According to statistics from the General Department of Customs, Vietnam’s cement and clinker exports in the first 10 months of 2025 reached nearly 30 million tons, equivalent to over 1.11 billion USD. This represents an 18% increase in volume and a 15% rise in value, though prices dropped by nearly 3% compared to the same period in 2024.

In October 2025 alone, exports were estimated at 3.47 million tons, valued at 128.43 million USD, showing significant growth in both volume and value year-over-year.

Recent trends in cement and clinker exports indicate a steady improvement. Production volumes are rising, export values continue to climb, and cement companies are successfully maintaining traditional markets while expanding into new territories. This progress is crucial for the cement industry to sustain its recovery and adapt to oversupply challenges and global trade fluctuations.

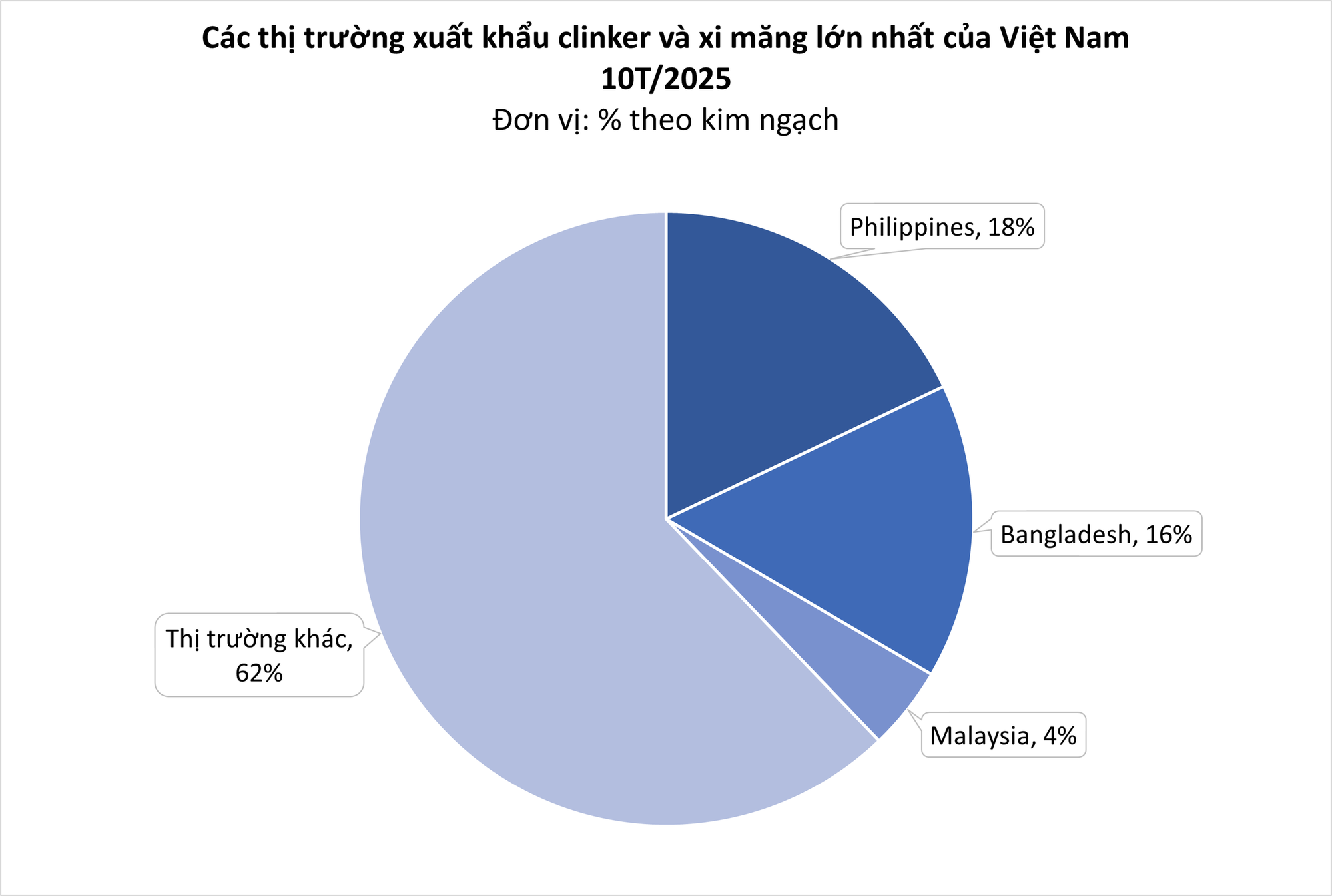

The Philippines remains the largest export market, accounting for nearly 18% of total exports in volume and value, with 5.22 million tons exported, worth over 199 million USD. However, this reflects a 21% decline in volume and a 25% drop in value.

Bangladesh ranks second, with 5.3 million tons of cement and clinker exported, generating 172 million USD—an 8% increase in volume and a 10% rise in value compared to 2024. Malaysia follows in third place, with exports reaching 1.4 million tons, valued at 49 million USD.

Notably, Laos has significantly increased its imports from Vietnam, with a 371% surge in volume and a 360% increase in value year-over-year.

Strong export growth, coupled with improved domestic consumption driven by accelerated public investment projects and residential construction, has led many manufacturers to report profits again. As we enter Q4, recovery prospects are expected to strengthen, supported by favorable weather conditions and faster public investment disbursements, boosting demand for construction materials.

The export tax rate on clinker cement was reduced from 10% to 5% at the end of May 2025 and will remain in effect until the end of 2026. This reduction is positively impacting export activities, while manufacturers are actively seeking new customers and markets.

International cement trade is rebounding, fueled by rising demand in key import markets and increased new export orders from domestic producers. However, export competition is intensifying, particularly with countries like Thailand, Indonesia, and China, which are also grappling with surplus production and seeking to expand their export market share.

Additionally, major export markets such as the Philippines, Bangladesh, Malaysia, Taiwan, and the United States are tightening technical regulations and imposing trade defenses or environmental barriers.

For instance, Taiwan imposed anti-dumping duties ranging from 13.59% to 23.20% on Vietnamese cement starting in July 2025. These duties will remain in effect for five years, until July 2030.

Nevertheless, the rise in trade protectionism and anti-dumping measures is prompting many exporters to adjust their strategies, reduce dependence on specific markets, and explore potential markets with high import demand.