VIX Securities Corporation (stock code: VIX) has officially adopted a board resolution to implement a rights issue plan aimed at increasing its charter capital, as approved by the Extraordinary General Meeting of Shareholders on November 28.

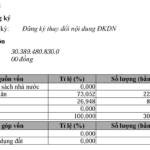

Specifically, VIX will offer nearly 919 million shares at a ratio of 10:6, priced at 12,000 VND per share. This rights issue is expected to raise up to 11 trillion VND, elevating the company’s charter capital to 24.5 trillion VND.

Currently, VIX shares are trading at 24,300 VND per share. Notably, the offering price for existing shareholders is half the current market price.

Alongside the rights issue announcement, VIX has also approved the criteria for selecting investors eligible to purchase residual shares resulting from rounding and unsubscribed shares. Additionally, the company has outlined measures to ensure compliance with foreign ownership limits during the 2025 rights issue.

The selection criteria for investors purchasing residual shares include: (1) Demonstrated potential to contribute to the company’s future growth; (2) Financial capability to meet payment deadlines and ensure the rights issue’s timeline; (3) Agreement to a one-year lock-up period for the purchased shares.

Furthermore, VIX has set a maximum foreign ownership limit of 100%. Consequently, foreign investors will face no restrictions when participating in this capital increase.

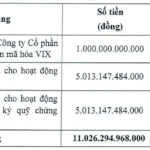

The proceeds from this rights issue, totaling over 11 trillion VND, will be allocated to proprietary trading, margin lending, and investment in VIXEX (VIX Cryptocurrency Exchange Corporation).

In the first nine months, VIX has emerged as the most profitable securities firm, reporting pre-tax and post-tax profits of 5.116 trillion VND and 4.123 trillion VND, respectively—a sevenfold increase year-on-year.

Recently, VIX significantly revised its 2025 financial targets. Pre-tax profit is now projected at 6.5 trillion VND, 1.5 trillion VND higher than the September proposal and a 433% increase from the initial annual plan. Post-tax profit is expected to reach 5.2 trillion VND.

A Leading Securities Firm Announces Offering of Nearly 1 Billion Shares to Shareholders

Should the offering be successful, the chartered capital of this securities company will surge to an impressive 24.5 trillion VND.

When Does VIX Opt to Increase Capital?

On December 2nd, the Board of Directors of VIX Securities JSC (HOSE: VIX) passed a resolution to implement a plan to issue nearly 919 million shares, raising over VND 11,026 billion. During the recent extraordinary general meeting, the company’s leadership shared the expected date for finalizing the list of shareholders eligible for the rights issue.

HDBank Raises VND 1,000 Billion Through Bond Issuance

HDBank has successfully issued 1,000 bonds under the code HDB12508, with a face value of 1 billion VND per bond, totaling an issuance value of 1 trillion VND.

THACO Announces ₫120 Billion Capital Reduction, Prepares for ₫10.13 Trillion Capital Increase

THACO emphasizes that capital adjustments, including both reductions and increases in charter capital, are integral to its strategy for refining governance models and optimizing capital efficiency. The corporation remains committed to sustainable development, leveraging its financial strength, streamlined management, and long-term investment vision to actively contribute to the nation’s economic growth.