Entrepreneurial Imprint 2025

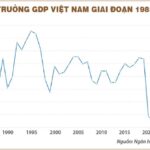

In 2025, the world faced geopolitical storms, while Vietnam, despite significant damage from natural disasters, recorded a 9-month GDP growth of 7.85%. Amidst this landscape, the resilience of nation-building entrepreneurs has never been more evident.

Entrepreneurial Imprint 2025

Billionaires Phạm Nhật Vượng, Nguyễn Thị Phương Thảo, and Trương Gia Bình: Internationally Significant Ventures

For billionaire Phạm Nhật Vượng, Chairman of Vingroup, 2025 marked a triumphant year for VinFast. From the beginning of the year to the end of Q3 2025, VinFast sold over 110,362 vehicles—an unprecedented figure in Vietnam’s automotive history. Notably, more than 10,000 vehicles were sold in international markets such as North America, India, Europe, Southeast Asia, the Middle East, and Africa.

Assuming the role of VinFast CEO in early 2024 and declaring “no Plan B,” Mr. Vượng personally funded VinFast with 28 trillion VND from his assets. To accelerate progress and ensure quality control, he implemented a unique approach, simplifying complex technical processes to make them accessible to all workers. This method also leveraged operational data from the Xanh SM fleet to continuously improve software.

VinFast’s 2025 goal is to sell 200,000 vehicles across 50 countries, doubling 2024’s output. The company also plans to launch its second factory in Hà Tĩnh and expand its international manufacturing footprint.

In late October 2025, Vingroup surprised with plans to research a mega-urban project in Congo, marking its first foray into the African market and expanding its green real estate portfolio internationally.

Despite significant overseas initiatives, the domestic market remains Vingroup’s financial backbone.

Vingroup has launched several large-scale real estate projects, including Vinhomes Hạ Long Xanh (Quảng Ninh, 18 billion USD), Vinhomes Cần Giờ (10-11 billion USD), Vinhomes Dương Kinh (Hải Phòng), Vinhomes Phước Vĩnh Tây (Long An), and seven Happy Home social housing projects nationwide.

Notably, Vingroup inaugurated the National Exhibition Center, a national and regional landmark and one of the world’s ten largest exhibition centers. It serves as a hub for international trade and cultural events.

Beyond real estate and electric vehicles, Phạm Nhật Vượng has ventured into challenging sectors.

In August 2025, Vingroup announced two new business pillars: Infrastructure and Energy. Through its subsidiary VinSpeed, the group proposed investments in major rail projects, including the North-South Railway (61.35 billion USD), Hà Nội – Quảng Ninh Railway (5.3 billion USD), and the HCM City – Cần Giờ Metro (4 billion USD).

Vingroup also proposed large-scale renewable energy and LNG power projects, totaling 25-30 billion USD for 2025-2030. Construction began on the Hải Phòng LNG plant, Vietnam’s largest, with a 7.7 billion USD investment.

Phạm Nhật Vượng further expanded into steel with Vinmetal, entertainment with V-Film, V-Spirit, and V-Talents, and even aerospace with VinSpace. Vin New Horizon was also established to develop urban and senior living services.

Financially, Vingroup’s stock (VIC) surged in 2025, increasing over fivefold (560%) since the year’s start. By September, the group’s total assets surpassed 1 million billion VND, making it Vietnam’s first non-financial private enterprise to achieve this milestone.

Billionaire Nguyễn Thị Phương Thảo, Chairwoman of Sovico Group and Vietjet, pursued ambitious expansion. Post-pandemic, Vietjet enhanced its international network, adding routes to India, China, Australia, Russia, and planning flights to Europe and North America.

Vietjet signed MOUs and orders worth tens of billions of USD in 2025, including a 25 billion USD deal for 100 A321neo and 20 A330neo aircraft from Airbus.

Additionally, the airline finalized a 32 billion USD order for 200 737 MAX aircraft from Boeing and a 3.8 billion USD engine contract with Rolls-Royce. These agreements not only expand the fleet but also balance Vietnam’s trade relations.

Despite operational success, Vietjet required significant capital for fleet and network expansion. Mrs. Thảo’s multi-industry ecosystem strategy was strengthened, with HDBank driving green finance. Sovico Group invested in Long Thành Airport’s logistics infrastructure, including Vietjet’s MRO maintenance center, marking private sector entry into this field.

Notably, the HDEX crypto asset exchange launched in September 2025, signaling early fintech and digital asset involvement.

Nguyễn Thị Phương Thảo’s wealth grew impressively in 2025, rising from 2.8 billion USD to a record 48,200 VND (as of December 2025), driven by surges in Vietjet (VJC) and HDBank (HDB) stocks.

