Garmex Saigon’s 2024 audit report flagged by regulators.

According to the State Securities Commission of Vietnam (SSC)’s 2025 inspection of AASCS, the 2024 financial audit report of Garmex Saigon (GMC) failed to meet regulatory standards.

During the audit, procedures were incomplete, and audit evidence was inadequately collected. Consequently, the two auditors who signed the report—Mr. Do Khac Thanh, Deputy General Director, and Ms. Duong Thi Quynh Hoa, Auditor—were suspended from auditing activities related to this financial statement.

The SSC mandated GMC to publicly disclose this information on the SSC’s disclosure system, the Hanoi Stock Exchange, and the company’s official website.

AASCS, established in 1999 as one of Vietnam’s pioneering professional auditing firms, transitioned from a state-owned enterprise. Mr. Do Khac Thanh serves as Chairman of the Board and Deputy General Director, while Mr. Phung Ngoc Toan holds the position of General Director.

Founded in 1976, GMC is a renowned textile exporter in Ho Chi Minh City. In 2004, it was privatized and listed on the Ho Chi Minh Stock Exchange (HoSE) under the ticker GMC on December 22, 2006. However, GMC was delisted from HoSE on January 24, 2025, and resumed trading on UPCoM on February 12 due to the suspension of its core operations for over a year.

Historically, GMC operated five factories—An Nhon, An Phu, Binh Tien, Tan My, and Garmex Quang Nam—spanning over 10 hectares, with 70 production lines and more than 4,000 workers. In 2018, GMC achieved peak revenue of VND 2.039 trillion and after-tax profit of VND 120 billion. From 2019 to 2021, revenue remained above VND 1 trillion annually.

However, since 2022, domestic and global economic challenges drastically reduced GMC’s export orders, with export sales plummeting 93% compared to 2021. Additionally, GMC faced ripple effects from Amazon Robotics LLC’s abrupt production cuts for Gilimex, impacting partners like GMC.

Following these setbacks, GMC’s traditional revenue streams nearly vanished. The company liquidated machinery and equipment, repurposed existing facilities on Hong Bang Street (District 5) for a pharmacy business, and advanced a residential real estate project in Phu My (Ba Ria – Vung Tau) to recover capital.

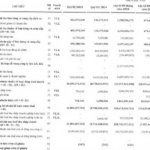

GMC’s audited 2024 consolidated financial report revealed revenue of just VND 2.1 billion, a 75% decline from 2023. Meanwhile, administrative expenses soared to VND 45 billion, resulting in a VND 30 billion after-tax loss.

Despite auditors’ assurances that the financial statements accurately reflected GMC’s financial position, the SSC deemed the audit evidence insufficient.

Auditor Suspended for Signing Financial Statements of Media Company

The State Securities Commission has announced plans to suspend the auditor responsible for signing off on the 2024 financial report of ODE Group Joint Stock Company (ODE Group, UPCoM: ODE). This decision follows a quality review of the auditing services provided.

Hoà Bình Securities Under Special Control

The State Securities Commission (SSC) has issued a decision placing Hoang Binh Securities Corporation under special control, halting its margin lending activities. The company’s stocks are also subject to trading restrictions.