Silver prices have surged over 80% since the beginning of the year, reaching a peak of $58/oz, sparking a global frenzy. Leading precious metals investment firms like BlackRock and Sprott are aggressively accumulating silver, holding massive quantities in their portfolios.

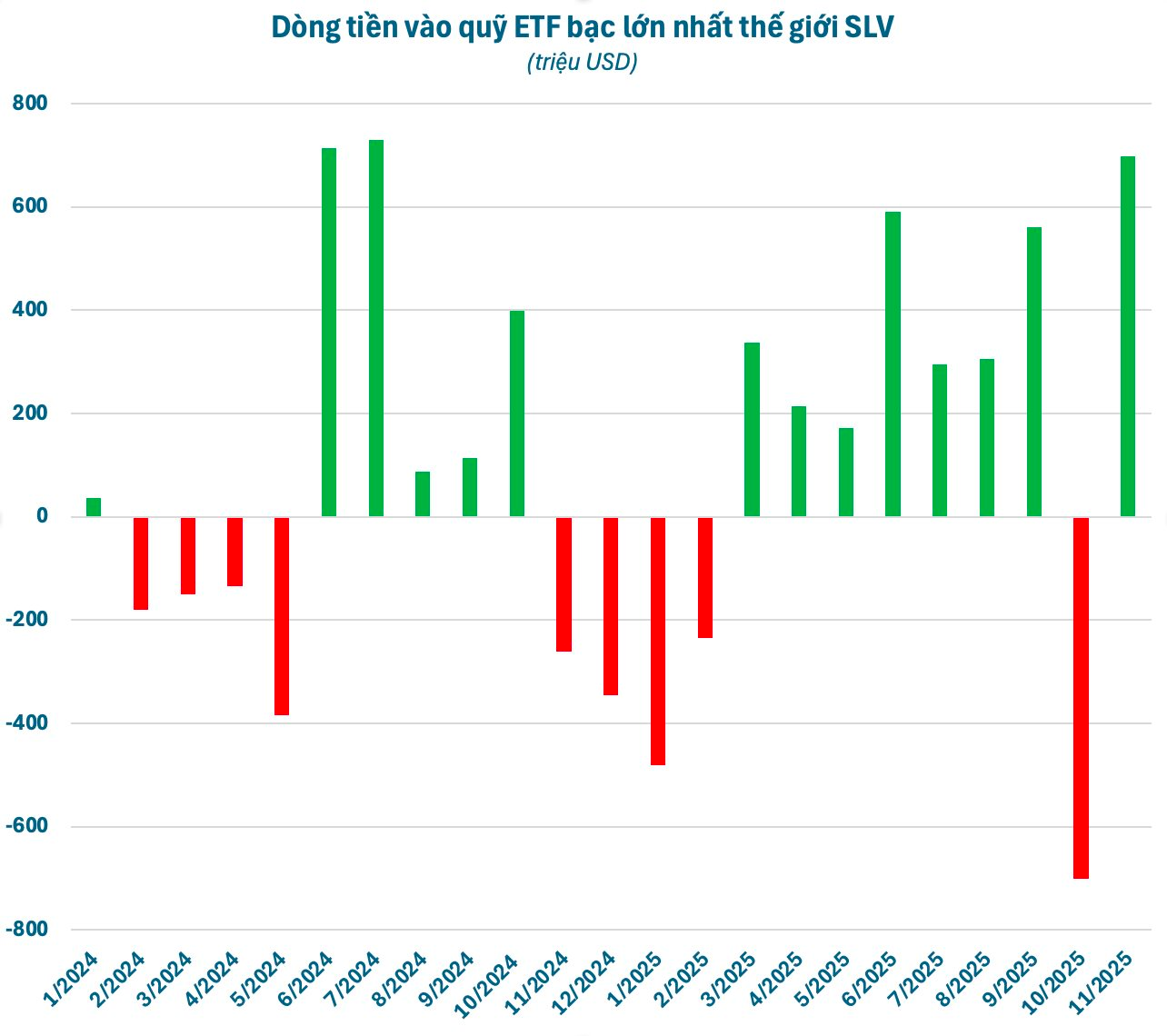

As of early December, BlackRock’s iShare Silver Trust stands as the world’s largest silver fund, holding approximately 508 million oz (15,800 tons) of silver, valued at over $29 billion. Since the start of 2025, the fund has invested nearly $1.8 billion to acquire 38 million oz (~1,200 tons) of silver.

BlackRock, managing $13.5 trillion in assets globally, invests across diverse sectors including stocks, corporate bonds, government bonds, commodities, and digital assets.

