Song Ba Ha Hydropower Joint Stock Company (stock code: SBH) has issued a Board of Directors’ resolution on temporary personnel arrangements to ensure the operation of the company and the Song Ba Ha Hydropower Plant. This decision comes as several key leaders are engaged with regulatory authorities.

According to the resolution, Mr. Nguyen Dinh Vu, Deputy Head of the Technical and Safety Department, will temporarily oversee all activities of the department. This delegation remains effective while the Head of the Technical and Safety Department is working with regulatory authorities.

Simultaneously, Mr. Nguyen Hong Viet, Head of the Planning and Materials Department and former Head of the Technical and Safety Department, will collaborate and provide technical support to Mr. Vu. This is particularly crucial for tasks related to the operation of the Song Ba Ha reservoir and the inter-reservoir operation procedures in the Ba River basin, which require high precision and technical safety.

In the operations sector, Mr. Nguyen Thanh Lam, Deputy Director of the Operation Workshop, will temporarily manage the workshop in place of the director during the latter’s engagement with regulatory authorities.

Notably, Chairman of the Board of Directors Vu Huu Phuc will temporarily oversee the operations of the company’s Executive Board. He will also assume the authorized responsibilities and legal representation duties during the CEO’s leave and engagement with regulatory authorities.

Song Ba Ha Hydropower Plant

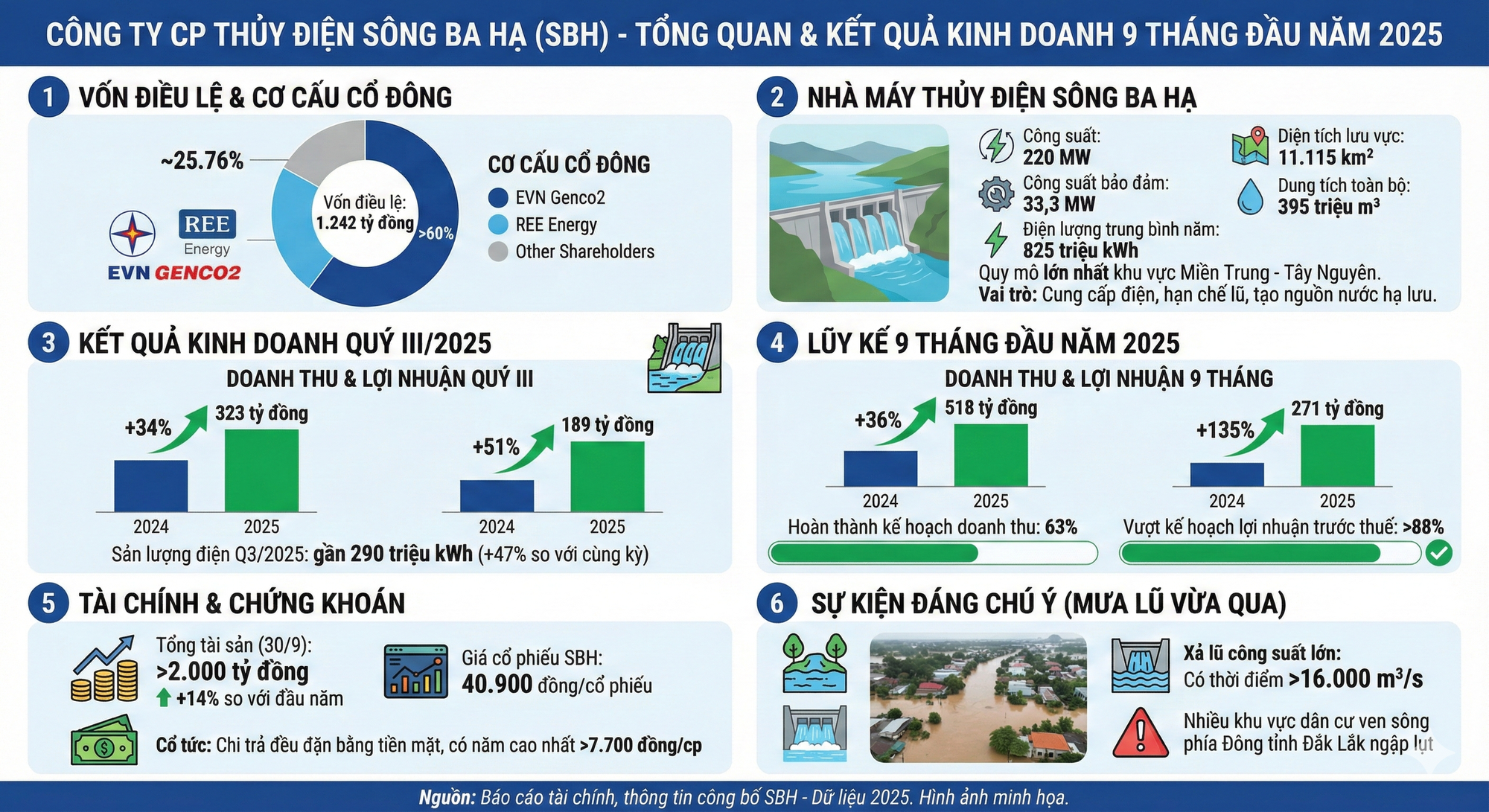

Song Ba Ha Hydropower Joint Stock Company has a chartered capital of 1,242 billion VND. EVNGENCO 2, a subsidiary of Vietnam Electricity (EVN), is the largest shareholder with over 60% ownership. REE Energy LLC is the second-largest shareholder with 25.76%.

The Song Ba Ha Hydropower Plant is among the critical facilities of EVNGENCO 2, alongside Thac Mo, A Vuong, Song Bung, and An Khe – Ka Nak.

With a capacity of 220 MW, the plant generates an average annual output of approximately 825 million kWh. Beyond power generation, it plays a vital role in flood control and water regulation for downstream areas, making it a key infrastructure project in the Central Highlands region.

