After a turbulent November, Vietnam’s stock market kicked off December with a widespread green trend from the opening session. The benchmark index maintained its upward momentum throughout the day, supported by large-cap stocks, particularly those from the Vingroup family. At the close, the VN-Index once again surpassed the critical 1,700-point threshold, settling at 1,701.67 points (up 10.68 points).

Previously, the benchmark index had closed above 1,700 on October 9 and maintained this level for over a week. However, it lost this milestone on October 20 and has only now managed to reclaim it. Nevertheless, buying demand was concentrated on a few select stocks, with total liquidity on the HOSE reaching just over 18.5 trillion VND, indicating more cautious and polarized investor sentiment across sectors.

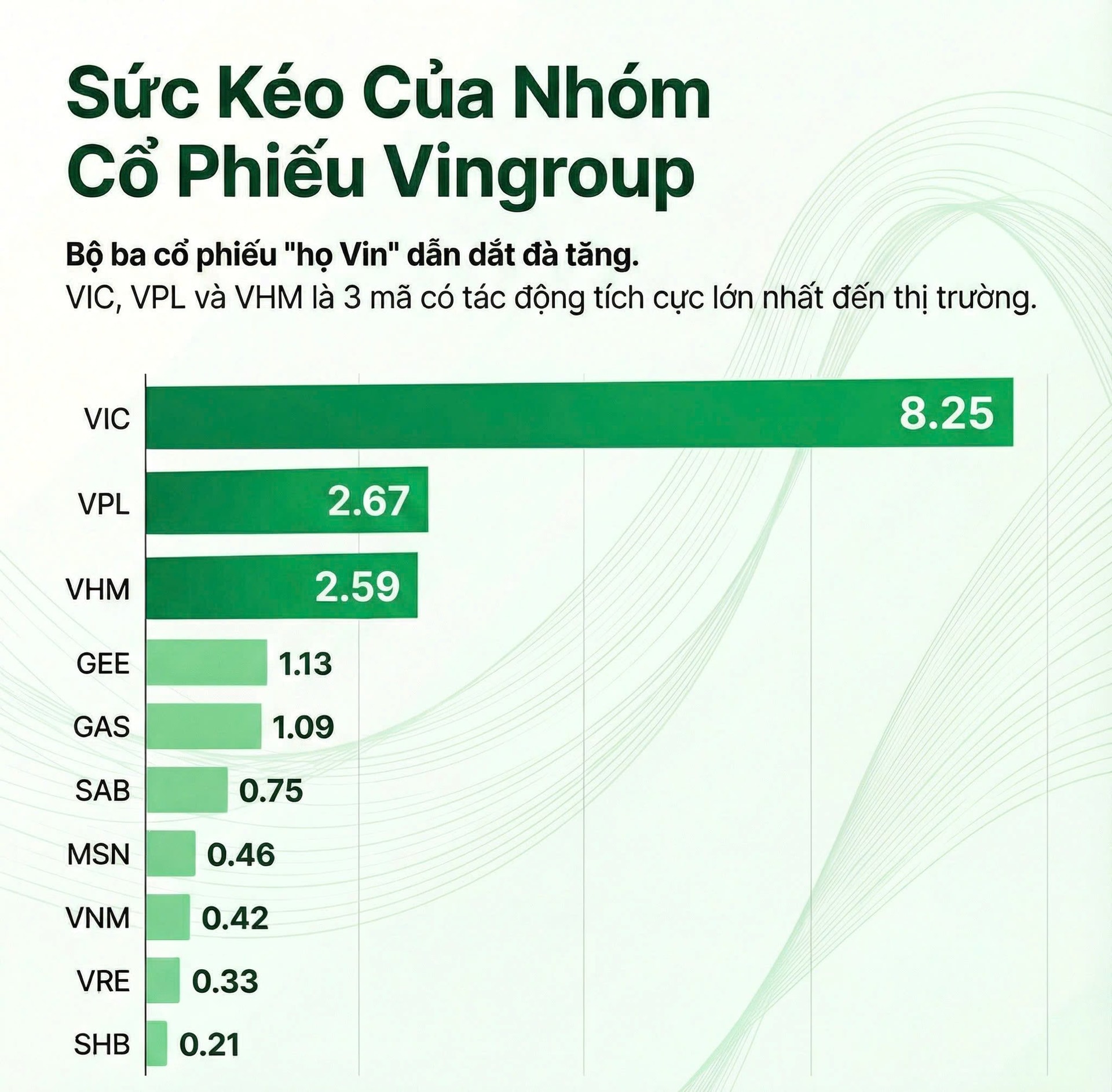

In reality, to support the VN-Index in surpassing the 1,700-point mark on December 1, leading market stocks recorded significant contributions from Vingroup’s major players. VIC led the pack with the largest impact, contributing 8.25 points. Following VIC were two other Vingroup stocks, VPL and VHM, contributing 2.67 and 2.59 points, respectively. At the close of the December 1 session, VPL hit its ceiling price, while VHM rose by 2.7%.

Additional support came from GEE and GAS, contributing 1.13 and 1.09 points, respectively, further bolstering the benchmark index’s rise. Other notable contributors included SAB, MSN, VNM, VRE, and SHB.

However, the market also saw stocks contributing to the decline, with KSV leading the downturn by -1.54 points. Other negatively impacting stocks included TCB, CTG, HVN, and GVR, though their overall effect was minimal.

It’s too early to predict a new wave as liquidity remains insufficient. However, a broadly rallying session is a welcome sign for investors after the sideways movement throughout November.

In a recent strategy report, Dragon Capital highlighted that Vietnam’s market possesses multiple fundamental factors to sustain positive growth in 2025–2026. Corporate earnings continue to exceed expectations, with profits from 80 companies tracked by Dragon Capital projected to grow by 21.3% in 2025 and maintain a 16.2% growth rate in 2026.

Moreover, market valuations are attractive, with a projected P/E ratio of 12.5–13 times for 2025 and 11 times for 2026—lower than many regional markets, despite robust profit growth.

Additionally, Vietnam’s upgrade from a frontier to an emerging market will unlock significant re-rating opportunities, as substantial international capital inflows could fuel a new growth cycle.

On a more optimistic note, Petri Deryng, head of PYN Elite Fund, recently raised the VN-Index target to 3,200 points by 2028. This target is based on an assumed average profit growth rate of 18–20% in the coming years. For 2025 specifically, the fund forecasts profit growth to exceed 20%.

The fund leader anticipates that macroeconomic policies will create an even more favorable environment for Vietnam’s economic growth and the profit expansion of listed companies.

Vietstock Daily 04/12/2025: Will the Rally Continue?

The VN-Index extended its winning streak to six consecutive sessions, breaking above the 50-day SMA and now hugging the Upper Band of the Bollinger Bands. This bullish outlook is reinforced by the MACD indicator, which continues to widen its gap above the Signal line. However, caution is warranted as the Stochastic Oscillator has ventured deep into overbought territory, leaving investors vulnerable to a potential sell signal in the coming sessions.

Foreign Investors Return to Scoop Up Over VND 650 Billion in Vietnamese Stocks as VN-Index Surges: What’s the Spotlight?

In contrast, foreign investors heavily offloaded ACB shares, recording a net sell value of approximately 75 billion VND.