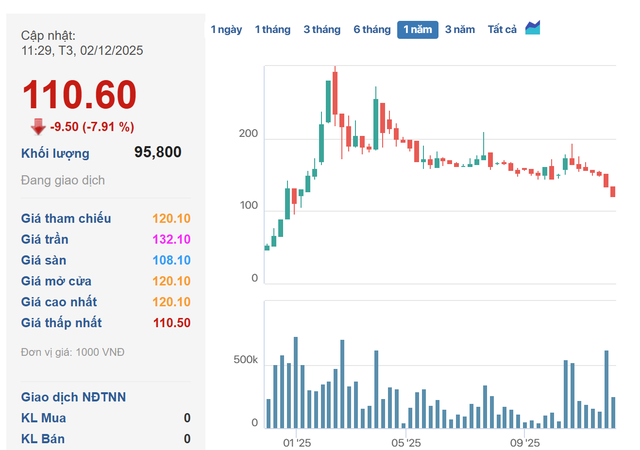

On the stock market, during the session of December 2, 2025, shares of KSV from Vietnam National Coal and Mineral Industries Group (VIMICO) traded at 110,600 VND per share, marking a 25% decline compared to November 27 and a 60% drop since February 2025.

The current market capitalization stands at 22 trillion VND, reflecting a loss of over 7.5 trillion VND in just three days.

The sharp decline in share price occurred following VIMICO’s issuance of a resolution on November 26, 2025, addressing compliance with public company requirements. According to the resolution, VIMICO acknowledges that as of November 2025, the company does not fully meet the criteria for a public company as stipulated by the Securities Law.

Specifically, the company must have a minimum of 10% of its voting shares held by at least 100 investors who are not major shareholders. This is a critical requirement to ensure the company’s public status and the liquidity of its shares in the market.

In response, VIMICO’s Board of Directors has agreed to have the CEO report and explain the company’s “unique shareholder structure” to the State Securities Commission (SSC). However, the company has also prepared for the worst-case scenario. The resolution states that if by January 1, 2026, VIMICO fails to meet the shareholder structure requirements or does not receive SSC approval for public company status, it will file for the revocation of its public company status as per the Securities Law.

Vietnam National Coal and Mineral Industries Group (VIMICO) listed 200 million shares on the UPCoM market under the code KSV in early 2016. As a key subsidiary of the Vietnam National Coal and Mineral Industries Corporation (TKV), KSV holds significant mineral resources, including copper, gold, zinc, and tin deposits.

According to annual reports and corporate governance disclosures, the Vietnam National Coal and Mineral Industries Corporation (TKV) has consistently maintained a dominant ownership stake, often exceeding 98% of the charter capital.

Dragon Capital Seeks to List Shares on UPCoM

On December 1st, Dragon Capital Vietnam Fund Management JSC (Dragon Capital – DCVFM) announced a Board of Directors resolution approving the registration of centralized custody of shares with the Vietnam Securities Depository (VSD). Simultaneously, the company has registered for trading its shares on the UPCoM system.

Government Inspectorate Audits State Capital and Asset Management at TKV

The Government Inspectorate has officially announced its decision to conduct an inspection at the Vietnam National Coal and Mineral Industries Group (Vinacomin).