Trương Gia Bình, Chairman of FPT, focused on core technology business, leveraging AI and global digital transformation. FPT secured major contracts in Asia (256 million USD) and the US (100 million USD).

FPT’s technological ambitions include the Semiconductor Incubation Center (VSIC), NVIDIA’s H200 AI chip, and plans for five “AI factories.” A 50,000 semiconductor engineer training program underscores this commitment.

In Q1-Q3 2025, FPT reported strong financials: 49.9 trillion VND in revenue and 9.54 trillion VND in pre-tax profit, up 10% and 18% YoY, respectively. Despite adjusted annual targets, overseas IT revenue remained robust, especially in Japan.

Positive results boosted FPT’s stock, which rebounded to over 100,000 VND/share, with foreign investors resuming net buying, signaling recovery after a 35% peak decline.

A notable development was the transfer of FPT Telecom’s 50.17% state-owned shares from SCIC to the Ministry of Public Security, ensuring national security and data safety.

These entrepreneurs share a global vision and technological focus but differ in risk appetite and financial strategies.

Phạm Nhật Vượng leverages real estate to fund industrial ventures like VinFast, while Trương Gia Bình pursues technology (AI, chips) from a stable financial base. Nguyễn Thị Phương Thảo builds a multi-industry ecosystem (aviation, finance, infrastructure), requiring complex capital coordination.

Billionaires Trần Đình Long, Nguyễn Đăng Quang, Nguyễn Đức Tài, and Đỗ Quang Hiển: Strengthening Foundations and Optimizing Internal Resources

Entrepreneurs like Nguyễn Đăng Quang and Trần Đình Long focused on core strengths, optimizing operations and expanding selectively.

Nguyễn Đăng Quang, Chairman of Masan Group, built a strong domestic foundation with the “Point of Life” ecosystem and is now selectively expanding globally, targeting culturally similar markets like South Korea and Japan.

WinCommerce (WCM) saw 9-month revenue rise 2.1%, with same-store sales up 5.6%, showcasing rural market strategy success.

Masan Consumer (MCH) faced Q3 profit declines due to new tax policies but implemented “Direct Coverage,” transitioning from wholesalers to direct retail relationships with 345,000 outlets. This strategy initially reduced Q3 revenue decline to 5.9% YoY and increased it by 20% QoQ.

Phúc Long adjusted its model, closing 44 kiosks and focusing on flagship stores, accepting a 9.5% 9-month revenue drop.

Masan prioritized debt repayment, reducing leverage, and focused on data and AI for domestic market optimization.

Trần Đình Long, Chairman of Hòa Phát (HPG), consistently strengthened heavy industry. In 9M 2025, HPG earned 11.626 trillion VND, meeting 78% of its annual target.

Hòa Phát completed the 88.4 trillion VND Dung Quất 2 Steel Complex in September 2025, raising total steel capacity to 16 million tons/year by 2026. The 120 trillion VND Phú Yên Industrial Park and Port Complex further extends its industrial ambitions.

Supporting national infrastructure, Hòa Phát invested 10 trillion VND in a Dung Quất rail factory for high-speed rail components.

Its agriculture arm (HPA) filed for IPO on HoSE, targeting December 2025 listing, with 9M revenue of 6.258 trillion VND and 1.412 trillion VND pre-tax profit.

In real estate, Hòa Phát developed new industrial parks like Hòa Tâm (Phú Yên) and Yên Mỹ II (Hưng Yên), and launched large social housing projects (31 ha in Yên Mỹ II). Existing parks like Phố Nối A maintain high occupancy and stable revenue.

Vietnam’s GDP Growth Outpaces Thailand by Sevenfold, Reports Sputnik

Vietnam’s Q3/2025 GDP growth surged to 8.23%, leading the ASEAN-6 and outpacing Thailand’s 1.2% growth by nearly sevenfold. Sputnik highlights Vietnam as a standout performer amidst a noticeable slowdown in many regional economies.

NCT Revises 2025 Profit Target Upward by 15%

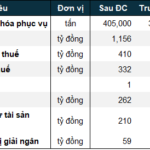

On November 18, 2025, the Board of Directors of Noi Bai Cargo Services Joint Stock Company (HOSE: NCT) approved an adjustment to the 2025 business plan, setting new targets for revenue and after-tax profit at VND 1,156 billion and VND 311.6 billion, respectively. These revised figures represent a 15% increase compared to the previous plan.

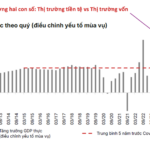

Unlocking 10% GDP Growth: Why Vietnam’s Capital Market Must Awaken

To achieve double-digit GDP growth, reliance on bank credit alone is insufficient, according to Phạm Lưu Hưng. Instead, the driving force should stem from the capital market, which embraces higher risk tolerance and holds the potential to generate more sustainable breakthroughs for the economy.