|

VNM ETF Shareholdings Changes: Week of November 21-28, 2025

|

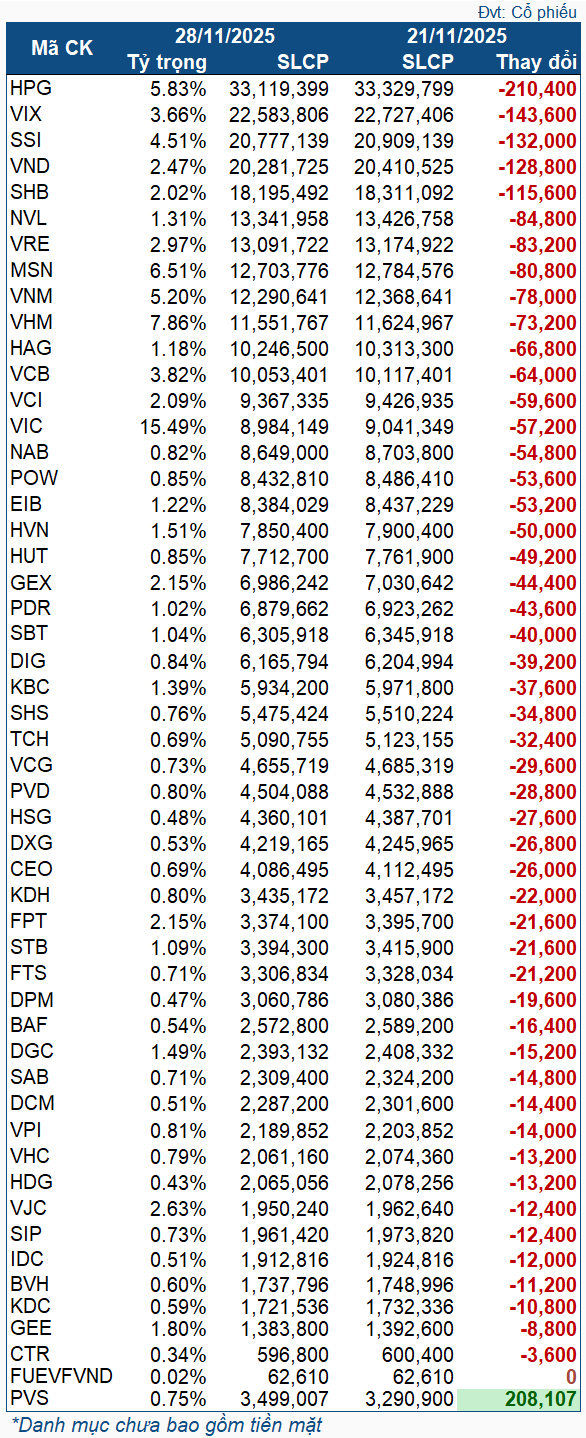

During the week, VNM ETF offloaded nearly all stocks in its portfolio. Leading the sell-off was HPG, with 210,400 shares sold. VIX, SSI, VND, and SHB followed suit, each shedding over 100,000 shares.

Only PVS saw a net increase, attributed to a 7% stock dividend from 2024 (100 shares yielding 7 new shares). However, considering actual movements, PVS likely faced a net sell-off of approximately 30,000 shares.

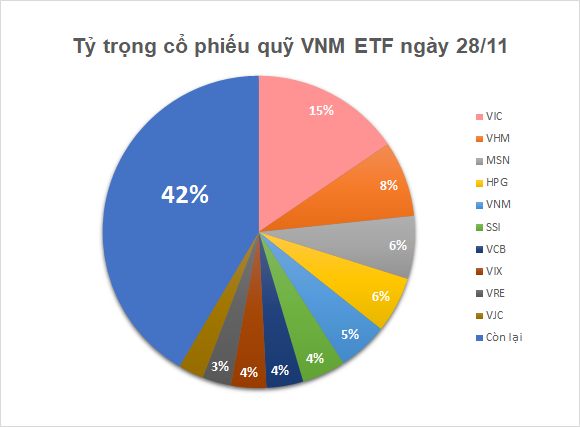

VNM ETF‘s selling activity occurred as the VN-Index surged toward 1,700 points, with VIC consistently hitting new highs and accounting for 15.49% of the portfolio by November 28. The fund’s total assets rose to $573 million, up from $566 million on November 21, allocated across 51 stocks and 1 fund unit. Following VIC, top holdings included VHM (7.86%), MSN (6.51%), HPG (5.83%), VNM (5.2%), and SSI (4.51%).

– 1:04 PM, December 3, 2025

Foreign Investors Reverse Course, Selling Hundreds of Billions of Dongs in Session 1/12: Which Stocks Were Hit Hardest?

In the afternoon trading session, foreign investors aggressively accumulated FPT shares, with the total value reaching approximately 93 billion VND.

Vietstock Daily 04/12/2025: Will the Rally Continue?

The VN-Index extended its winning streak to six consecutive sessions, breaking above the 50-day SMA and now hugging the Upper Band of the Bollinger Bands. This bullish outlook is reinforced by the MACD indicator, which continues to widen its gap above the Signal line. However, caution is warranted as the Stochastic Oscillator has ventured deep into overbought territory, leaving investors vulnerable to a potential sell signal in the coming sessions.

Vietnam’s Stock Market Diverges: King Stocks and VN-Index No Longer in Sync

Amidst the ongoing correction in the market’s largest-cap stocks, the VN-Index managed to maintain its upward trajectory in November. This divergence highlights that the market’s momentum is increasingly driven by sectors beyond banking, signaling a broader-based rally.