Illustrative Image

Amidst the volatile international seafood market, Vietnam’s squid and octopus exports have continued to show promising figures in the first 10 months of 2025. Despite domestic raw material supply challenges, the processing and export sector has maintained impressive growth. In October 2025, export turnover reached a new peak, reflecting strong demand from key markets as the year-end approaches.

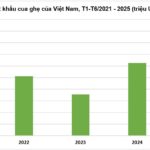

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), by the end of October 2025, Vietnam’s squid and octopus exports totaled $627 million, a 19% increase compared to the same period last year. Despite persistent raw material shortages, October recorded the highest monthly export value of the year at $83 million, up 25% from September and 25% from October 2024. International markets are seeing increased demand for convenience and ready-to-eat products as the year-end season nears.

Vietnam’s squid and octopus exports remain dominated by East Asian and ASEAN countries, accounting for 94% of total turnover. South Korea leads as the largest partner, capturing 38% of total exports, followed by Japan with 23%.

Thailand, an emerging market, has shown robust growth, with a 39% increase over the past 10 months, primarily driven by dried squid and ready-to-eat grilled squid products.

A notable trend in these markets is the strong shift toward convenience products such as ready-to-eat dried squid, sun-dried squid, and processed octopus. Markets like South Korea and Japan have a particular preference for ready-to-eat products, fueling Vietnam’s squid and octopus export growth.

One of the key highlights in 2025’s export landscape is the shift in consumer preferences. Ready-to-eat products, especially instant dried squid and frozen boiled octopus, are gaining popularity in key markets such as South Korea, Japan, and Thailand. These products not only offer convenience but also meet consumer demands for safety and ease of use.

This trend presents a significant opportunity for Vietnamese squid and octopus processors and exporters, as the demand for ready-to-eat products continues to rise. With stable domestic raw material supply, Q4/2025 is projected to see a 10-15% growth compared to Q3. Thailand, with its high demand for instant dried squid and sun-dried squid, stands out as a promising market for year-end export strategies.

While Vietnam’s squid and octopus exports maintained positive growth in 2025, the sector may face challenges in 2026 if the EU’s IUU yellow card and the U.S. MMPA red card are not resolved.