According to Circular 18/2024 issued by the State Bank of Vietnam (SBV), which regulates bank card activities, the total cash withdrawal limit for credit cards per BIN is capped at 100 million VND per month.

This restriction remains unchanged in Circular 45/2025, an amendment to Circular 18, effective from January 1, 2025.

Compared to the previous regulation in Circular 19/2016 (expired on July 1, 2024), this is a significant change. Previously, many banks allowed credit cardholders to withdraw cash ranging from 50% to 80% of their credit limit. For instance, a credit card with a 100 million VND limit could withdraw up to 80 million VND per month, while a 300 million VND limit could reach 240 million VND.

However, starting in 2025, the new regulation limits the total cash withdrawal from credit cards to a maximum of 100 million VND per month, regardless of the actual credit limit.

Banks discourage customers from withdrawing cash from credit cards. Illustration: Nam Khánh |

This regulation is uniformly applied per card BIN, aiming to better control credit risk and encourage cardholders to use credit cards for their intended purpose—payment transactions—rather than uncontrolled cash withdrawals.

While cash withdrawals from credit cards via ATMs or bank counters are permitted, they are not encouraged due to higher associated fees and interest rates compared to regular payment transactions.

Each cash withdrawal incurs a bank fee, typically ranging from 1% to 4% of the transaction amount. Many banks also set a minimum fee per withdrawal, usually between 50,000 and 100,000 VND.

This means that even for small withdrawals, customers may incur substantial fees.

For example, withdrawing 2,000,000 VND with a 4% fee but a 100,000 VND minimum fee would result in a 100,000 VND charge instead of 80,000 VND (4% of 2,000,000 VND).

Additionally, the interest rate on withdrawn cash is typically high, ranging from 20% to 45% annually, depending on the bank. This interest is often applied immediately from the transaction date, without a grace period as in regular purchases.

Therefore, cash withdrawals from credit cards should only be considered as a last resort in urgent situations when no other financial options are available.

Tuân Nguyễn

– 20:27 03/12/2025

“A Detailed Roadmap is Essential to Eliminate the Credit Room Allocation Mechanism”

The proposal was put forth by Nguyen Thi Viet Nga, Deputy Head of the Hai Phong City Delegation, during the morning plenary discussion session on December 3rd.

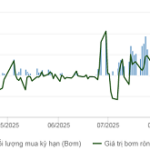

Central Bank’s Record Net Injection in 10 Months

During the week of November 24 to December 1, the State Bank of Vietnam (SBV) significantly expanded its liquidity support to the system, injecting a net of VND 98,980 billion into the open market operations (OMO). This marks the seventh consecutive week of net injections and represents the highest level since late January this year.

Finance Ministry Proposes Approval of Credit Limit Exemption for EVN

In the draft Decree on the operational mechanism and special financial management mechanism for Vietnam Electricity (EVN), the Ministry of Finance proposes specific regulations regarding EVN’s capital mobilization and lending mechanisms.