Tôn Đông Á Product – Illustrative Image

According to HoSE, Ton Dong A’s listing application was received on December 2, 2025, with Ho Chi Minh City Securities Corporation (HSC) as the consulting firm. This move follows the October shareholder approval to transfer stock trading from UPCoM to HoSE, reviving a previously stalled listing plan.

Historically, Ton Dong A conducted an IPO between 2021-2023, initially aiming for a direct HoSE listing. However, adverse steel industry conditions negatively impacted financial performance, failing to meet listing criteria. Consequently, the company listed on UPCoM in September 2023.

Ton Dong A Revenue

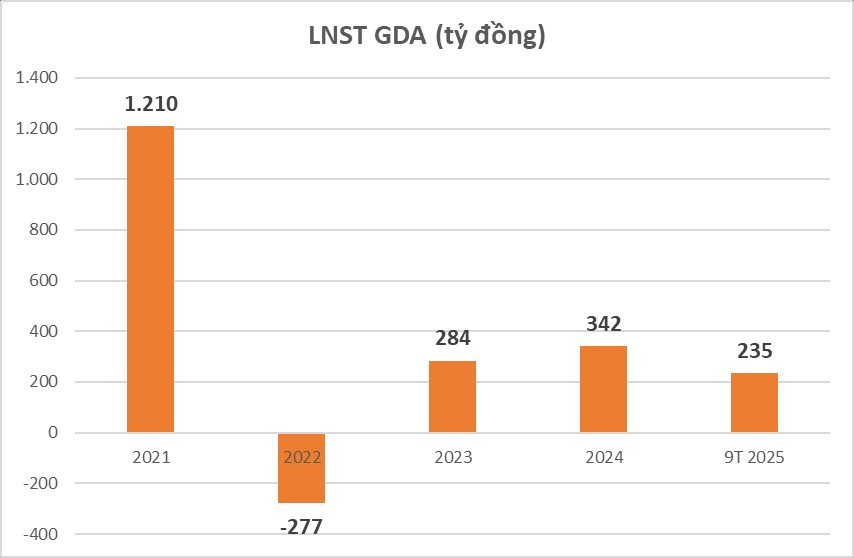

Ton Dong A Net Profit

In Q3/2025, Ton Dong A reported net revenue of VND 3,680 billion, down 29% YoY from VND 5,162 billion. However, net profit surged 58% to VND 85 billion from VND 53.7 billion in Q3/2024, driven by effective cost management. Selling expenses were significantly reduced from VND 280 billion to VND 67 billion.

For 9M/2025, cumulative revenue reached VND 11,914 billion, and net profit VND 235 billion, down 22% and 26.5% YoY, respectively. Against 2025 targets of VND 18,000 billion revenue and VND 300 billion profit, the company achieved 66% and 78% of goals, respectively.

Ton Dong A ranks among Vietnam’s top three galvanized steel producers alongside Hoa Sen Group and Nam Kim Steel. Its 800,000-ton/year facility produces galvanized, cold-rolled, and color-coated steel for domestic and export markets.

As of September 30, 2025, total assets stood at VND 11,558 billion. Cash and bank deposits totaled VND 3,278 billion (28% of assets), earmarked for the VND 7,000 billion Phu My steel plant project. This 1.2 million-ton/year facility is slated for trial operation in 2027.

Liabilities totaled VND 7,651 billion, including VND 6,183 billion in loans (debt-to-equity ratio: 1.6x). Inventory valued at VND 3,801 billion as of Q3/2025.

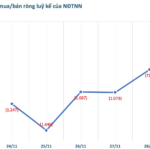

GDA Stock Price Movement

The listing announcement positively impacted investor sentiment. On December 3, GDA shares rose to VND 16,300-16,600, breaking a September downtrend. The HoSE reference price will be based on UPCoM’s final trading sessions.

Why Did Masan Consumer Choose This Moment to Announce Its HOSE Listing Plan?

On December 4th, Masan Consumer (UPCoM: MCH) will unveil details regarding its planned transition from UPCoM to HOSE listing. This move is garnering market attention, as companies typically opt for such a shift only when they have solidified operational foundations, financial capabilities, and long-term growth strategies.