The corresponding share issuance ratio is set at 10:6 (each shareholder holding 1 share receives 1 purchase right, with 10 rights allowing the purchase of 6 new shares). If successful, VIX will increase its charter capital from over VND 15,314 billion to nearly VND 24,503 billion.

At an offering price of VND 12,000 per share, VIX is expected to raise more than VND 11,026 billion, which will be fully disbursed immediately after the offering. The company plans to allocate over VND 5,013 billion for proprietary trading, over VND 5,013 billion for margin lending, and VND 1,000 billion for additional investment in VIXEX, a cryptocurrency trading platform subsidiary of VIX.

During the extraordinary shareholders’ meeting held on November 28th, in response to shareholder inquiries about the offering timeline, the VIX Board of Directors stated that they would initiate the necessary procedures to obtain approval from state regulatory authorities immediately after the meeting. The shareholder list for the rights issue is expected to be finalized in Q1 2026.

Addressing shareholder concerns about VIX‘s preparedness for entering the cryptocurrency market, a company representative confirmed that they have already established VIXEX and selected a technology partner. The company emphasized the significant potential of this emerging market, particularly following the government’s resolution allowing pilot cryptocurrency trading platforms.

VIXEX was founded on August 26th with a charter capital of VND 1,000 billion. The three founding shareholders are VIX (15%), FTG Vietnam JSC (64.5%), and 3C Computer – Communication – Control JSC (21%).

The newly established company shares its headquarters with VIX at 22nd floor, 52 Le Dai Hanh Street, Hai Ba Trung District, Hanoi. Mr. Nguyen Van Hieu, born in 1978, serves as both the CEO and legal representative of VIXEX.

VIX‘s 2025 Extraordinary Shareholders’ Meeting took place on November 28th in Hanoi

|

In addition to the capital increase, the meeting also approved an upward adjustment to the 2025 business plan, targeting pre-tax profit of VND 6,500 billion and post-tax profit of VND 5,200 billion, a 4.33-fold increase compared to the annual shareholders’ meeting approval.

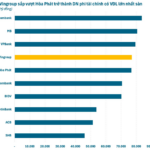

In the first nine months, VIX reported pre-tax profit of VND 5,116 billion and post-tax profit of VND 4,123 billion, achieving 79% of the new plan. This result is also 7.5 times higher than the same period last year.

Source: VIX, compiled by the author

|

Furthermore, the meeting approved the resignation of Mr. Truong Ngoc Lan from the Board of Directors. This decision was made to allow him to focus on his role as CEO, separating the management responsibilities of the Board from the executive duties of the CEO. Mr. Truong Ngoc Lan will continue to serve as CEO and legal representative of the company.

Mr. Phan Duc Linh, with over 20 years of experience in technology and management, was elected as a new Board member.

– 17:39 02/12/2025

Technical Analysis Afternoon Session 27/11: MACD Crosses Above Zero Threshold

The VN-Index continues its upward trajectory, firmly positioned above the 50-day SMA, while the MACD has decisively crossed above the zero line. Meanwhile, the HNX-Index is experiencing a tug-of-war as it retests the Middle Band of the Bollinger Bands.

Unveiling Stanley Brothers’ Key Shareholders in a Landmark $87 Million Capital Raise

Stanley Brothers Securities Corporation (SBSI, UPCoM: VUA) has announced a resolution to implement a private placement of shares to increase its chartered capital. The resolution includes a detailed list of investors participating in this offering.