Eric Trump at the Bitcoin 2025 Conference in Las Vegas. American Bitcoin is among the cryptocurrency companies supported by the President’s son.

|

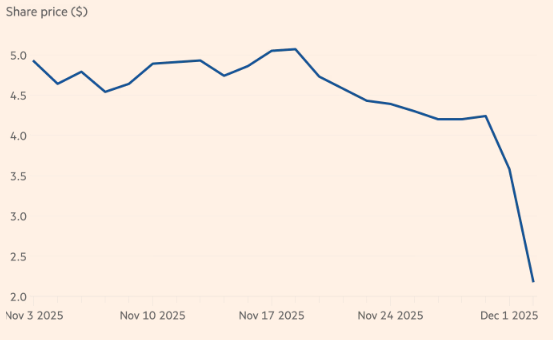

Closing the session on December 2, American Bitcoin’s stock plummeted by 38.8%, erasing approximately $1 billion in market capitalization. Trading volume surged nearly 40 times the daily average.

The primary cause was the unlocking of shares for investors from the $215 million fundraising round in June, allowing them to sell for the first time to secure profits. Eric Trump explained on X that this was the “cause of the volatility” in the stock price, while affirming he would retain all his shares and remains “100% committed to the industry.”

American Bitcoin—aiming to “build the world’s strongest and most efficient Bitcoin accumulation platform”—went public in September through a reverse merger with Gryphon Digital Mining on Nasdaq.

Currently, Eric Trump serves as co-founder and Chief Strategy Officer, while Donald Trump Jr. is an early investor. Company Chairman Matt Prusak emphasized that the share unlocking only affects trading activity and does not impact business operations.

|

American Bitcoin Stock Performance

|

This decline occurred amid a broader cryptocurrency market panic. Bitcoin has lost about 30% of its value since its October peak, though it rebounded 6% to $91,000 on December 2.

President Trump has pledged to make the U.S. a “crypto superpower” and ease industry regulations, despite previously criticizing the sector years ago.

Originally named American Data Centers, American Bitcoin rebranded in late March following a partnership with Hut 8. Under the agreement, Hut 8 provided all Bitcoin mining equipment to American Bitcoin in exchange for a majority stake. Hut 8’s stock also dropped 13.5% during this trading session.

American Bitcoin is just one of several struggling crypto ventures tied to the Trump family. The President’s sons also co-founded World Liberty Financial and own the WLF token, which has lost 86% of its value over the past year.

Trump Media & Technology Group—owner of the Truth Social platform—once announced plans to raise $2.5 billion for a “Bitcoin reserve,” but its stock has fallen nearly 70% this year.

The Trump family isn’t alone in facing challenges. MicroStrategy, led by Michael Saylor and holding 650,000 Bitcoin (3.1% of global supply), has seen its value drop 40% due to investor concerns over continuous stock issuance and borrowing to purchase Bitcoin.

– 09:51 03/12/2025

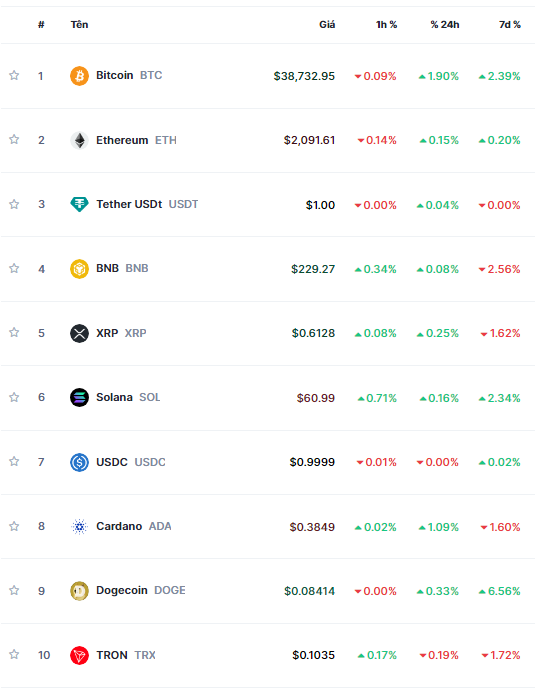

Today’s Crypto Market, December 2: Bitcoin Forecast to Plunge Sharply

The greatest value of the On-chain Alliance to IFC-HCM lies in unlocking a boundless space for experimentation, innovation, and real-world application.

Today’s Crypto Market, November 28: A Tough Decision Awaits Bitcoin

Bitcoin’s upward trajectory is anticipated to solidify once it breaches the $94,000–$95,000 resistance level, according to leading market analysts.