The first trading session of December concluded with a notable milestone: the VN-Index successfully surpassed the 1,700-point mark after nearly two months of fluctuation.

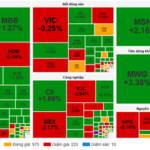

From the opening of the December 1st session, strong inflows of capital propelled the index upward, driven by positive market sentiment. By the close, the VN-Index had risen by 10.68 points, or 0.63%, ending at 1,701.67 points—its highest level since October. However, behind this optimistic figure lies an uneven landscape: the market saw 178 declining stocks, overshadowing 135 advancing stocks and 53 unchanged stocks.

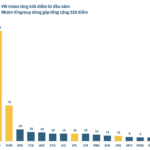

The primary driving force came from large-cap stocks, particularly those within the Vingroup ecosystem. VIC made the most significant contribution to the index, single-handedly boosting the VN-Index by over 8 points. Two other Vingroup-affiliated stocks, VPL and VHM, also provided substantial support, contributing 2.67 points and 2.59 points, respectively. Notably, VPL hit its upper limit, while VHM climbed by 2.7%.

Stocks associated with major conglomerates such as MSN, VNM, FPT, and SHB also performed well, helping to maintain the index’s upward momentum.

Despite the VN-Index and blue-chip stocks rallying, the broader market remained in the red. Photo: Gemini

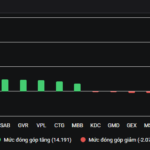

While the index rose, liquidity remained sluggish. The total market turnover exceeded 21 trillion VND, a lower-than-expected figure given the VN-Index’s significant milestone. Within the VN30 basket, only a few stocks, including SHB, SSI, HPG, VPB, and VRE, saw trading volumes above 10 million shares. The majority traded at lower levels, with some, like BCM, LPB, and DGC, recording only a few hundred thousand units.

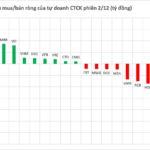

Foreign investors continued their net selling trend, with a total value nearing 298 billion VND, exerting pressure on market sentiment. VHM faced the heaviest net selling, at over 227 billion VND, followed by VIC with more than 162 billion VND. This, coupled with declines in mid-cap real estate stocks such as NVL, DIG, and DXG, left many investors holding these stocks in a losing position, despite the index’s upward trend.

Conversely, foreign capital shifted toward net buying in growth stocks like FPT, MSN, VNM, VPL, and VPB. This highlights a clear divergence in foreign investors’ portfolio restructuring strategies.

Data also revealed that over 8.664 trillion VND flowed into advancing stocks, surpassing the 6.262 trillion VND invested in declining stocks. Although red dominated in terms of stock count, capital tended to concentrate on leading stocks with distinct growth narratives.

According to analysts, the December 1st session marked a significant numerical advancement but also raised concerns. The VN-Index’s breach of 1,700 points, supported by blue-chip stocks, indicates that the current rally lacks broad participation. For many investors, the sentiment of “index gains but portfolio losses” persists, underscoring a highly fragmented market where short-term risks remain prevalent.

Market Pulse 03/12: Foreign Investors Maintain Net Buying, Capital Flows Back to Financial Sector

At the close of trading, the VN-Index surged by 14.71 points (+0.86%), reaching 1,731.77 points, while the HNX-Index climbed 0.8 points (+0.31%) to 267.61 points. Market breadth favored the bulls, with 461 stocks advancing and 236 declining. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 9 fell, and 2 remained unchanged.