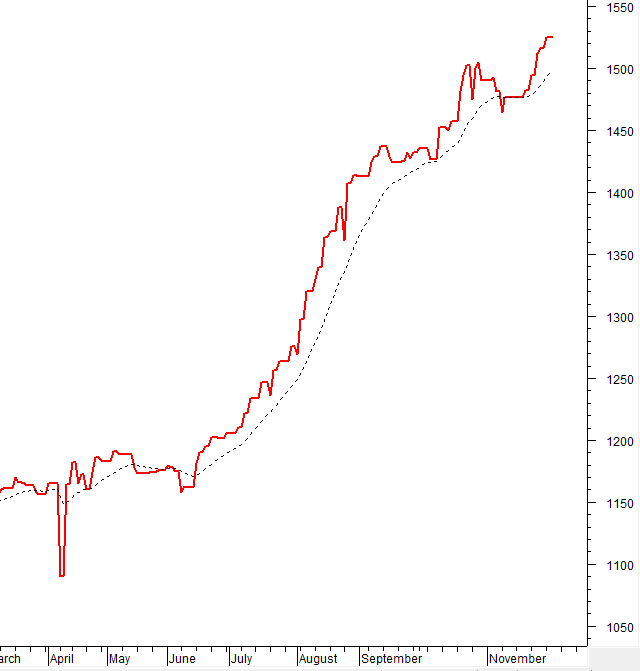

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued to net buy in the December 3, 2025, trading session. If foreign investors maintain this action in upcoming sessions, the outlook will become even more optimistic.

III. MARKET STATISTICS ON DECEMBER 3, 2025

Economic & Market Strategy Analysis Department, Vietstock Advisory Division

– 17:14 December 3, 2025

Vietnam’s Stock Market Diverges: King Stocks and VN-Index No Longer in Sync

Amidst the ongoing correction in the market’s largest-cap stocks, the VN-Index managed to maintain its upward trajectory in November. This divergence highlights that the market’s momentum is increasingly driven by sectors beyond banking, signaling a broader-based rally.