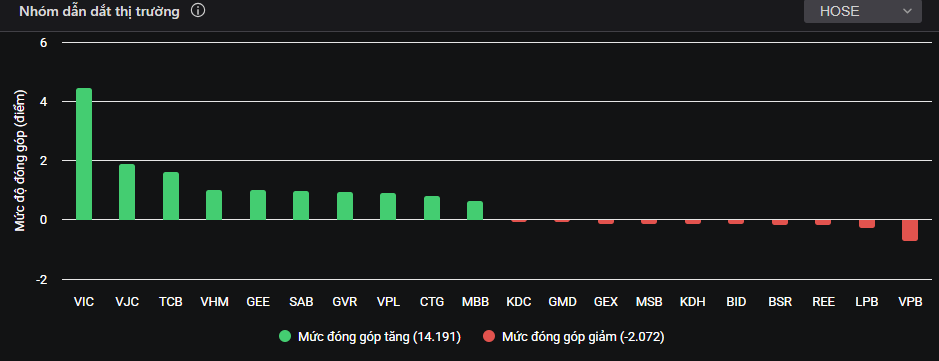

A recovery rally emerged in the afternoon session as a surge of capital flowed into blue-chip stocks, particularly the Vingroup family of stocks.

VIC closed the session up 1.89%, rebounding nearly 3% in the afternoon alone, with trading volume leading the market at over 1.1 trillion VND. VHM and VRE also reversed course positively, with VRE regaining its reference price. VPL continued its streak of 8 consecutive gaining sessions.

Alongside Vingroup stocks, the banking sector also accelerated. TCB rose 3.01%, while CTG, MBB, and HDB all gained over 1%. The VN30 basket recorded a dominant green with 20 gainers, notably SAB hitting its ceiling price. However, due to their smaller market capitalization, the impact was localized.

Despite the VN-Index’s gain, polarization remained evident. On HoSE, 149 stocks declined compared to 144 gainers, with 60 stocks falling more than 1%. A bright spot came from foreign capital inflows. Foreign investors net bought a whopping 846 billion VND, focusing on VJC (223.8 billion VND), VIC (148.8 billion VND), and TCB (131 billion VND).

VIC continues to lead the market.

While blue-chips propelled the VN-Index above 1,700, many stocks lagged or only inched up slightly. VPB was the most negatively impactful stock, falling 1.4% to 28,900 VND. Today’s session marked a strong afternoon reversal, but risks remain in mid-cap stocks and those that have recently overheated.

Beyond Vingroup’s notable trading activity, in a market lacking broad leadership, the action in some divestment stocks continued to heat up. GTD and VTC hit their ceiling prices. Notably, GTD of Thuong Dinh Shoe Joint Stock Company had its 10th consecutive ceiling session, with the stock price nearly quadrupling in just over two weeks. Immediately after Hanoi People’s Committee announced plans to auction its entire 68% stake on December 16th, GTD shares surged.

Hanoi People’s Committee aims to divest over 6.38 million shares in Thuong Dinh Shoe.

Explaining the consecutive ceiling prices, Thuong Dinh Shoe Joint Stock Company stated that its production and business operations remain normal, with no unusual fluctuations affecting the stock price.

“The rise in GTD’s stock price is an objective market dynamic driven by supply and demand. The company has not taken any actions to influence the trading price,” the enterprise affirmed.

According to the Hanoi Stock Exchange (HNX), Hanoi People’s Committee will auction its entire stake at a starting price of 20,500 VND per share. If successful, the committee could raise a minimum of 130.8 billion VND. The auction is scheduled for the morning of December 16th.

Similarly, VTC of VTC Telecom also had its 10th consecutive ceiling session following state divestment news. VNPT registered to sell its entire 2.1 million shares in VTC Telecom at a starting price of over 104 billion VND. The registration and deposit period runs from November 18th to 3:30 PM on December 12th, with payment for shares from December 19th to 25th.

Recently, several stocks linked to divestment “waves” have also performed positively, such as MSB, ICT, VEC, and ABC…

As with previous deals, stocks tied to divestment news often attract attention due to large block trades, agreement prices above market prices, and expectations of corporate changes as ownership shifts to the private sector. This is why many investors view this group as “special stories” in the market, especially in the absence of supportive news.

However, divestment waves are typically short-lived and highly volatile. Analysts suggest that instead of chasing the trend, investors should carefully evaluate each company’s fundamentals, post-divestment prospects, and financial health to identify stocks with genuine long-term value potential, rather than just short-term momentum plays.

At the close on December 2nd, the VN-Index gained 15.39 points (0.9%) to 1,717.06.

Blue-Chip Stock Code Unexpectedly Hit by Strong Net Selling from Securities Firm’s Proprietary Trading on December 2nd

Proprietary trading desks at securities firms reversed their position, shifting to net selling with a total value of 64 billion VND.

Market Pulse 03/12: Foreign Investors Maintain Net Buying, Capital Flows Back to Financial Sector

At the close of trading, the VN-Index surged by 14.71 points (+0.86%), reaching 1,731.77 points, while the HNX-Index climbed 0.8 points (+0.31%) to 267.61 points. Market breadth favored the bulls, with 461 stocks advancing and 236 declining. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 9 fell, and 2 remained unchanged.

December Dilemma: Strategic Moves for Investors in the Information Void

In December, market-moving catalysts are expected to be scarce, with exchange rates emerging as one of the few critical factors to monitor closely. Numerous investment strategies and scenarios have been outlined for the final month of the year, extending into the promising landscape of 2026.