Over the years, Song Ba Ha Hydropower has maintained positive business results, consistently paying cash dividends, with some years reaching over 7,700 VND per share. 2025 continues to be a favorable year due to favorable hydrological conditions. In Q3 alone, the company recorded an output of nearly 290 million kWh, a 47% increase year-on-year, generating 323 billion VND in revenue, up 34%; after-tax profit reached nearly 189 billion VND, a 51% increase.

For the first nine months of 2025, the company’s revenue totaled 518 billion VND, a 36% increase, with after-tax profit reaching 271 billion VND, a robust 135% increase year-on-year. With these results, the company has achieved 63% of its annual revenue target and surpassed nearly 90% of its profit goal. As of September 30, the company’s total assets exceeded 2,000 billion VND, a 14% increase from the beginning of the year.

On the stock market, SBH shares are currently trading at around 40,900 VND per share.

During the recent heavy rainfall and flooding, the Song Ba Ha Hydropower Plant drew attention for its significant discharge rates, peaking at over 16,000 m³/second. The substantial water release led to deep flooding in several residential areas along the riverbanks in eastern Dak Lak province.

River Ba Ha Hydropower Company Announces Interim Leadership Changes

The Board of Directors of Song Ba Ha Hydropower Joint Stock Company has issued a resolution temporarily assigning personnel to oversee the company’s operations. This decision comes as the CEO and several key staff members take a leave of absence to engage with relevant authorities.

Unveiling the Business Operations of the Lower Ba River Hydropower Company

The operator of the Ba Ha Hydropower Plant on the Ba River, which recently released a record-breaking flood in Dak Lak, is experiencing robust growth. In 2024, the company reported a remarkable post-tax profit of over 270 billion VND. This year’s performance has been exceptionally strong, with the third quarter alone contributing an additional post-tax profit of more than 63 billion VND.

Proposed Regulation for Re-Evaluation of Assets in EVN’s Subsidiary Companies

The Ministry of Finance has drafted a Decree outlining the operational and financial management mechanisms specific to Vietnam Electricity (EVN). This includes a proposal to re-evaluate assets of fully EVN-owned subsidiaries, specifically power projects that have reached the end of their depreciation period.