Mr. Dominic Scriven, Chairman of the Board of Directors of Dragon Capital Fund Management JSC, spoke at the Annual Listed Companies Conference held on the afternoon of December 3, 2025.

|

Mr. Dominic Scriven began by acknowledging the difficulty of predicting the future but referenced billionaire Ray Dalio’s assessment of the upcoming year of global risks. These risks include wars, internal issues within nations, international conflicts, climate change/aging, and technological challenges. However, he noted that Vietnam might experience a milder impact.

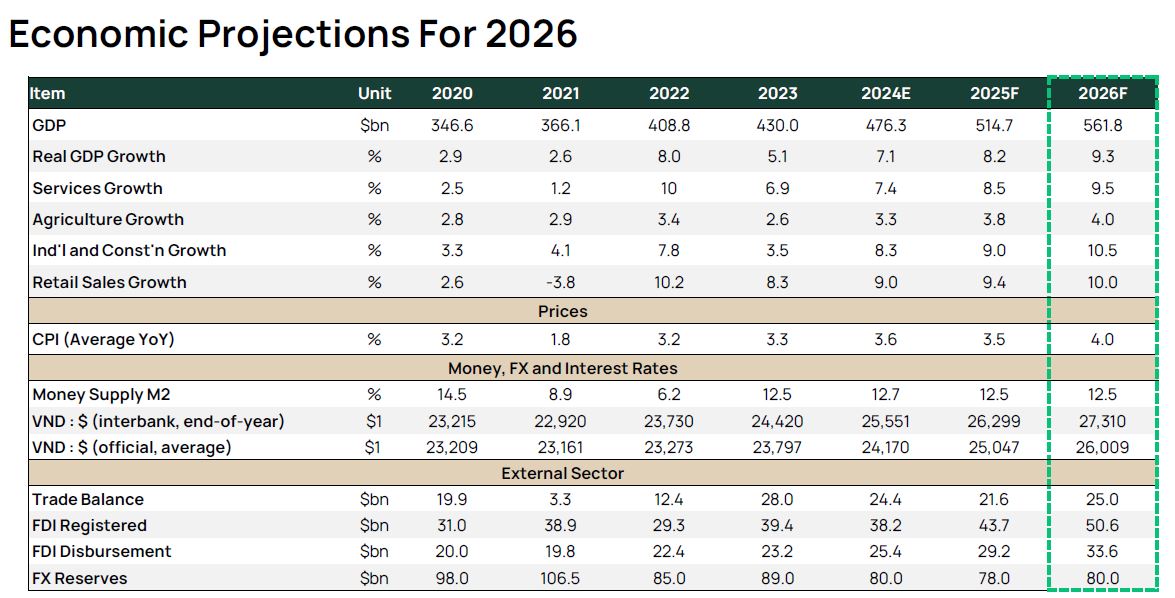

According to Mr. Dominic, thanks to government policies, Vietnam has achieved positive growth in recent quarters and is relatively optimistic as 2025 comes to a close. He also mentioned the goal of reaching a 10% growth rate in 2026, raising the question of how to move from 8% to 10%. He believes that confidence plays a significant role in achieving these numbers.

|

Dragon Capital’s Macroeconomic Forecast for Vietnam in 2026

|

Based on Resolution 68, the private sector, comprising around 500,000 companies and 5 million individual businesses, is encouraged to participate actively and robustly. Mr. Dominic believes new tax policies will significantly impact, bringing informal economic activities into the formal economy, potentially contributing over 1% to GDP growth annually for the next 3-4 years.

Regarding foreign direct investment (FDI), inflows continue to grow strongly each year. However, FDI trends are shifting from primarily industrial and manufacturing investments to include real estate.

The expert emphasized that public investment is key to next year’s growth trend. Total investment in Vietnam for 2025 is estimated to increase, potentially reaching 40% of GDP, up from 30%. This means public investment could rise to $35 billion, and private investment to $120 billion, a combined increase of $40 billion, equivalent to 8% of GDP.

Additionally, exports, a traditional strength of Vietnam, have exceeded initial forecasts this year. Successful diplomatic and internationalization efforts have reduced barriers, benefiting businesses.

In the financial market, Mr. Dominic noted high government credit growth this year, though Vietnam’s total credit (over 100% of GDP) remains moderate compared to other countries. He cautioned that uncontrolled credit growth could pose risks, emphasizing the need to focus on the capital market’s role.

In the corporate bond market, which is still small compared to bank credit, further development is essential. The goal by 2030 is to reduce reliance on the banking system by strengthening the capital market.

Exchange rates have been a concern this year. While the Vietnamese dong has depreciated against some currencies, it has stabilized since the U.S. Federal Reserve signaled rate cuts.

Regarding the stock market, Mr. Dominic observed that Vietnam’s market has performed well this year, despite challenges in 2022 and 2023, highlighting the importance of investor confidence. Vietnam is currently the best-performing market in ASEAN, with a 27.8% increase in USD terms.

Dragon Capital analyzed approximately 120 listed companies, focusing on 80 large companies representing nearly 80% of market capitalization. Their after-tax profits in Q3 2025 increased by 21% year-on-year.