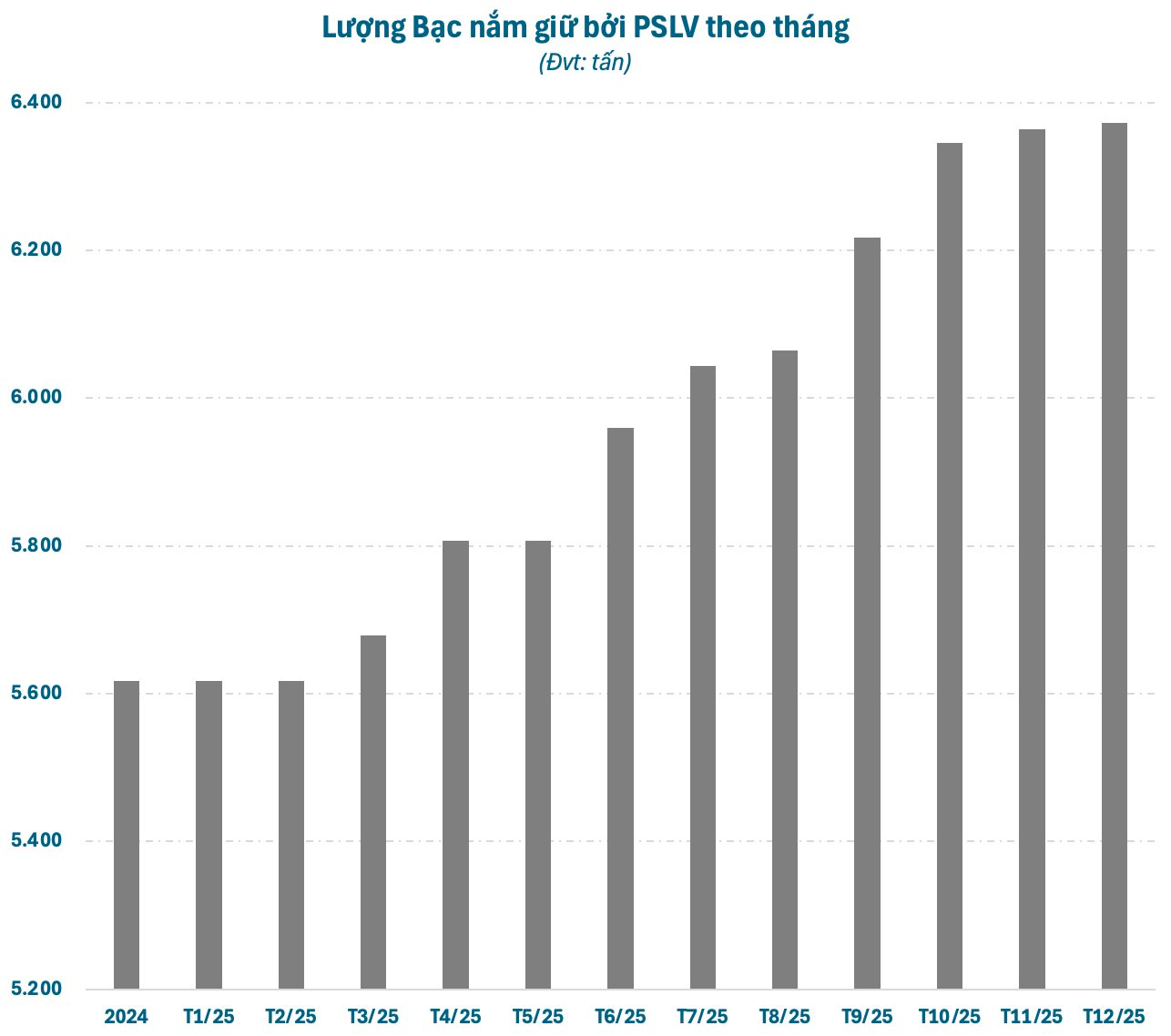

Meanwhile, Sprott Physical Silver Trust (PSLV), managed by Sprott Asset Management LP, holds nearly 205 million oz (~6,400 tons) of silver, valued at approximately $12 billion. Since the year began, the fund has added 25 million oz (750 tons) to its reserves.

PSLV is one of the world’s largest physical silver funds, embodying Sprott’s “real silver” philosophy. The Canadian asset manager, with over $49 billion in assets, specializes in precious metals (gold, silver, copper, platinum, palladium) and natural resources.

Together, BlackRock and Sprott Asset Management LP hold over 700 million oz (22,200 tons) of silver.

Silver’s industrial applications, from solar energy and electronics to green technologies, drive substantial physical demand. In 2025, the U.S. Department of the Interior designated silver as a strategic metal.

Clem Chambers, CEO of Online Blockchain PLC, attributes silver’s price surge primarily to individual investors. “Governments aren’t focused on silver, but retail investors are. When they buy, the market becomes unstoppable,” he emphasizes.

Beyond investment flows, silver’s rally is fueled by declining inventories, surging investment demand, and tightening physical supply. These factors have propelled silver beyond previous cycle peaks.

Shanghai Futures Exchange silver inventories have dropped to near 10-year lows. In October, China exported 660 tons of silver to London—an unusually large volume—to ease physical delivery pressures at the LBMA.

Global silver mine production remains stagnant, with some producers reporting output declines. Recycling volumes have not kept pace despite higher prices.

Analysts warn of a potential supply-demand imbalance. While not immediately measurable, prolonged tightness could trigger sharper price spikes.

Clem Chambers predicts a structural market shift, with strong investment flows and limited supply driving further gains. “This isn’t the peak. It’s just the beginning. Silver will rise further. I’ll consider selling at $95,” he states.

Paul Williams, CEO of Solomon Global, agrees, citing sustained market fundamentals. “Silver could reach $100/oz by late 2026,” he forecasts, noting its undervaluation relative to gold.

Silver Prices Surge Nearly 6% in a Single Session, Breaking Records Above $2,500 per Ounce

Silver prices today witnessed a significant surge both domestically and globally, marking a notable upward trend in the market.