During the morning session on December 3rd, National Assembly Delegate Nguyen Thi Viet Nga urged the State Bank of Vietnam to establish a detailed roadmap for phasing out credit growth quotas.

According to the delegate, while the credit quota mechanism has been reduced, the timeline for its complete elimination remains unclear. Resolution 62/2022/QH15 explicitly mandates the study of limiting and eventually abolishing the mechanism of allocating credit growth targets to individual credit institutions. The government’s report indicates that the State Bank has made adjustments, including more transparent quota allocation criteria, categorizing credit institutions by safety levels, and granting some institutions greater autonomy in managing credit growth. These are positive steps.

However, Delegate Nguyen Thi Viet Nga noted that the credit quota mechanism is still in place, with specific targets assigned and adjusted for each credit institution. The report focuses on describing current practices but lacks a clear roadmap for completely phasing out the mechanism. It also fails to adequately explain why, after many years, there is still no specific timeline or solution for eliminating the quota system.

In light of these issues, Delegate Nguyen Thi Viet Nga proposed that the State Bank develop and submit to the National Assembly a detailed roadmap for gradually reducing and ultimately eliminating the administratively allocated credit growth targets. Until the mechanism is fully abolished, credit quotas should be assigned consistently, with minimal mid-year adjustments, and more credit institutions should be allowed to autonomously manage their credit growth within a predefined “safety framework.”

Delegate Nguyen Thi Viet Nga – Hai Phong City National Assembly Delegation speaks at the session (Photo: Quochoi.vn)

The credit quota mechanism has been maintained by the State Bank for over a decade as a tool to control the quality and scale of bank lending, as well as to support macroeconomic objectives such as interest rates, money supply, and inflation.

After significantly contributing to the State Bank’s operations for many years, the credit quota allocation mechanism has revealed several limitations. This is particularly evident as the demand for capital to fuel economic growth continues to rise, and most banks have already complied with international standards under Basel II and Basel III, enabling the banking sector to operate more flexibly.

In August, the Prime Minister directed the State Bank to expedite the development of a roadmap and pilot the elimination of credit growth quotas starting in 2026. The regulatory body must establish standards and criteria for banks to adhere to safety ratios and credit quality indices. The State Bank will oversee and conduct post-audits to prevent systemic risks.

Bank Foreclosure on Primary Residence: Mandatory 12-Month Salary Support for Borrowers

Commercial banks are now required to set aside an amount equivalent to 12 months of the minimum wage to support borrowers whose sole residence is being foreclosed upon as collateral.

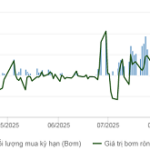

Central Bank’s Record Net Injection in 10 Months

During the week of November 24 to December 1, the State Bank of Vietnam (SBV) significantly expanded its liquidity support to the system, injecting a net of VND 98,980 billion into the open market operations (OMO). This marks the seventh consecutive week of net injections and represents the highest level since late January this year.

Businesses Deposit Over 8.35 Quadrillion into Banks

As of the end of September 2025, corporate deposits in the banking system surpassed 8.35 quadrillion VND, marking an 8.91% increase compared to the end of 2024. This figure also exceeded individual deposits by a significant margin of 518 trillion VND.