The Ministry of Finance is seeking input on a draft decree outlining the operational and financial mechanisms specific to the Vietnam Oil and Gas Group (Petrovietnam – PVN). The draft focuses on streamlining organizational management, corporate finance, and relationships with affiliated units.

Regarding foreign currency, PVN reports significant foreign exchange needs, primarily for (i) capitalizing ongoing power projects, (ii) investing in oil and gas exploration projects, (iii) paying gas suppliers, and (iv) servicing debt. Foreign currency revenue is limited to (i) dividends from Rusvietpetro and (ii) oil sales from two blocks operated on behalf of the host country.

As a result, PVN faced a USD 563 million shortfall in the first half of 2025. This deficit is expected to grow as the Group continues investing in projects like the Blue Whale, Block B Gas Chain, Long Phu 1 Thermal Power Plant, and other gas-fired power plants.

To ensure foreign currency liquidity, PVN has requested the Ministry of Finance to allow the Group to utilize the entire amount of foreign currency due to the state budget to meet its foreign exchange obligations.

Current regulations permit PVN to use only up to 30% of its foreign currency needs from the state budget, with the remainder to be self-financed. Corresponding budget contributions are converted to Vietnamese Dong as per regulations.

Regarding the Vietnam-Russia joint venture Vietsovpetro, PVN proposes to directly manage and account for the Vietnamese government’s capital contribution in Vietsovpetro. PVN would oversee and monitor Vietsovpetro’s operations, ensuring compliance with current laws. All assets, liabilities, revenues, and expenses of Vietsovpetro would be consolidated into PVN’s financial statements.

This proposal provides a legal basis for PVN’s consolidated financial statements to fully reflect Vietsovpetro’s assets, capital, revenue, and profits.

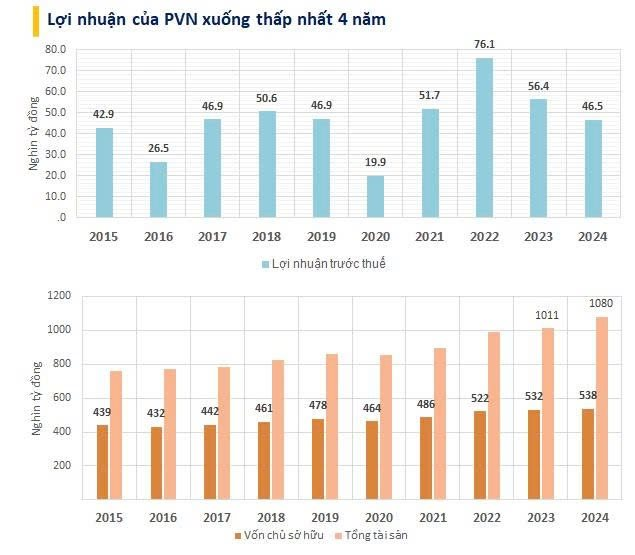

In 2024, PVN reported consolidated net revenue of nearly VND 558.602 trillion, an 8.1% increase from 2023. Earlier, PVN announced total revenue exceeding VND 1,000 trillion, likely representing the combined revenue of all related entities.

After deducting costs, gross profit fell by 7.6% to VND 54.719 trillion.

Pre-tax profit for 2024 was VND 46.496 trillion, a 17.5% decline from 2023 and the lowest in four years. Post-tax profit reached VND 32.674 trillion, down nearly 19% year-on-year.

As of December 31, 2024, PVN’s total assets exceeded VND 1,080 trillion, up by VND 69 trillion from the start of the year. Cash and equivalents surged by nearly 59% to VND 136.381 trillion. The Group also holds nearly VND 280 trillion in term deposits. Over VND 88 trillion of the cash and deposits is held in trust for site restoration funds on behalf of contractors.

“Energy Sector Titan Backs Neighboring Province of Hanoi, Poising It for Major Transformation”

The province aspires to emerge as the premier energy industry hub in Northern Vietnam, driving regional growth and innovation.

Accelerating Production to Surpass the 2025 Plan

“The most tangible action BSR can take to support our fellow citizens nationwide is to vigorously enhance our production and business operations, striving to meet and exceed our 2025 targets. This effort will help offset the losses our people and country have endured due to recent flooding in various regions. We are proactively developing new growth drivers and gradually establishing a sustainable development model for 2026 and beyond.”