This growth is widespread, not limited to a few companies but spanning large, medium, and small enterprises. Dragon Capital forecasts average after-tax profits to rise by 16-17% in 2026.

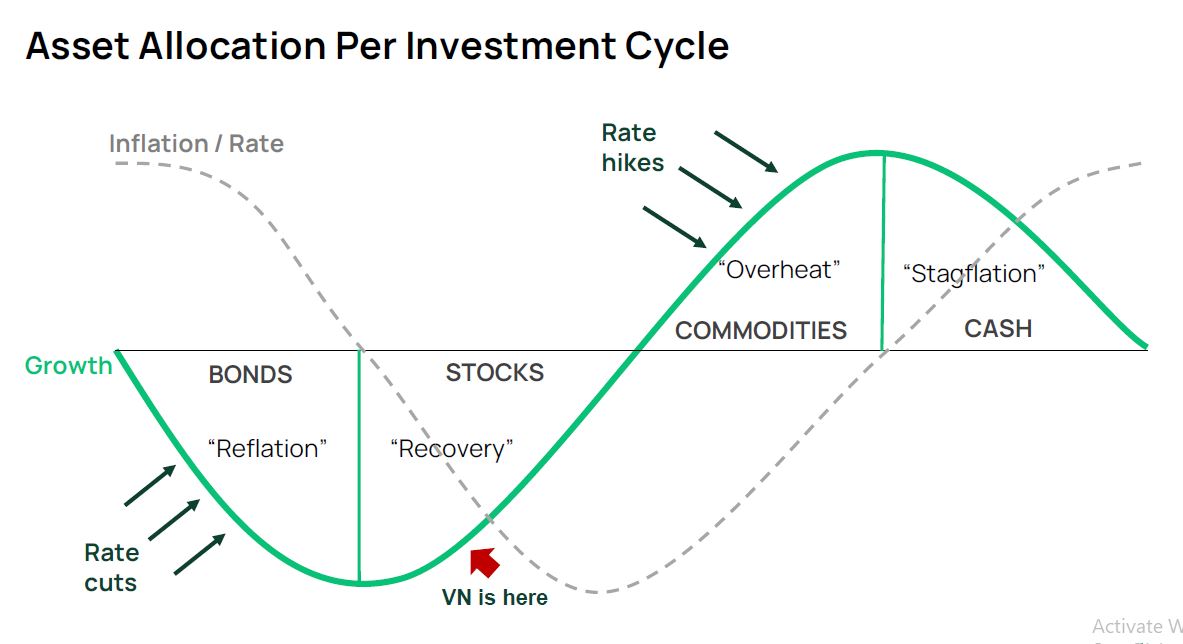

Despite strong profit growth, Vietnamese companies are generally undervalued. According to Dragon Capital’s investment cycle, Vietnam is in a recovery phase, with broad-based profit growth. This context, combined with reasonable valuations and favorable market conditions, supports sustained profitability.

|

Economic Cycle and Vietnam’s Position

Source: Dragon Capital

|

|

On December 3, the top 50 listed companies in transparency for 2025 were honored at the 18th Listed Company Awards (VLCA). The event was held in conjunction with the Annual Listed Companies Conference, attended by leaders from the Ministry of Finance, the State Securities Commission, stock exchanges, and representatives from over 300 listed companies, securities firms, fund managers, and other financial institutions. 2025 marks a significant milestone as Vietnam’s stock market was upgraded to emerging market status, attracting high-quality foreign investment and enhancing its regional financial standing. Legal frameworks supporting this upgrade continue to improve, fostering a more transparent and professional investment environment aligned with international standards. After nearly six months of voting, the Selection Council chose 50 outstanding companies from over 500 listed firms across two stock exchanges, recognizing them in three categories: Annual Reports, Corporate Governance, and Sustainability Reports. |

– 10:29 04/12/2025

Revising Resolution 98: Government Proposes Establishment of Ho Chi Minh City Free Trade Zone

On the afternoon of December 3rd, as part of the 10th session agenda, the Government presented to the National Assembly a draft Resolution to amend and supplement certain provisions of Resolution No. 98/2023/QH15. This Resolution focuses on piloting specific mechanisms and policies for the development of Ho Chi Minh City. A key highlight of the draft is the addition of provisions for the establishment of the Ho Chi Minh City Free Trade Zone.

MCH to Officially Announce HOSE Listing Plan on December 4th

As a leading player in the fast-moving consumer goods (FMCG) industry, Masan Consumer’s (UpCom: MCH) announcement of its listing roadmap on HOSE has captured market attention. The anticipation stems from the expectation that HOSE will welcome a robust enterprise with strong brands and a substantial scale, poised to become a long-term anchor for both domestic and foreign capital.

2025 Milestones: Phạm Nhật Vượng Invests $1.2B in VinFast’s ‘No Plan B’ Strategy, Trần Đình Long Unveils New ‘Steel Fist’, Nguyễn Đức Tài Completes Mission

Vietnam’s business landscape is dominated by visionary leaders. Billionaires Phạm Nhật Vượng, Nguyễn Thị Phương Thảo, and Trương Gia Bình are global players, shaping industries on an international scale. Meanwhile, Bùi Thành Nhơn and Đoàn Nguyên Đức are masterminds of corporate revival, breathing new life into their enterprises.