According to the Ministry of Agriculture and Environment, cashew nut exports for the first 11 months of the year are estimated at 698,100 tons, valued at 4.76 billion USD. This represents a 4% increase in volume and a 19.5% rise in value compared to the same period last year.

The average export price of cashew nuts for the first 11 months of 2025 reached 6,816 USD/ton, a 14.9% increase from the previous year. This significant price hike has driven the surge in export value, despite a modest growth in volume.

China, the United States, and the Netherlands are Vietnam’s top three cashew nut consumers, accounting for 21.3%, 18.9%, and 9.6% of the market share, respectively.

Compared to the same period last year, cashew nut export value to China increased by 53.7% in the first 10 months of 2025, while exports to the Netherlands rose by 20.7%. Conversely, exports to the U.S. market declined by 17%.

China increases cashew nut imports from Vietnam, replacing expensive U.S. nuts due to tariffs.

Explaining this shift, Mr. Bach Khanh Nhut, Vice Chairman of the Vietnam Cashew Association (VINACAS), noted that since April 2025, China has consistently been Vietnam’s top cashew nut importer (except in July 2025).

For Vietnam, retaliatory tariffs imposed by the U.S. have made exports to this market challenging, forcing businesses to seek alternative customers. China has emerged as a promising market due to its proximity and status as a traditional trading partner.

On the buyer’s side, U.S. retaliatory tariffs have caused the price of nuts like almonds, walnuts, and pecans imported from the U.S. to China to triple or quadruple. As a result, Chinese buyers are turning to alternative nuts, with Vietnamese cashews being an optimal choice.

From April to October 2025, Chinese companies significantly increased their imports of Vietnamese cashews, with monthly growth rates ranging from 45% to 137% compared to the same period last year.

Specifically, in the first 10 months of 2025, China imported 128,649 tons of cashew nuts from Vietnam, valued at 813.1 million USD.

The Impact of Seafood Stocks Amid a Turbulent Year of Tariff Disruptions

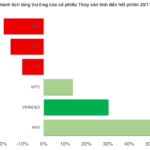

Amidst a year marked by turbulent U.S. tariff policies, seafood stocks continue to make their mark. While 3 out of the 5 major industry players have seen significant declines, ANV has found a glimmer of hope in the export of tilapia.

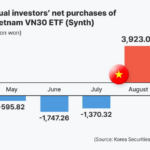

Korean Investors Flock to Vietnamese Stock Market

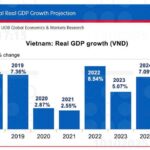

Amidst the sluggish growth of South Korea’s domestic stock market, retail investors are increasingly channeling capital into Vietnam’s equity market, drawn by the country’s promising economic indicators and robust growth prospects. This influx of Korean retail investment underscores Vietnam’s emerging appeal as a lucrative destination for international capital.

The Ultimate Guide to Importing from Cambodia: How a 0% Tariff is Boosting Vietnam’s Economy

The Cambodian savior has arrived on Vietnamese shores, commanding a price tag nearly 20% higher than the first half of last year.