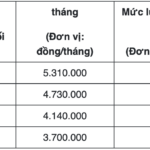

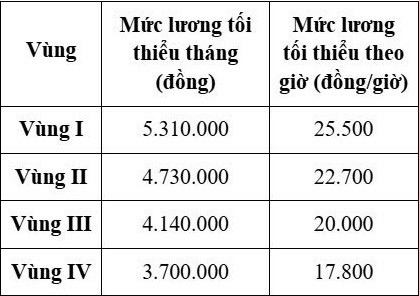

According to Decree 293/2025/NĐ-CP issued by the Vietnamese Government, starting January 1, 2026, the monthly and hourly minimum wage for workers categorized by region will increase by 7.2% compared to current rates. This translates to an increase of VND 250,000 – 350,000 per person per month, with corresponding adjustments to the hourly minimum wage.

Adjusted regional and hourly minimum wage rates. Image: HN |

As outlined in Articles 90 and 91 of the 2019 Labor Code, the minimum wage represents the lowest compensation payable to workers performing the simplest tasks under normal working conditions. This wage is designed to ensure a basic standard of living for workers and their families, aligning with the nation’s socioeconomic development.

Employers are prohibited from paying wages below the minimum threshold. Image: HN |

Effective January 1, 2026, employers are obligated to adjust wages for any employees currently earning below the minimum rates stipulated in Decree 293/2025/NĐ-CP.

Additionally, under Article 17, Clause 3 of Decree 12/2022/NĐ-CP, businesses found paying wages below the minimum threshold face administrative fines as follows:

– VND 20-30 million for violations involving 1-10 employees;

– VND 30-50 million for violations involving 11-50 employees;

– VND 50-75 million for violations involving 51 or more employees.

Beyond fines, businesses must rectify the situation by paying the outstanding wages, plus interest calculated at the highest non-term deposit rate offered by commercial banks at the time of penalty imposition.

Ensuring compliance with minimum wage regulations is not only a fundamental right of workers but also a strict legal obligation for businesses.

HẢI NHI

– 05:48 04/12/2025

Hanoi Offers Up to 24 Months’ Salary Support for Non-Permanent Staff Leaving During Two-Tier Government Implementation

Individuals working outside the official staffing quota at Party and State-assigned Associations at the city and district levels prior to July 1, 2025, who leave their positions due to the implementation of the two-tier government organizational model, will receive a one-time allowance. This allowance is capped at a maximum of 24 months of their current salary or remuneration.