VISC Allocates 120 Billion VND for Headquarters Relocation

Vietnam Financial Investment Securities Corporation (VISC, stock code: VIG) has announced its intention to purchase a commercial floor and sign a deposit agreement to secure the Commercial Floor Purchase Contract.

Accordingly, VISC plans to acquire a 989.5m² commercial floor on the second level of the King Palace mixed-use building, located at 108 Nguyen Trai Street, Thanh Xuan District, Hanoi. The project is developed by Cherry Blossom Real Estate JSC.

The resolution outlines a projected purchase price of 120 billion VND, with VISC depositing 60 billion VND, equivalent to 50% of the purchase value. The deposit will be made once the project meets the conditions for sale.

The company stated that the commercial floor will serve as its new headquarters and office space. The registration process is expected to take place in late 2025.

With this plan, VISC is likely to relocate from its current headquarters on the 1st and 8th floors of Tower B, Song Da Building, Pham Hung Road, Tu Liem District, Hanoi.

The King Palace project is situated on a prime 6,973m² plot. The development includes two towers, A and B, with 36 floors and 3 basements, covering a construction area of 3,137m².

Tower A, spanning 1,800m², houses 410 luxury apartments (from the 5th to 36th floors), while Tower B, with an area of 1,333m², accommodates a hotel and serviced apartments.

King Palace Project, 108 Nguyen Trai Street, Thanh Xuan District, Hanoi

To date, only Tower A has been completed and put into use. Tower B’s development is delayed due to ongoing legal procedures, prompting the developer to seek adjustments and extensions.

Cherry Blossom Real Estate JSC, established in September 2009, is a joint venture between Alphanam Group, led by Nguyen Tuan Hai, and Hoang Tu LLC, owner of the Hung Tuy interior showroom chain. Alphanam holds 55% of the charter capital, while Hoang Tu holds the remaining 45%.

Between 2018 and 2023, the company underwent several capital adjustments. By July 2024, its charter capital increased from 70 billion VND to 350 billion VND.

As of August 2025, Ho Ngoc Hai serves as both CEO and legal representative of Cherry Blossom Real Estate.

The Connection Between VISC and Cherry Blossom Real Estate

Notably, both Cherry Blossom Real Estate and VISC share common ownership.

In December 2024, Thang Long Investment Group (TIG, HNX-listed) approved the acquisition of 28 million shares, representing 80% of Cherry Blossom Real Estate’s charter capital. The transfer price was 30,000 VND per share, totaling 840 billion VND.

Following the transaction, TIG gained control of Cherry Blossom Real Estate and became the new owner of the King Palace project.

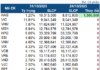

VISC, established in 2007 as Vietnam Industrial and Commercial Securities (VICS), has a charter capital of 150 billion VND. Its founding shareholders include TIG, SCB, PVFC, VCCI Invest, Vinachem, Vinapaco, Vinafood1, Lilama, and Cienco4.

In October 2009, an extraordinary shareholders’ meeting approved HNX listing and increased the charter capital to over 300 billion VND. VICS officially listed on HNX in December 2009 under the stock code VIG.

During 2021-2022, with strategic investment and restructuring from Thang Long Investment Group, VICS rebranded as Vietnam Financial Investment Securities Corporation (VISC) and raised its capital to over 451 billion VND.

Currently, VIG’s Chairman, Nguyen Phuc Long, also serves as TIG’s Chairman.

Nguyen Phuc Long

At Cherry Blossom Real Estate, Nguyen Phuc Long holds the position of Standing Vice Chairman. Meanwhile, Ho Ngoc Hai, CEO of Cherry Blossom Real Estate, also serves as a Board Member and CEO of TIG.

Born in 1974, Nguyen Phuc Long holds a Master’s degree in Economics. As of June 30, 2025, he owns 38.1 million TIG shares, representing 19.68% of the capital.

On Thang Long Investment Group’s website, the project at 108 Nguyen Trai Street, Thanh Xuan District, Hanoi, is introduced as the TIG Infinity Office Tower, Apartments, and Hotel.

Additionally, TIG owns other projects such as Vuon Vua Resort & Villas, a tourism and eco-resort complex, and the TIG Dai Mo Garden Housing project in Dai Mo Ward, Nam Tu Liem District, Hanoi.

Ha Ly