Policy Impacts on Vietnam’s Tourism Sector

As of August 15, 2023, Vietnam extended the visa-free stay for foreign tourists from one month to three months, alongside granting unlimited entry-exit privileges. This policy has sparked a dynamic recovery in key international tourism markets.

In the first eight months of 2025, Chinese tourists led arrivals to Vietnam with over 3.5 million visitors, marking a 44.3% year-on-year increase. South Korea followed with 2.9 million visitors, while Taiwan contributed 829,000. Indian tourists also surged by more than 42% compared to the previous year. European markets, particularly Russia, recorded the strongest annual growth during January-August 2025.

In February 2025, the Ministry of Tourism launched the “Vietnam – Travel to Love” growth plan. This strategy focuses on enhancing hotel service quality and expanding Vietnam’s international tourism portfolio. The initiative aims to welcome 22-23 million international visitors in 2025, with projections reaching 25 million by 2026.

From a hospitality and tourism perspective, the 2025 provincial restructuring presents new opportunities for industry transformation. With anticipated high tourist volumes in the coming years, affected regions will likely face pressure to upgrade transportation networks, service quality, and accommodations to meet rising visitor expectations. Key challenges will involve aligning strategic planning initiatives, marketing campaigns, and infrastructure investments, ultimately supporting Vietnam’s tourism sector in rebranding, operational reorganization, and pursuing long-term environmental sustainability.

Major transactions to focus on prime hotel properties and luxury resorts

National hotel room supply has grown steadily since 2015, averaging a 7% annual increase until 2024. As of July 2025, total supply surpassed 185,000 rooms across over 1,500 hotels, with upscale and luxury segments accounting for 57% of the national inventory.

Ho Chi Minh City, Hanoi, and Da Nang remain central, contributing 14%, 13%, and 12% of the national supply, respectively. New hotel pipelines for 2025–2028 will primarily focus on Hanoi, Da Nang, and Hoi An, while Ho Chi Minh City maintains its position as the fourth-largest development market. Notably, approximately 33% of upcoming supply will cater to the midscale segment, addressing the diversifying demands of domestic and international guests.

Domestically, financially robust investors—such as diversified conglomerates, hotel management firms, and major real estate developers—are driving acquisitions. They actively diversify portfolios while seeking ownership opportunities in both urban core hotels and internationally acclaimed resort destinations.

International investors maintain interest in Vietnam, targeting internationally branded hotels in major economic hubs or prominent resort projects. Strategies prioritizing operationally efficient assets, prime locations, and high upgrade potential are fostering healthy competition for strategically positioned properties.

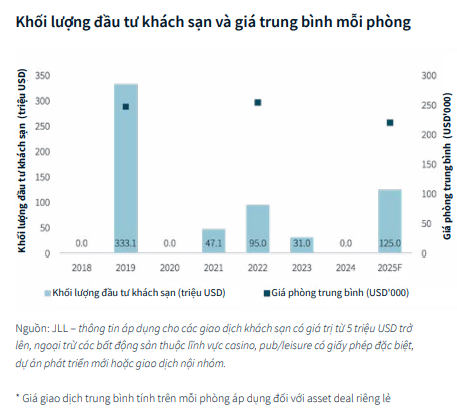

According to JLL, major transactions will continue focusing on prime hotel properties and luxury resorts in the coming years, attracting both domestic and international investors. Monitoring market dynamics and potential deals, JLL has revised its 2025 hotel investment volume forecast for Vietnam from $100 million to $125 million, reflecting confidence in market growth and increasing appeal to both local and foreign capital.

The 2026 outlook remains positive, with expectations of growing standardized supply and transaction volumes, provided the market maintains transparency and a stable legal environment. However, the primary challenge lies in identifying investment-grade assets amidst limited qualified supply.

– 14:01 03/12/2025