The ex-dividend date is set for December 16, with the payment expected to commence from December 25. With approximately 122 million outstanding shares, NTL is projected to allocate around 122 billion VND for this dividend distribution.

Source: VietstockFinance

|

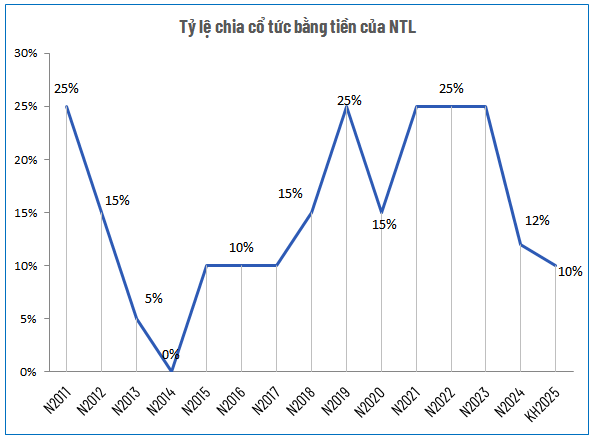

NTL’s cash dividend history from 2011 to 2024 reveals fluctuating payout ratios, ranging from a low of 5% to a high of 25%. Despite record profits exceeding 620 billion VND in 2024, the company declared a cash dividend of only 12%.

| NTL’s Financial Performance Over the Years |

For 2025, NTL has adopted a cautious approach, setting a revenue target of 80 billion VND and after-tax profit of 24 billion VND, reflecting a 95% and 96% decline, respectively, compared to 2024. With a 10% interim dividend, the company will fulfill its dividend commitment to the Annual General Meeting.

| NTL’s 9-Month Financial Performance Over the Years |

In the first nine months of 2025, NTL’s net revenue reached nearly 14 billion VND, with a net profit of 21 billion VND, marking a 99% and 97% decrease, respectively, year-on-year. The previous year’s exceptional performance was driven by revenue and profit recognition from the sale of land in the Bai Muoi urban area project (Ha Long, Quang Ninh). In contrast, this year’s nine-month period saw minimal core business revenue as the company focused on finalizing investment and construction procedures for new real estate projects. Nonetheless, NTL surpassed its pre-tax profit target by 11% and achieved 85% of its annual after-tax profit plan.

Source: VietstockFinance

|

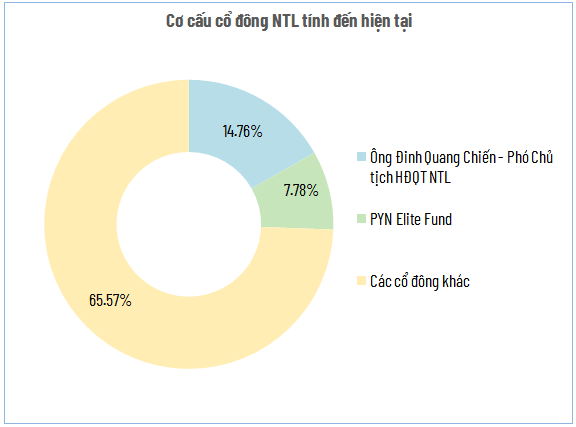

Among major shareholders, Vice Chairman of the Board Dinh Quang Chien holds 14.76%, expected to receive over 18 billion VND in dividends, while PYN Elite Fund owns 7.78%, corresponding to nearly 9.5 billion VND.

– 08:08 04/12/2025

Pioneer Plastics Fined and Taxed Over 10 Billion VND

Pioneering Plastics has been slapped with a hefty administrative fine and tax arrears totaling over 10.2 billion VND due to inaccurate tax declarations.

Phú Mỹ Tops Urea Market Share, Aims for Billion-Dollar Revenue

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCO – Phu My, HOSE: DPM) is entering a strategic acceleration phase. Building on its leadership in the domestic urea market, the company aims to expand into the chemicals and petrochemicals value chain, with a focus on green products such as clean ammonia and hydrogen.

Land Prices Skyrocket 2-6 Times Due to a Single Formula

According to HoREA, the application of the “land price table multiplied by an adjustment factor” is unreasonable, causing land costs to soar abnormally. The association proposes establishing a separate coefficient for real estate projects to untangle the most significant bottleneck in the composition of housing prices.

G Kitchen Chain Owner Reports 2.5x Surge in Half-Year Profits

According to its periodic financial report submitted to the Hanoi Stock Exchange (HNX), Greenfeed Vietnam JSC recorded a significant surge in profits during the first half of 2025. However, the company’s total liabilities also saw a notable increase during the same period.