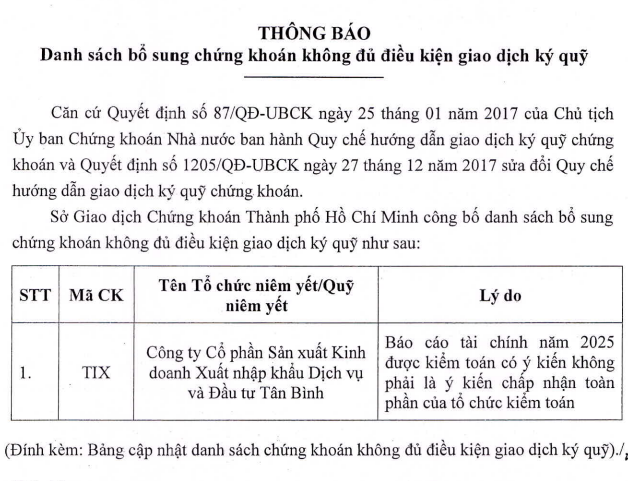

The decision stems from the audited financial report for the fiscal year 2025 (October 1, 2024 – September 30, 2025) of TIX, which received a qualified opinion from the auditing firm. This brings the total number of margin-cut stocks on HOSE to 66.

Source: HOSE

|

The auditing firm, A&C Auditing and Consulting LLC, issued a qualified opinion regarding a principal and interest debt of nearly VND 21 billion from Kien Duc Plastic Packaging Trading and Services JSC, a company that has ceased operations and is in the process of liquidating assets.

“Based on the available evidence at the Company, we are unable to assess the recoverability of this debt,” A&C stated.

In a recent explanation, TIX noted that the debt matured on July 12, 2025. However, on July 10, 2025, Kien Duc requested a six-month extension until January 13, 2026, citing the liquidation of its Blowing System 4 as the source of repayment. Kien Duc is currently negotiating the sale of this system to meet its debt obligations.

The debt in question is from the bond issuance NKDCH2225001, launched by Kien Duc on July 12, 2022. These are “triple-zero” bonds—non-convertible, without warrants, and unsecured. The issuance raised VND 20 billion with an interest rate of 9% per annum, paid semi-annually.

Earlier this year, TIX invested nearly VND 23 billion (approximately VND 11,596 per share) in Kien Duc, acquiring nearly 2 million shares (19.76% of its charter capital). However, TIX had to provision nearly VND 6 billion for this investment. The shares were later sold to Viet An Trading and Consulting JSC for only VND 1,000 per share.

In addition to the audit issues, TIX also addressed the 11% year-on-year increase in after-tax profit for 2025, reaching nearly VND 117 billion.

The company attributed this growth to revenue from extending the lease agreement for the Tan Binh Industrial Park infrastructure and increasing rental rates for certain warehouse and factory space leases.

On the cost side, the company benefited from a 30% reduction in land rent for 2024, as approved by the Ho Chi Minh City Tax Department. Additionally, some investment properties had fully depreciated, reducing the cost of goods sold by 12%.

However, the company faced significant financial costs, nearly seven times higher than the previous year, following the divestment from Kien Duc due to its poor performance. In 2024, the company also recorded other income from the handover of infrastructure in the Ao Doi area, DC6 group, within the Tan Binh Industrial Park.

Looking ahead, TIX plans to hold its 2025 Annual General Meeting on January 15, 2026, in Ho Chi Minh City. Key agenda items include profit distribution for the 2025 fiscal year, the 2026 business plan, and the removal of La Ngoc Thong from the Board of Directors.

On the stock market, TIX shares have maintained a long-term upward trend since late 2011. As of December 3, the stock price closed at VND 47,000 per share, up nearly 33% over the past year. However, trading volume remains low, averaging just over 1,000 shares per day, with some sessions seeing as few as 100 shares traded, such as on December 12, 2024.

– 08:58 04/12/2025

Steel Giant’s HoSE Ascent: Holding $136M in Cash, Q3 Profits Surge 58%

The Ho Chi Minh City Stock Exchange (HoSE) has officially announced the acceptance of the listing application for all 149 million shares of Ton Dong A Joint Stock Company (stock code: GDA). This milestone marks a significant step in the company’s transition to the main bourse, following over two years of trading on the UPCoM market.

Another Giant Files for Listing on HOSE

Tôn Đông Á (UPCoM: GDA) has officially re-entered the race to list on the Ho Chi Minh City Stock Exchange (HOSE), marking a significant comeback after years of interruption.

Seafood & Food Stocks Lead the Week in Attracting Investment

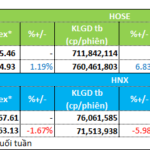

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.