Notably, VGC announced the receipt of the resignation letter from Mr. Quách Hữu Thuận on December 1, while Mr. Thuận submitted his resignation on November 14, proposing to take leave from December 1.

Mr. Quách Hữu Thuận, born in 1974, holds a Bachelor’s degree in Silicate Engineering and a Master’s in Business Administration. He has served as Deputy General Director of VGC since March 2021. According to the QFR as of June 30, 2025, Mr. Thuận also holds positions as a Board Member of Viglacera Tile Trading JSC, Vice Chairman of Viglacera Hạ Long JSC, and Chairman of Viglacera Packaging and Brake Linings JSC.

Mr. Quách Hữu Thuận appears in the Executive Board of VGC – Image: VGC website on December 3, 2025

|

At VGC, Mr. Thuận oversees the tile segment and the Communications Department. Recently, VGC has frequently appeared in the media for less-than-positive news, most notably the closure of 7 branches and business locations, along with a fine of hundreds of millions of dong for tax declaration errors.

The Q3 2025 business results, previously announced, were also unfavorable, with net profit dropping by 55% year-over-year to just over 92 billion dong. The company attributed this to seasonal business fluctuations and adverse weather conditions, including heavy rains and storms, which impacted profitability.

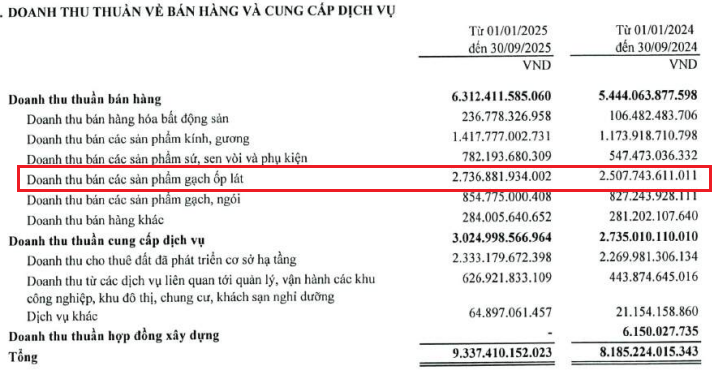

However, the first nine months of 2025 still show a bright picture. Net revenue reached over 9,337 billion dong, a 14% increase year-over-year. The tile segment, managed by Mr. Thuận, contributed over 2,736 billion dong in revenue, up by 9%.

In VGC‘s revenue structure, tiles are the largest revenue-generating product, accounting for 29%. Other significant contributors include glass and mirrors (15%), bricks and tiles (9%), and land leasing with developed infrastructure (25%).

|

Tiles are the flagship product in VGC‘s business operations

Source: Q3 2025 FSR of VGC

|

The company recorded pre-tax profit of nearly 1,322 billion dong and net profit of 851 billion dong, up 45% and 49%, respectively. Compared to the 2025 pre-tax profit target of 1,743 billion dong, the company has achieved 76% after the first three quarters.

In the stock market, reflecting the challenging Q3 results, VGC shares have been on a downward trend since mid-August 2025. From a peak of 65,000 dong/share after a heated rally, the current price hovers around 44,150 dong/share (as of December 3), nearly unchanged from the beginning of the year.

| VGC share price has been declining since mid-August 2025 |

Returning to VGC‘s key personnel, prior to Mr. Thuận, another Deputy General Director, Mr. Lương Thanh Tùng, submitted his resignation on October 20. At that time, Mr. Tùng stated he was stepping down to focus on completing his assigned tasks at GELEX Infrastructure JSC, which directly owns 50.21% of VGC.

“Currently, as General Director of GELEX Infrastructure JSC, I need to dedicate all my time and resources to managing, operating, and implementing investment tasks at GELEX Infrastructure JSC under the new direction” – Mr. Tùng wrote in his resignation letter.

The VGC Board promptly approved Mr. Tùng’s request on October 31 and appointed Mr. Bùi Lê Cao Kế as his replacement, effective November 1.

– 16:28 03/12/2025

Technical Analysis for the Afternoon Session of November 6th: Shifting Towards the August 2025 Lows

The VN-Index halted its upward momentum, unexpectedly correcting sharply toward its August 2025 lows (around 1,605–1,630 points). Meanwhile, the HNX-Index exhibited negative volatility, forming a Bearish Engulfing candlestick pattern.

Insider of HNA’s Board Chairman Registers Full Capital Withdrawal Following Company’s Significant Profit Announcement

Mr. Vo Dang Giap, the elder brother of Mr. Vo Trung Chinh, Chairman of the Board of Directors at Huana Hydropower Joint Stock Company (HOSE: HNA), has registered to sell his entire holding of 251,800 HNA shares. This transaction, representing 0.1% of the company’s charter capital, is scheduled to take place between November 3rd and 28th.